Ex-UK PM Liz Truss Backs Bitcoin, Slams CBDCs and Bank of England’s Policies

Ex-UK PM Liz Truss Supports Bitcoin, Warns Against CBDCs

Former UK Prime Minister Liz Truss has voiced strong support for Bitcoin and cryptocurrency, highlighting their role in promoting decentralization, while expressing deep concerns about the potential dangers of central bank digital currencies (CBDCs).

- Truss supports Bitcoin’s decentralization.

- She warns against CBDCs due to surveillance risks.

- Criticizes Bank of England’s QE and independence.

- Calls for more accountability in monetary policy.

In a candid interview with Bitcoin advocate Peter McCormack, Liz Truss didn’t mince words about her stance on cryptocurrencies. “I am a supporter of Bitcoin and cryptocurrency. I think they’re a good thing. I think they help take power away from central banks… I’m very, very worried about anything like a central bank digital currency completely. I think they give the state huge amounts of power,” she declared. For those unfamiliar, Bitcoin is a decentralized digital currency that operates on a peer-to-peer network, free from central bank control. On the other hand, central bank digital currencies (CBDCs) are digital versions of fiat currency issued and backed by a central bank.

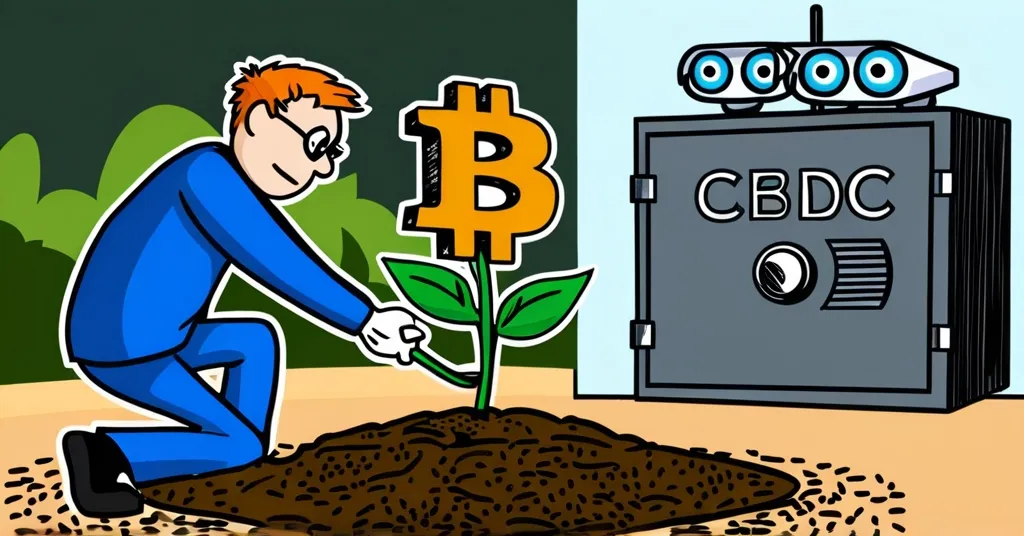

Truss’s reservations about CBDCs stem from the fear that they could enable more invasive state surveillance and control over individual transactions. While CBDCs could potentially enhance financial inclusion and efficiency, as some proponents argue, Truss’s warning is a reminder of the delicate balance between technological advancement and personal freedoms. It’s like choosing between a government-controlled farm and a community garden where you can plant and harvest freely—Bitcoin being the latter, CBDCs the former.

Her critique didn’t stop at CBDCs. Truss slammed the Bank of England’s use of quantitative easing (QE), a monetary policy where central banks purchase government securities to increase money supply and lower interest rates, accusing it of contributing to inflation and financial strain on British households. “We’ve had huge levels of inflation, we had QE that went on for far too long, asset price spikes… and the result was inflation. We were told beforehand that it was going to be transitory and it wasn’t transitory, even though the lessons had all been learned before,” she noted. Truss also took a swipe at the decision to grant the Bank operational independence, attributing it to former UK Chancellor Gordon Brown. “What Gordon Brown did in making it independent… you can see the results. We’ve had QE for far too long… supporting very, very lax government spending policies with printing money,” she added.

During her tenure at the Treasury, Truss revealed she was discouraged from engaging in monetary policy discussions, which only fueled her belief that central banks need to be more accountable. “Whenever an organization justifies itself by saying it’s independent, that in my view is a red flag that there is a problem,” she remarked. Her call for a broader debate on the international monetary system, central bank independence, and the role of cryptocurrencies reflects a desire to address these systemic issues head-on.

While Truss’s support for Bitcoin aligns with the ideals of decentralization and freedom championed by many in the crypto space, it’s crucial to acknowledge the challenges and nuances involved. Bitcoin, for instance, faces issues like scalability and environmental concerns related to mining, which are critical to consider in its broader adoption and impact. It’s not all sunshine and rainbows in Bitcoin land.

At the time of Truss’s comments, Bitcoin’s price stood at $94,079, reflecting its volatile yet significant role in the global financial landscape.

Key Takeaways and Questions:

- What is Liz Truss’s stance on Bitcoin and CBDCs?

Truss supports Bitcoin for its potential to decentralize power from central banks but is deeply concerned about CBDCs due to fears of increased state surveillance and control.

- How does Truss view the Bank of England’s independence?

Truss criticizes the Bank of England’s operational independence, arguing it has led to unaccountable monetary policies like prolonged QE, contributing to inflation and financial strain on households.

- What are Truss’s concerns about the impact of monetary policies on British households?

Truss believes that the Bank of England’s QE policies have resulted in high inflation and asset price spikes, causing significant financial strain on British households.

- Why does Truss believe central banks should be more accountable?

Truss argues that central banks should be more accountable due to their significant influence on monetary policy and the economy, which she sees as currently unaccountable and leading to negative outcomes.

- What broader debates does Truss call for regarding the financial system?

Truss calls for a broader debate on the international monetary system, the independence of central banks, and the role of cryptocurrencies to improve monetary policy and increase accountability.

Truss’s perspectives offer a critical lens through which to view the evolving dynamics of money, power, and technology. As the crypto world continues to challenge traditional financial systems, her voice adds to the chorus demanding change, transparency, and perhaps a return to principles that many in the Bitcoin community hold dear.