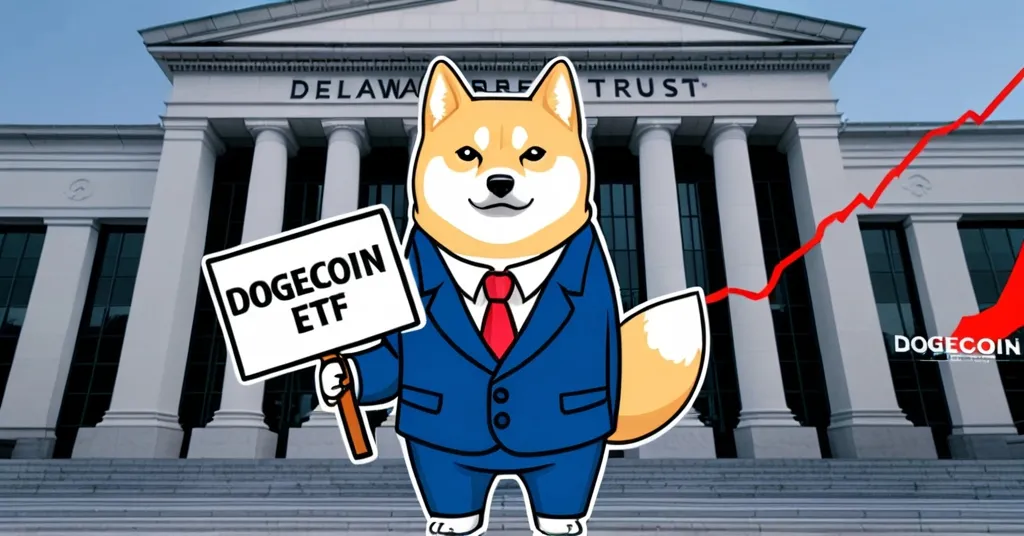

Bitwise Registers Dogecoin ETF Trust in Delaware, Aims for Mainstream Adoption

Bitwise Bets Big on Dogecoin: Registers ETF Trust in Delaware

Bitwise has taken a bold step towards launching a Dogecoin Exchange-Traded Fund (ETF) by registering “Bitwise Dogecoin ETF Trust” in Delaware, signaling its intent to tap into Dogecoin’s growing popularity while navigating the complex regulatory landscape.

- Bitwise registers “Bitwise Dogecoin ETF Trust” in Delaware

- Move indicates intent to launch Dogecoin ETF

- Dogecoin, from meme to market mover

- Regulatory approval remains a major hurdle

Delaware’s reputation for its business-friendly laws makes it the perfect launchpad for Bitwise’s latest venture. By setting up shop in Delaware, Bitwise is strategically positioning itself to navigate the regulatory maze with precision. An ETF, or Exchange-Traded Fund, is an investment vehicle that tracks an index, commodity, or basket of assets like cryptocurrencies, traded on stock exchanges like traditional stocks. This move allows investors to gain exposure to Dogecoin without the hassle of directly owning the cryptocurrency.

Originally created as a humorous take on Bitcoin in 2013, Dogecoin has since transformed from a meme to a market mover. With a substantial market capitalization and endorsements from high-profile figures like Elon Musk, Dogecoin has transcended its playful origins. However, turning it into an ETF is no laughing matter. Dogecoin, inspired by the “Doge” meme featuring a Shiba Inu, has become a household name, yet its journey from internet joke to serious investment is fraught with challenges.

The establishment of the “Bitwise Dogecoin ETF Trust” is just the first step in what promises to be a long and winding journey. The Securities and Exchange Commission (SEC), the financial watchdog, has yet to approve a spot Bitcoin ETF, let alone one for Dogecoin. The SEC’s cautious approach to crypto-related financial products means that regulatory approval is a steep hill to climb. Concerns include market manipulation, investor protection, and Dogecoin’s legendary price volatility, which can be a tough pill for traditional investors to swallow.

Bitwise’s move is a testament to their belief in Dogecoin’s staying power and its potential to attract both crypto enthusiasts and traditional investors. Yet, it’s also a reminder that in the world of cryptocurrency, where memes can turn into millions, the road to mainstream acceptance is paved with both opportunity and uncertainty. While a Dogecoin ETF could further legitimize the cryptocurrency as a serious investment asset, it also raises questions about the environmental impact of cryptocurrencies and the long-term viability of Dogecoin itself.

The crypto community is buzzing with excitement, but the real test will be whether Bitwise can navigate the regulatory waters and bring Dogecoin into the ETF fold. As we watch this story unfold, one thing is clear: the future of finance continues to be written in blockchain, and Dogecoin’s inclusion in this narrative could be a game-changer.

Key Questions and Takeaways

- What is Bitwise’s strategy behind registering an entity in Delaware for a Dogecoin ETF?

Bitwise’s strategy involves utilizing Delaware’s favorable business laws to facilitate the creation of a Dogecoin ETF. This move is part of a broader approach to navigate the complex regulatory landscape of cryptocurrency ETFs.

- How does the registration of the “Bitwise Dogecoin ETF Trust” impact the perception of Dogecoin as an investment asset?

The registration signals increased legitimacy for Dogecoin, as it suggests that institutional investors see potential in Dogecoin as an investment asset. However, the actual impact will depend on the ETF’s approval and market performance.

- What are the potential regulatory challenges Bitwise might face in launching a Dogecoin ETF?

Bitwise will likely face scrutiny from regulatory bodies like the SEC, which has been cautious about approving crypto-related ETFs. Concerns include market manipulation, investor protection, and the underlying volatility of cryptocurrencies like Dogecoin.

- What role does Delaware play in the registration of cryptocurrency-related entities?

Delaware is favored for its business-friendly laws, including a robust legal framework that attracts corporations. It provides a strategic advantage for companies like Bitwise in setting up entities for innovative financial products like cryptocurrency ETFs.

- What are the potential benefits of a Dogecoin ETF for investors?

A Dogecoin ETF could offer investors easier access to cryptocurrency markets, diversification of their investment portfolios, and the ability to invest without the complexities of owning the cryptocurrency directly. For more insights on potential benefits, see here.

- What are the risks associated with Dogecoin’s volatility?

Dogecoin’s price volatility poses significant risks for investors, including potential large losses and market unpredictability. Traditional investors accustomed to more stable assets might find these fluctuations challenging to navigate.

- How might the launch of a Dogecoin ETF impact the broader cryptocurrency market?

The launch of a Dogecoin ETF could further legitimize cryptocurrencies as investment assets, potentially attracting more institutional investment and increasing market liquidity. However, it could also lead to increased speculation and market volatility. For community discussions on this topic, visit this forum.