Coinbase Battles to Protect Prime Trust Customers’ Assets in Bankruptcy

Coinbase Fights for Prime Trust Customers in Bankruptcy Showdown

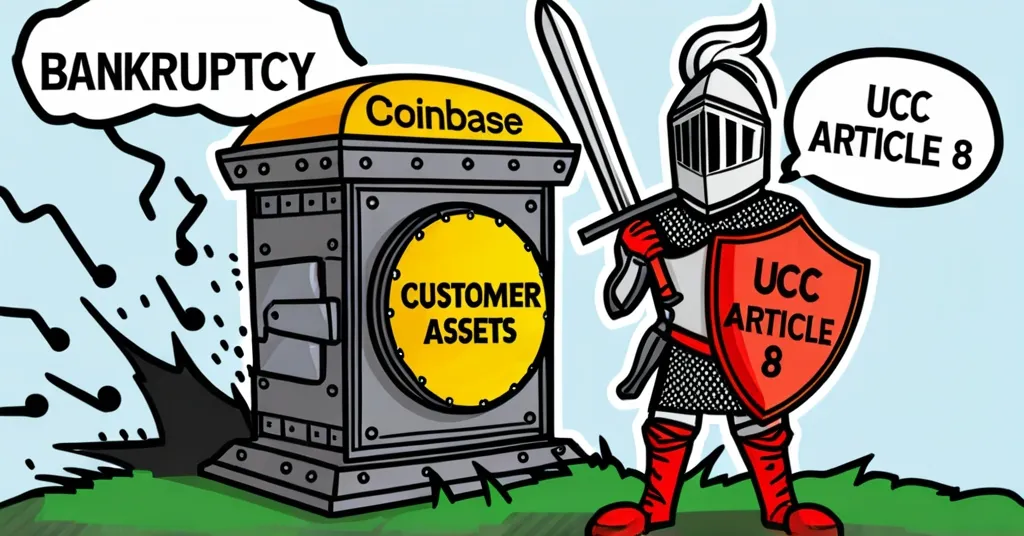

Coinbase has boldly stepped into the ring to protect Prime Trust customers’ assets amid the custodian’s bankruptcy filing, showcasing the critical need for legal safeguards in the volatile world of crypto.

- Coinbase files to protect customer assets in Prime Trust bankruptcy

- Prime Trust faces $82 million deficit and $500 million in liabilities

- UCC Article 8 invoked to shield customer assets

In a move that underscores the industry’s growing pains, Coinbase, a leading crypto exchange, filed an amicus brief on February 5, 2023, in the Prime Trust bankruptcy case. This “friend of the court” filing, led by Coinbase’s chief legal officer Paul Grewal, argues that customer assets held by Prime Trust should remain untouched by the company’s financial reorganization. Prime Trust, a crypto custodian, filed for Chapter 11 bankruptcy on August 14, 2023, in Delaware, citing a staggering $82 million shortfall in customer deposits, primarily due to their holdings in illiquid tokens—assets that can’t be easily sold without affecting their market price.

The heart of Coinbase’s argument hinges on Article 8 of the Uniform Commercial Code (UCC), a set of laws that govern commercial transactions in the United States. Grewal contends that UCC Article 8 ensures these assets remain the property of customers, not to be absorbed into the bankruptcy estate. With Prime Trust’s liabilities potentially reaching up to $500 million, the stakes couldn’t be higher for both the firm and its clients.

Coinbase’s intervention isn’t just about Prime Trust; it’s a battle for broader legal protections for customer assets across both crypto and traditional finance sectors. As Grewal succinctly put it, “UCC Article 8 is a pillar of commercial law that protects customer assets– held by custodians big and small, in digital or traditional finance (including BNY and DTC) – from unfairly getting swallowed up in bankruptcy.” He further emphasized, “This is bigger than crypto,” highlighting the case’s far-reaching implications.

“UCC Article 8 is a pillar of commercial law that protects customer assets– held by custodians big and small, in digital or traditional finance (including BNY and DTC) – from unfairly getting swallowed up in bankruptcy.” — Paul Grewal, Coinbase’s chief legal officer

The backdrop to Prime Trust’s bankruptcy is the recent collapse of FTX, which led to the conviction and 25-year prison sentence of its founder, Sam Bankman-Fried. This event, less than a year ago, intensified scrutiny on the financial stability of crypto custodians and underscored the urgent need for clear legal frameworks to protect customer assets. Prime Trust’s case could set a crucial precedent for how customer assets are treated in future bankruptcy scenarios, not just within the crypto industry but across all sectors.

The implications of Coinbase’s move extend far beyond the immediate case. It’s a testament to the growing pains of the crypto industry as it navigates the broader commercial law landscape. The protection offered by UCC Article 8 could become a benchmark for how customer assets are handled during financial turmoil, ensuring that the rights of individuals are not trampled by the complexities of bankruptcy law.

But let’s not sugarcoat it: the crypto world is like a rollercoaster—thrilling but occasionally nauseating. Illiquid tokens and significant deficits are red flags that can’t be ignored. While Coinbase’s efforts are commendable, the industry must also confront its own shortcomings and work towards more robust financial practices. The road to mainstream adoption is paved with both innovation and accountability.

As we champion the ideals of decentralization, freedom, and privacy, we must also recognize the importance of protecting the everyday investor. Coinbase’s stand is a reminder that while we push the boundaries of what’s possible with blockchain and cryptocurrencies, we must also safeguard the trust and investments of those who believe in this financial revolution.

The crypto industry needs to get its act together and stop playing fast and loose with people’s money. Scammers have no place in this revolution, and unrealistic price predictions only serve to undermine the genuine progress being made. We’re here to inform our audience responsibly and drive adoption in a way that respects the intelligence of our readers.

Here are some key takeaways and questions to consider:

- Why did Coinbase file an amicus brief in the Prime Trust bankruptcy case?

Coinbase filed an amicus brief to protect customer assets held by Prime Trust, emphasizing the importance of legal protections in crypto bankruptcies.

- What is UCC Article 8, and how does it relate to asset protection?

UCC Article 8 is a part of commercial law that ensures assets held by custodians remain the property of customers during bankruptcy, applicable across both digital and traditional finance sectors.

- How might Prime Trust’s bankruptcy impact the crypto custodial services industry?

Prime Trust’s bankruptcy highlights potential flaws in custodial services, likely leading to increased regulatory scrutiny and improved legal protections for customer assets.

- What role did the FTX collapse play in the current situation with Prime Trust?

The FTX collapse heightened scrutiny on the stability of crypto custodians and underscored the need for legal frameworks like UCC Article 8 to protect customer assets.

- What broader implications does Paul Grewal suggest regarding UCC Article 8?

Paul Grewal suggests that UCC Article 8’s protections extend beyond crypto, impacting traditional finance and emphasizing its fundamental role in commercial law.

Coinbase isn’t just sitting on the sidelines; they’re stepping into the ring to fight for what’s right. In this intricate dance of legal battles and financial restructuring, their move is a beacon of hope for those who believe in the potential of cryptocurrencies to disrupt the status quo. Yet, it’s a reminder that with great potential comes great responsibility. The crypto community must continue to advocate for robust legal protections while pushing the boundaries of what’s possible in this exciting, albeit tumultuous, space.