Strike CEO Jack Mallers Warns Ripple’s Lobbying Threatens Bitcoin’s Public Utility Role

Strike CEO Jack Mallers Slams Ripple’s Lobbying Efforts: A Threat to Bitcoin’s Public Utility

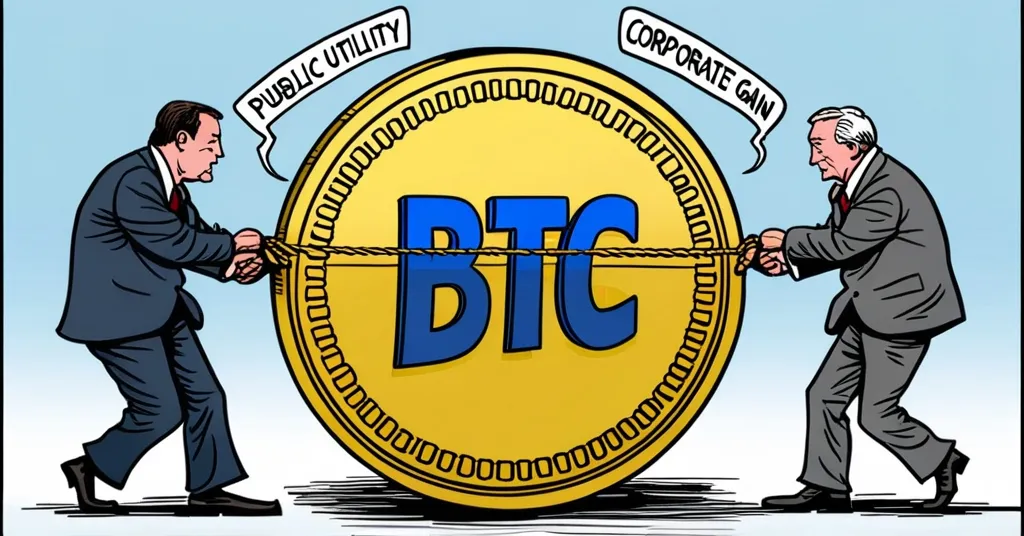

Jack Mallers, the CEO of Strike, has thrown down the gauntlet against Ripple, accusing the company of crossing a line with its lobbying efforts around the Bitcoin Strategic Reserve, a proposed U.S. initiative to hold Bitcoin as a national asset. Mallers argues that Ripple’s push to promote its own products, XRP and RLUSD, prioritizes corporate gain over public good, potentially jeopardizing Bitcoin’s role as a public utility—a tool meant to benefit the public rather than be controlled by private entities.

- Jack Mallers criticizes Ripple’s lobbying

- Ripple accused of prioritizing corporate interests

- Brad Garlinghouse calls for crypto industry collaboration

Mallers doesn’t mince words when he says,

“Bitcoin’s a public utility for us, and there’s corporate lobbying that’s trying to take that away and prioritize their interest. So that was my message, and I’m glad that it got some attention. And, you know, Ripple, in my opinion, crossed the line.”

He points to Ripple’s giving itself 100 billion XRP tokens, which they later sold, as a stark contrast to Bitcoin advocates like Michael Saylor, who hold their Bitcoin rather than selling it off.

This isn’t just about Ripple; Mallers sees it as part of a larger historical pattern where corporations claim to help the public while actually pursuing their own self-interest. He warns that such corporate lobbying could derail Bitcoin’s potential to become a true public utility, a tool for financial freedom and empowerment, rather than just another asset controlled by big players.

While Mallers sees corporate lobbying as a threat, Ripple’s CEO, Brad Garlinghouse, advocates for a different approach. He believes that the crypto industry can achieve more by working together rather than competing.

“The crypto industry can achieve its goals if people work together instead of competing; it’s not a zero-sum game,”

Garlinghouse stated, advocating for a collaborative approach that could benefit the entire ecosystem, not just Bitcoin. By collaboration, Garlinghouse might mean joint efforts on regulatory frameworks or shared development of blockchain technologies that could enhance the whole industry’s growth.

The debate over the Bitcoin Strategic Reserve is more than just a spat between industry leaders; it reflects a fundamental tension between those who see Bitcoin as a revolutionary public good and those who view it as just another piece of the financial puzzle to be maneuvered for corporate gain. Mallers’ critique of Ripple highlights this tension, while Garlinghouse’s call for collaboration suggests a path forward that could include a variety of cryptocurrencies, not just Bitcoin.

The implications of this debate are far-reaching. If corporate lobbying continues to prioritize private interests over public good, the vision of Bitcoin as a decentralized, public utility could be at risk. On the other hand, a collaborative approach, as Garlinghouse suggests, might lead to a more inclusive and diverse crypto ecosystem, where different technologies and currencies can coexist and thrive.

As the crypto space continues to evolve, the role of corporate lobbying and the balance between private and public interests will remain crucial. Whether Bitcoin can fulfill its potential as a public utility, or whether it will be overshadowed by corporate agendas, is a question that will shape the future of finance and technology.

Key Takeaways and Questions

- What is Jack Mallers’ concern regarding Ripple’s involvement in the Bitcoin Strategic Reserve?

Mallers is concerned that Ripple’s lobbying efforts focus on promoting its own products, XRP and RLUSD, rather than contributing to the public good, potentially undermining Bitcoin’s role as a public utility.

- How does Mallers contrast Ripple’s actions with Bitcoin advocates like Michael Saylor?

Mallers contrasts Ripple’s distribution and sale of 100 billion XRP tokens with Bitcoin advocates like Saylor, who hold (HODL) their Bitcoin, indicating a difference in approach and intent between the two.

- What historical pattern does Mallers see in Ripple’s behavior?

Mallers sees Ripple’s actions as part of a historical pattern where private corporations claim to help the public while actually pursuing their own self-interest.

- What is Brad Garlinghouse’s perspective on the crypto industry’s approach?

Garlinghouse believes that the crypto industry should work together rather than compete, viewing it as a non-zero-sum game.

- What could be the potential impact of Ripple’s lobbying on Bitcoin, according to Mallers?

Mallers warns that Ripple’s lobbying could derail Bitcoin’s path toward becoming a public utility and reaching its full potential.