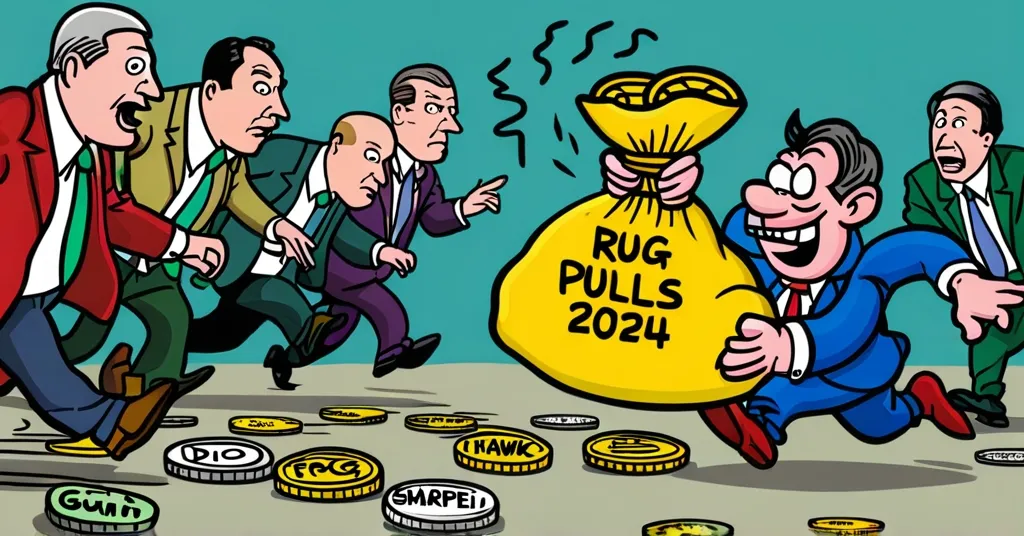

Biggest Crypto Rug Pulls of 2024: DIO, Froggy, Hawk Tuah, Sharpei, GUNIT Analyzed

Unpacking the Biggest Crypto Rug Pulls of 2024: Lessons from a Tumultuous Year

Ever wondered how to spot a crypto scam before it’s too late? In 2024, the crypto world faced a series of devastating rug pulls, scams where developers abandon projects and abscond with investors’ funds. Understanding these incidents is crucial for anyone navigating the decentralized finance landscape, where freedom and innovation collide with fraud and manipulation.

- DIO Token Pump-and-Dump: 98.8% drop due to alleged manipulation.

- Froggy Coin Rug Pull: 99.95% drop after liquidity drain.

- Hawk Tuah Rug Pull: 71% crash within minutes.

- Sharpei Solana Meme Coin Rug Pull: 96.3% drop due to false alliance claim.

- GUNIT Hack and Rug Pull: 100% value loss following account hack.

The cryptocurrency industry is built on the promise of decentralization and financial freedom, but it’s also a breeding ground for scams. A crypto rug pull is a fraudulent scheme where developers suddenly pull out, taking the invested funds with them and leaving investors holding worthless tokens. This year’s high-profile rug pulls serve as stark warnings about the need for vigilance in the crypto space.

Let’s start with the DIO token, linked to the gaming project Fracture Labs. Launched on the HTX exchange, its value plummeted by 98.8% from an all-time high of $0.5879 to $0.007276. Allegedly manipulated by Jump Trading, this incident not only devastated investors but also underscored the urgent need for mechanisms to prevent market manipulation. A pump-and-dump is when the price of a token is artificially inflated (pumped) before being sold off (dumped), leaving buyers with significant losses.

Next, the Froggy (FROGGY) coin, a meme token, epitomized the risks of investing in tokens driven by hype over substance. After peaking at $0.00001577, its liquidity was drained, causing a 99.95% drop to $0.0000000073964. Meme coins, while entertaining, are often the most vulnerable to these scams. Liquidity refers to the availability of tokens for trading; when it’s drained, the token’s value can plummet.

The Hawk Tuah (HAWK) token, endorsed by social media celebrity Hailey Welch, made headlines for its rapid rise and fall. Within 20 minutes, its value crashed from a $500 million valuation to $60 million, marking a 71% decrease from its all-time high of $0.0022413 to $0.0006404. Social media played a pivotal role in promoting the token, with celebrity endorsement driving initial value before the rapid decline. This incident led to a lawsuit from Burwick Law targeting those involved in the scam, though Welch herself was not named as a defendant but is cooperating with the legal efforts.

The Sharpei (SHAR) token, a Solana-based meme coin, saw its value soar to $54 million before plummeting 96.3% to $1.3 million. The rug pull was triggered by a debunked claim of a strategic alliance with the popular meme coin Bonk (BONK). Key contributors Kadense and Nom refuted the claim, and the pseudonymous influencer Joji was implicated, though he denied any involvement. False alliances can mislead investors, leading to significant losses when the truth comes out.

Finally, the GUNIT token scam exploited the hacked accounts of rapper 50 Cent to promote a token that plummeted from $0.05085 to $0.00002133, a 100% drop. The hackers reportedly made millions in minutes, showcasing the speed and audacity of modern crypto scams. Token supply changes, especially when monitored on centralized exchanges, can signal potential scams.

These incidents highlight the darker side of the crypto ecosystem but also underscore the potential for growth and improvement. As we champion decentralization and the disruption of financial norms, it’s crucial to acknowledge the challenges and work towards creating a safer environment for all. The path to a decentralized future is fraught with challenges, but with education and vigilance, we can navigate it successfully.

So, how can you protect yourself from falling victim to such scams? The key lies in due diligence. Researching the project thoroughly, checking the liquidity of the token, and monitoring changes in token supply on centralized exchanges can help you gauge the legitimacy and stability of an investment. Remember, in the crypto world, if it sounds too good to be true, it probably is. For instance, consider the case of an investor who avoided a potential rug pull by noticing unexplained changes in token supply on a centralized exchange, a red flag that saved them from significant losses.

Despite these challenges, the crypto community is not standing still. Positive developments and efforts to combat rug pulls are ongoing. For example, some platforms are implementing stricter project vetting processes, and educational initiatives are helping to inform new investors about the risks and red flags to watch out for. These efforts are crucial in building trust and ensuring the long-term health of the crypto ecosystem.

While Bitcoin and other established cryptocurrencies continue to push the boundaries of finance, the broader ecosystem remains vulnerable to scams. But with a blend of skepticism, humor, and no-nonsense reporting, we can keep our wits about us on this wild ride towards a decentralized future.

Key Takeaways and Questions

What is a crypto rug pull?

A crypto rug pull is a scam where developers abandon a project and take all the invested funds, leaving investors with worthless tokens.

What are the top five crypto rug pulls of 2024?

The top five rug pulls of 2024 include the DIO token pump-and-dump, Froggy coin rug pull, Hawk Tuah rug pull, Sharpei Solana meme coin rug pull, and the GUNIT hack and rug pull.

How can investors protect themselves from rug pulls?

Investors can protect themselves by researching projects thoroughly, checking token liquidity, and monitoring changes in token supply on centralized exchanges.

What was the impact of the DIO token scam?

The DIO token experienced a 98.8% decrease from its all-time high, severely impacting its value and investor trust.

What role did social media play in the Hawk Tuah rug pull?

Social media was instrumental in promoting the Hawk Tuah token, with celebrity endorsement driving initial value before the rapid decline.

Why is due diligence important in the crypto market?

Due diligence is crucial to avoid falling victim to scams like rug pulls, ensuring investors are aware of the project’s legitimacy and financial health.