Bybit Suspends India Operations Amid Regulatory Crackdown on Crypto

Bybit Halts Operations in India Amid Regulatory Storm

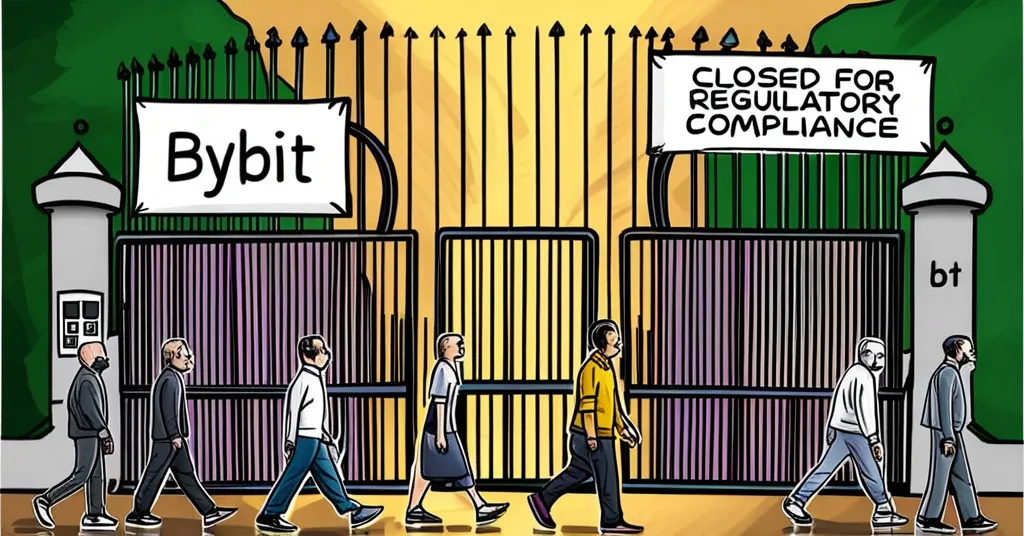

Bybit, a leading cryptocurrency exchange, has temporarily suspended its services in India due to increasing regulatory scrutiny of unregistered platforms. This decision reflects the broader tension between crypto innovation and regulatory compliance in one of the world’s most populous nations.

- Bybit suspends services in India

- Regulatory crackdown on unregistered crypto platforms

- Tension between crypto innovation and regulation

Imagine waking up to find your favorite crypto exchange has suddenly halted operations. That’s the reality for Bybit users in India, as the platform announced a temporary suspension due to the country’s stringent regulatory environment. The Indian government has been cracking down on unregistered crypto platforms, enforcing compliance with laws designed to prevent illegal activities like money laundering (known as AML laws). Bybit’s move is a proactive step to align with these increasingly tough local regulations.

This suspension impacts both new and existing Bybit users in India, who are now unable to open new positions or increase their exposure on the platform. However, they can still close existing positions and are advised to withdraw their funds promptly. Bybit has left the timeline for resuming services open-ended, adding to the uncertainty for its Indian user base. It’s about as helpful as a broken blockchain explorer.

The situation in India is a microcosm of a broader regulatory challenge confronting the cryptocurrency sector. The Indian government is actively developing a comprehensive regulatory framework for cryptocurrencies, but the current environment remains fluid and uncertain. This uncertainty poses significant hurdles for crypto businesses trying to follow the country’s rules.

From a bitcoin maximalist perspective, Bybit’s suspension serves as a stark reminder of the value of truly decentralized systems like Bitcoin. These systems operate independently of government control, offering an alternative way of handling money that values personal freedom and privacy. While centralized exchanges like Bybit grapple with regulatory constraints, Bitcoin and other decentralized cryptocurrencies continue to champion the core principles of the crypto ethos.

Yet, it’s crucial to recognize the complexities and risks involved in operating within a regulatory gray area. While the ideal of decentralization is central to the crypto community’s vision, practical considerations demand that businesses comply with local laws to avoid legal entanglements. This tension between ideological purity and regulatory compliance is a persistent challenge in the crypto world.

On a more optimistic note, this regulatory pressure might catalyze innovation within the sector. As centralized exchanges face restrictions, the focus could shift towards decentralized exchanges (DEXs) and other solutions that bypass traditional regulatory frameworks. Such a shift aligns with the principles of effective accelerationism, potentially leading to the development of more robust and resilient financial systems. DEXs are platforms where users can trade cryptocurrencies directly with one another without a central authority, much like trading baseball cards on a playground.

For those new to the crypto space, a “regulatory crackdown” refers to government actions aimed at enforcing compliance with financial regulations, often resulting in restrictions or bans on certain activities. “Decentralization” describes a system or network that operates without a central authority, with control distributed among its users.

Bybit’s suspension in India is a call to action for the crypto industry to adapt and innovate, but it also underscores the ongoing tension between regulatory forces and the foundational principles of decentralization and freedom that drive the cryptocurrency movement. As Bybit navigates its way back into the Indian market, the crypto industry must continue to innovate and adapt, ensuring that the principles of decentralization and freedom remain at its core.

Key Questions and Takeaways:

- What led to Bybit’s suspension of services in India?

Bybit suspended its services in India due to the country’s increasing regulatory scrutiny of unregistered crypto platforms.

- How does this affect Bybit users in India?

Users in India cannot open new positions or increase exposure on Bybit, but they can close existing positions and withdraw funds.

- What is the broader regulatory context in India?

India is working on a comprehensive regulatory framework for cryptocurrencies, but the current environment remains uncertain.

- How does this impact the crypto industry?

This regulatory crackdown could push the industry towards more decentralized solutions, aligning with the principles of decentralization and effective accelerationism.

- What does this mean for Bitcoin and other decentralized cryptocurrencies?

It highlights the value of decentralized systems like Bitcoin, which can operate independently of government control, emphasizing the importance of freedom and privacy in the crypto space.