Eugene Fama Predicts Bitcoin’s Demise in 10 Years, Advocates for Stablecoins

Eugene Fama Predicts Bitcoin Will Be Worthless in 10 Years

Nobel laureate Eugene Fama, known as the “Father of modern finance,” has cast a shadow over the future of Bitcoin, predicting it will likely be worth nothing within a decade. During a discussion on the “Capitalisn’t” podcast, Fama expressed his doubts about cryptocurrencies, suggesting they lack the stable real value necessary for a reliable way to buy and sell things. As Bitcoin enthusiasts, we need to weigh Fama’s critique against the ongoing evolution of digital currencies.

- Eugene Fama predicts Bitcoin’s value will hit zero in 10 years.

- Cryptocurrencies lack stable value, making them unsuitable for transactions.

- Stablecoins could be a viable alternative to Bitcoin.

- 51% attacks pose a significant threat to Bitcoin’s security.

- Fama favors gold over Bitcoin due to its practical uses.

Fama’s Prediction

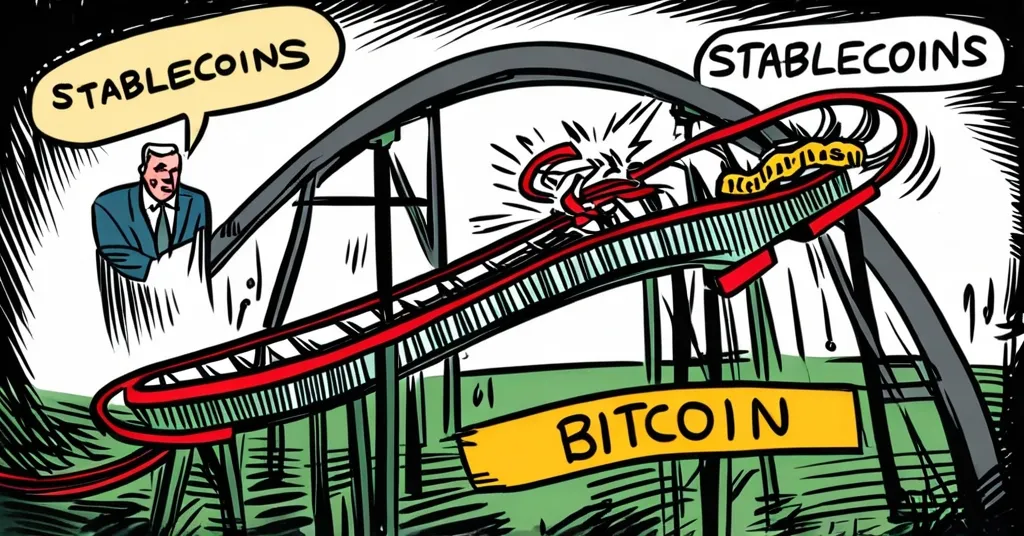

Eugene Fama’s skepticism about Bitcoin’s future is rooted in its notorious volatility. “They don’t have a stable real value. You know, they have highly variable real value. That kind of medium of exchange is not supposed to survive,” he stated. For Fama, this volatility undermines Bitcoin’s potential as a currency for everyday transactions, challenging the principles of monetary theory. Monetary theory, in simple terms, is the study of how money functions in an economy, and Fama’s concern is that Bitcoin’s wild swings in value might force a complete rethink of these principles.

But Fama isn’t rooting for Bitcoin’s failure just to be contrarian. He hopes the Bitcoin bubble bursts to save the existing frameworks of monetary theory from an overhaul. “I’m hoping it would bust because, if it doesn’t, we have to start all over with monetary theory — it’s gone. It might be gone already,” he remarked. This hope isn’t out of spite but a desire to maintain the integrity of established economic theories.

The Volatility Challenge

Bitcoin’s volatility is a significant hurdle. Imagine trying to buy a coffee with Bitcoin one day and finding its value halved the next. This instability makes it a risky proposition for everyday use. While some argue that Bitcoin’s volatility is a symptom of its youth and will diminish as it matures, Fama remains unconvinced, viewing it as a fundamental flaw.

