Trump’s Digital Tax Memo Threatens US Crypto Firms with New Compliance Challenges

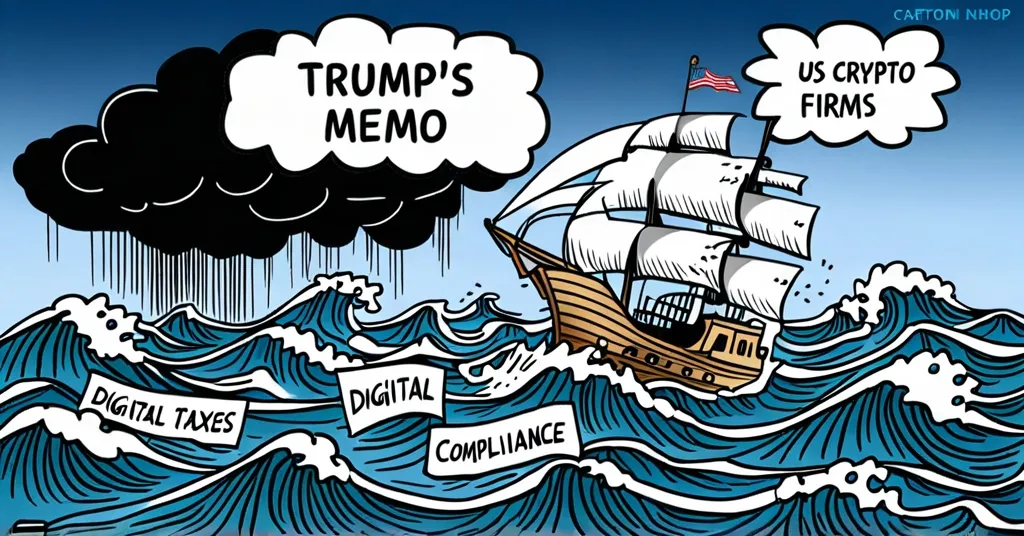

Trump’s Digital Tax Memo: A Storm Brewing for US Crypto Firms

President Donald Trump’s latest move might send shockwaves through the crypto sector. With a memorandum on the horizon, the US Trade Representative is tasked with countering foreign digital services taxes, and this could mean trouble for blockchain companies and exchanges in America.

- Trump’s memo targets discriminatory digital taxes.

- 30 countries, including France, UK, and Canada, are in the crosshairs.

- US crypto firms could face new compliance and tariff challenges.

The memo, as reported by Bloomberg, focuses on digital service taxes implemented by around 30 countries, such as France, the UK, and Canada. These taxes, which the US views as unfairly targeting certain companies, hit major American tech giants like Alphabet and Meta Platforms. But don’t think the crypto industry will escape unscathed—Canada’s recent implementation of its digital service tax in July 2024 is just the beginning of a potential cascade of problems.

The potential retaliatory measures outlined in Trump’s memo could introduce a new world of compliance headaches for US-based crypto firms. Tariffs and increased scrutiny might just be the tip of the iceberg. The crypto sector, known for its sensitivity to trade policies, could face significant challenges that deter market expansion and disrupt trading activity. Remember the last time? On February 3, the crypto market saw its largest liquidation event of the year, with over $2 billion wiped out from leveraged positions in just 24 hours following tariff announcements. Leveraged positions, for those new to the game, are trades that use borrowed money to amplify potential gains or losses, making them particularly vulnerable to market shocks.

This isn’t just about taxes; it’s about a broader global trade dispute brewing. The US response could trigger a domino effect, impacting blockchain companies and crypto exchanges operating internationally. The evolving global tax environment might lead to increased scrutiny and tax obligations for crypto businesses, potentially stifling innovation and growth in a sector that thrives on disrupting the status quo. For more insight into these disputes, see Digital Service Taxes and Global Trade Disputes.

As champions of decentralization and freedom, we must keep a keen eye on these developments. While Bitcoin and other cryptocurrencies have the potential to revolutionize finance, the path forward is fraught with regulatory challenges. The crypto community needs to stay informed and prepared to navigate these turbulent waters.

Impact on US Crypto Firms

The potential impact of digital service taxes on US crypto firms cannot be understated. These taxes, essentially levies on online services and products, could mean new compliance challenges that crypto firms might need to navigate. Imagine a US-based crypto exchange suddenly facing tariffs on its international transactions—crypto firms might need to become tax detectives to navigate this new labyrinth of regulations! Learn more about the impact of digital services taxes on cryptocurrency companies.

Strategies for crypto firms to mitigate these challenges include enhancing their compliance teams, exploring international operations adjustments, and staying abreast of policy changes. By proactively addressing these issues, crypto firms can better position themselves to weather the storm. For strategies on navigating these challenges, check out Strategies for Crypto Firms to Navigate Compliance Challenges.

Broader Implications

The US response to these digital service taxes could trigger broader global trade and tax disputes. Not only will tech companies feel the pinch, but blockchain companies and crypto exchanges operating internationally could find themselves in the crosshairs of a complex web of regulations. The potential for increased scrutiny and tax obligations could stifle the growth and innovation that the crypto sector is known for. For more on the broader implications of Trump’s actions, visit our discussion on the topic.

Trump’s actions also hint at a broader review of EU and UK policies, suggesting that his concerns extend beyond just digital service taxes. This adds another layer of complexity to the story, as the administration aims to protect America’s tax base and ensure fair treatment for US companies. For a detailed look into Trump’s digital services taxes memorandum, see President Trump digital services taxes memorandum 2024.

Key Questions and Takeaways

- What is the purpose of President Trump’s memorandum?

The purpose is to direct the US Trade Representative to develop trade remedies against foreign digital services taxes that the US considers discriminatory.

- Which countries have implemented digital service taxes?

Around 30 countries, including France, the UK, and Canada, have implemented such taxes.

- How might the crypto sector be affected by these measures?

The crypto sector could face new compliance challenges, increased tax obligations, and potential tariffs, which might deter market expansion and affect trading activity.

- What previous impacts have US trade policies had on the crypto market?

Previous trade policies, such as tariffs on imports from Mexico, Canada, and Europe, triggered significant liquidations in the cryptocurrency market, with over $2 billion wiped out from leveraged positions on February 3.

- What are the potential broader implications of the US response?

The US response could trigger broader global trade and tax disputes, affecting not only tech companies but also blockchain companies and crypto exchanges operating internationally.

While we’re optimistic about the future of Bitcoin and blockchain technology, we must also acknowledge the real challenges and risks. As advocates for decentralization, privacy, and disrupting the status quo, we must remain vigilant and critical of policies that could hinder this revolution. Stay tuned as we continue to monitor these developments and provide you with the latest insights and analysis. For more on the impact of digital taxes on crypto firms, join the conversation on our platform. Additionally, for insights into compliance challenges, see Compliance Challenges for US Crypto Firms.