Riot Platforms Surges to $109.4M Profit in 2024, Eyes AI and HPC Expansion

Riot Platforms Turns the Tables: From Loss to $109.4M Profit in 2024

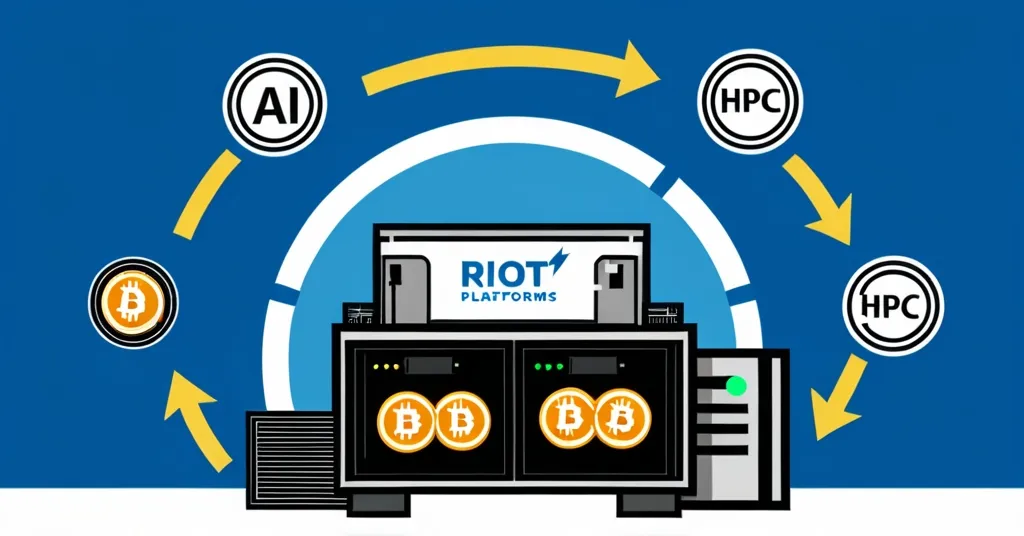

Riot Platforms, a leading Bitcoin mining company, turned a significant corner in 2024, posting a net profit of $109.4 million after a $49.4 million loss the previous year. Their total revenue surged by 34% to $376.7 million, driven by a near doubling of Bitcoin mining revenue to $321 million. Despite facing challenges such as the Bitcoin halving and increased mining costs, Riot expanded its operations through strategic acquisitions and increased its Bitcoin holdings. Looking ahead, the company plans to venture into artificial intelligence (AI) and high-performance computing (HPC) sectors at its Corsicana Facility.

- Net profit of $109.4 million in 2024

- Total revenue increased by 34% to $376.7 million

- Bitcoin mining revenue nearly doubled to $321 million

- Expanded into AI and HPC sectors

Riot Platforms’ journey from a financial loss to a robust profit in 2024 is nothing short of a crypto comeback story. The company’s revenue reached $376.7 million, a significant leap from $280 million in 2023, with Bitcoin mining operations at the forefront, generating $321 million. This was fueled by higher Bitcoin prices and an increased operational hash rate, which is the computing power used to mine Bitcoin. Essentially, Riot managed to mine more efficiently and capitalize on favorable market conditions.

However, the road wasn’t without its bumps. The number of Bitcoins mined decreased from 6,626 in 2023 to 4,828 in 2024, influenced by rising mining costs, the Bitcoin halving event in April 2024, and a 67% increase in the global network hash rate. The Bitcoin halving, a scheduled event that halves the reward for mining new blocks, naturally increases the cost per Bitcoin mined, pushing Riot’s average cost from $3,831 in 2023 to a staggering $32,216 in 2024.

Riot’s strategic power management helped mitigate some cost pressures, achieving an all-in power cost of 3.4 cents per kilowatt hour. This is akin to finding a discount on fuel while driving a gas-guzzler. Yet, the company saw a decline in power credits from $71.2 million in 2023 to $33.7 million in 2024, showing that even the savviest strategies have their limits.

To bolster its growth, Riot made key moves in 2024. Acquisitions of Block Mining and E4A Solutions enhanced Riot’s mining operations and engineering capabilities. Meanwhile, the energization of the Corsicana Facility marked a significant milestone. Riot also raised $579 million through convertible senior notes, a financial maneuver that allowed them to increase their Bitcoin holdings by 141% to 17,722 BTC. It’s like going from a piggy bank to a vault overnight.

