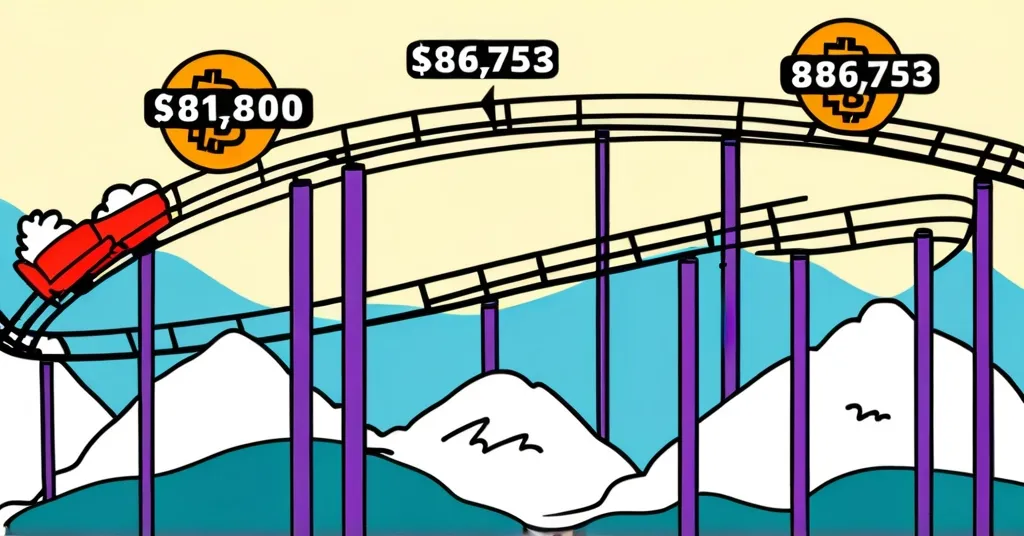

Bitcoin at $81,800: Will It Crash to $69,000 or Break Resistance?

Bitcoin’s Volatility: Navigating the $69,000 Threshold

Bitcoin’s price, currently hovering around $81,800, has the crypto community on high alert, with fears of a potential drop back to $69,000.

- Bitcoin at $81,800

- Support at $79,270 and $69,450

- Resistance at $84,296-$86,753

- Psychological impact

- Liquidity and demand

Bitcoin, the king of crypto, is currently trading at $81,800, a price point that has investors feeling a mix of uncertainty and cautious optimism. As it wavers between key support levels at $79,270 and $69,450, and a resistance band between $84,296 and $86,753, the market is on edge. Support levels are price points where Bitcoin tends to find buying interest, preventing further drops. Resistance, on the other hand, is where selling pressure often kicks in, making it hard for prices to rise above these points. At the resistance level, a staggering 287,200 BTC is held by 556,030 addresses, making it a challenging hurdle to overcome. As Ryan Lee, Chief Analyst at Bitget Research, notes, “Breaking past this level will not be easy.”

The first safety net for Bitcoin lies between $79,274 and $81,731, where 301,410 BTC are waiting for buyers across 368,550 addresses. Should this zone fail to hold, the next critical support zone stretches between $69,445 and $71,902, with 313,160 BTC held by 752,840 addresses. If Bitcoin falls through these levels, the market could see a sharp decline, reminiscent of a rollercoaster plummeting in a storm.

The $69,000 mark is more than just a number; it’s a psychological milestone. This was Bitcoin’s peak in 2021 before it soared to new heights in March 2024. A drop back to this level would be a stark reminder of past struggles, potentially shaking the confidence of even the most dedicated Bitcoin enthusiasts. As one analyst put it, “Dropping back to that level would not just be another dip. It would be a psychological setback, a reminder of Bitcoin’s past struggles before breaking new highs.” Imagine if Bitcoin dropped to $69,000 overnight – it would be like waking up to find your favorite stock back where it was years ago.

Liquidity and market demand are the twin pillars that support Bitcoin’s price stability. Liquidity refers to how easily Bitcoin can be bought or sold without affecting its price, while demand is the desire of investors to own it. “For months, the market has been trying to build a strong foundation above old all-time highs, and a slip toward $69,000 would raise questions about whether Bitcoin’s latest rally is running out of steam,” another expert observed. Recent liquidity issues, such as the Bybit hackers cashing out $300 million of their $1.5 billion crypto heist, have contributed to Bitcoin’s volatility, as noted by QCP Capital. Upcoming macroeconomic releases like the Consumer Price Index (CPI) and Producer Price Index (PPI) could further influence Bitcoin’s trajectory.

Yet, amidst these bearish scenarios, it’s crucial to remember Bitcoin’s resilience and its role in challenging the status quo. Bitcoin has defied expectations before, bouncing back from significant drops with renewed vigor. While predicting its next move is akin to trying to catch a greased pig at a county fair – slippery and unpredictable – Bitcoin continues to push the boundaries of what’s possible in finance and technology.

Moreover, not all is doom and gloom. Recent developments in Bitcoin’s adoption, such as increased institutional interest and the integration of Bitcoin into traditional financial systems, provide a counterpoint to the bearish narrative. These positive indicators suggest that Bitcoin’s journey is far from over, and its potential to disrupt traditional finance remains strong.

So, what does all this mean for Bitcoin’s future? Are we on the brink of a disastrous fall to $69,000, or is this just another chapter in Bitcoin’s rollercoaster saga? Only time will tell, but one thing is clear: Bitcoin continues to challenge the status quo, pushing the boundaries of what’s possible in the world of finance and technology.

Key Questions and Takeaways

- What is the current trading price of Bitcoin?

Bitcoin is currently trading at $81,800.

- What are the critical support levels for Bitcoin?

The critical support levels are at $79,270 and $69,450.

- What is the resistance level for Bitcoin?

The resistance level is between $84,296 and $86,753.

- How many BTC are held at the resistance level?

About 287,200 BTC are held by 556,030 addresses at the resistance level.

- What would be the psychological impact of Bitcoin dropping to $69,000?

It would be a significant psychological setback, reminding investors of Bitcoin’s past struggles before breaking new highs.

- What factors are crucial for determining Bitcoin’s future price movements?

Liquidity and market demand are crucial factors in determining Bitcoin’s future price movements.