Stablecoins as a Solution

Moving from Fama’s critique of Bitcoin’s volatility, let’s consider his views on stablecoins. Fama sees potential in these cryptocurrencies, which are pegged to stable assets like the U.S. dollar. “All we thought we know about monetary theory says [cryptocurrency] shouldn’t survive,” he noted, yet he’s open to the idea that stablecoins might be the exception. Stablecoins like Tether aim to mitigate the volatility issues by maintaining a predictable value, offering a more reliable way to buy and sell things in the digital realm. Fama’s thoughts on stablecoins versus Bitcoin highlight a potential path forward for cryptocurrencies.

The Threat of 51% Attacks

Another point of concern for Fama is the risk of 51% attacks on Bitcoin. A 51% attack occurs when a group gains control of more than half of a blockchain’s computing power, enabling them to manipulate transactions and potentially double-spend coins. This vulnerability highlights the need for robust verification and rule enforcement in any transaction system. While Bitcoin’s large network makes it less susceptible to such attacks compared to smaller altcoins, the theoretical risk remains, and ongoing vigilance is crucial.

The Role of Gold and Government

Fama’s preference for gold over Bitcoin is clear. With its multiple use cases, from jewelry to industrial applications, gold is seen as a more practical asset. Bitcoin, in Fama’s view, lacks these practical applications, making it less appealing. Additionally, he believes government intervention could accelerate Bitcoin’s descent into worthlessness. As regulatory scrutiny intensifies, the future of Bitcoin might become more precarious.

Yet, in a surprising twist, Fama shows a willingness to be proven wrong. “His open-mindedness for admitting that he might be wrong… he’s willing to adapt his universe at age 86,” noted Luigi Zingales, co-host of the podcast. This openness to new developments in economic theory is a testament to Fama’s adaptability.

Counterpoints and Balanced View

While Fama’s prediction might sound like a death knell for Bitcoin, it’s crucial to consider the counterpoints. Bitcoin’s growing acceptance as a store of value and its role in promoting financial inclusion challenge Fama’s views. Technological innovations, such as the Lightning Network, aim to address volatility and enhance security. Moreover, the rise of institutional adoption and the development of regulatory frameworks could provide the stability Fama seeks.

As advocates of decentralization and privacy, we can’t ignore the disruptive potential of Bitcoin and other cryptocurrencies. They challenge the status quo and offer new avenues for financial freedom. Yet, we must also acknowledge the realities of economic principles and the need for security, as highlighted by Fama’s critique. It’s a balancing act between embracing innovation and ensuring stability.

Key Takeaways and Questions

- What is Eugene Fama’s prediction about Bitcoin’s future value?

Eugene Fama predicts a high probability that Bitcoin will be worthless within a decade.

- Why does Fama believe cryptocurrencies won’t survive?

Fama believes cryptocurrencies won’t survive because they lack stable real value, which he argues is essential for a medium of exchange.

- What alternative to Bitcoin does Fama suggest could work?

Fama suggests that stablecoins, which are backed by stable currencies like the U.S. dollar, could work as a medium of exchange.

- What is a 51% attack, and why is it a threat to Bitcoin according to Fama?

A 51% attack occurs when a group gains control of more than half of a blockchain’s mining power, allowing them to manipulate transactions. Fama sees this as a significant threat to Bitcoin because it highlights vulnerabilities in verification and rule enforcement.

- How does Fama view gold in comparison to Bitcoin?

Fama favors gold over Bitcoin because it has multiple use cases, unlike Bitcoin, which he sees as lacking practical applications.

- What role does Fama think the government might play in Bitcoin’s future?

Fama believes government intervention may accelerate Bitcoin’s loss of value.

- Does Fama show any openness to being wrong about Bitcoin?

Yes, Fama shows openness to being wrong about Bitcoin’s future, which is noted by Luigi Zingales as a remarkable trait at his age.