Looking forward, Riot isn’t just mining for gold; they’re prospecting in new territories. The company plans to explore the burgeoning fields of AI and HPC at its Corsicana Facility in 2025. This strategic pivot aligns with a broader industry trend where companies leverage existing infrastructure for new technological ventures. It’s a nod to effective accelerationism, pushing the boundaries of what’s possible in finance and technology. But, as any seasoned crypto enthusiast knows, diversification is a double-edged sword. While it may offer new revenue streams, it also risks diluting focus from Bitcoin, the heart of Riot’s operations.

“The revenue boost was primarily attributed to Bitcoin mining operations, which generated $321 million—nearly double the $189 million recorded in 2023—benefitting from higher Bitcoin prices alongside an increased operational hash rate.”

“The reduction was a result of rising mining costs, the Bitcoin halving event in April 2024, and a 67% increase in the global network hash rate.”

“Riot noted that the average cost to mine each Bitcoin rose to $32,216 in 2024, a significant increase from $3,831 in 2023 due to reduced power credits and the more competitive mining environment.”

“Going forward, Riot said that it plans to capitalize on emerging opportunities in artificial intelligence (AI) and high-performance computing (HPC), particularly at its Corsicana Facility.”

While Riot’s success is commendable, it’s crucial to maintain a balanced perspective. The crypto world is notoriously volatile, and while Riot has made significant strides, the industry’s challenges remain formidable. Bitcoin maximalists might celebrate Riot’s focus on Bitcoin, but the move into AI and HPC could be seen as a smart diversification strategy, albeit one that might raise eyebrows among those who believe Bitcoin should be the sole focus. However, in the quest for financial stability and growth, exploring these new frontiers is a calculated risk worth watching.

As champions of decentralization and disrupting the status quo, Riot’s journey is a potent reminder of the potential and pitfalls within the crypto world. Their focus on Bitcoin, coupled with exploration into new technological avenues, aligns with the ethos of effective accelerationism. Yet, we must remain vigilant, keeping an eye on the dark corners of the industry where scams lurk and unrealistic price predictions are peddled by those looking to profit off unwary investors.

Key Takeaways and Questions

- What was Riot Platforms’ financial performance in 2024?

Riot Platforms reported a net profit of $109.4 million in 2024, a significant turnaround from a $49.4 million loss in 2023. The company’s total revenue increased by 34% to $376.7 million.

- How did Bitcoin mining contribute to Riot Platforms’ revenue in 2024?

Bitcoin mining was the primary revenue driver, generating $321 million in 2024, nearly double the $189 million from 2023, due to higher Bitcoin prices and an increased operational hash rate.

- What factors led to a decrease in the number of Bitcoins mined by Riot Platforms in 2024?

The decrease from 6,626 BTC in 2023 to 4,828 BTC in 2024 was due to rising mining costs, the Bitcoin halving event in April 2024, and a 67% increase in the global network hash rate.

- How did Riot Platforms manage to reduce mining costs?

Riot Platforms implemented a unique power strategy that helped achieve an all-in power cost of 3.4 cents per kilowatt hour, though power credits decreased from $71.2 million in 2023 to $33.7 million in 2024.

- What strategic acquisitions did Riot Platforms make in 2024?

Riot Platforms acquired Block Mining and E4A Solutions, which expanded its mining operations and strengthened its engineering and operational capabilities.

- How did Riot Platforms increase its Bitcoin holdings in 2024?

Riot raised $579 million through a convertible senior notes offering, using the proceeds to acquire an additional 5,784 BTC, bringing its total holdings to 17,722 BTC by the end of 2024.

- What are Riot Platforms’ plans for 2025?

Riot Platforms plans to capitalize on emerging opportunities in AI and HPC, particularly at its Corsicana Facility.

As Riot Platforms continues to navigate the crypto landscape, their story embodies both optimism and realism. It resonates with those who believe in the potential of Bitcoin and blockchain while acknowledging the hurdles that must be overcome. For newcomers and veterans alike, Riot’s journey offers valuable lessons on the importance of strategic planning, adaptability, and the courage to explore new horizons in the quest for progress and financial freedom.