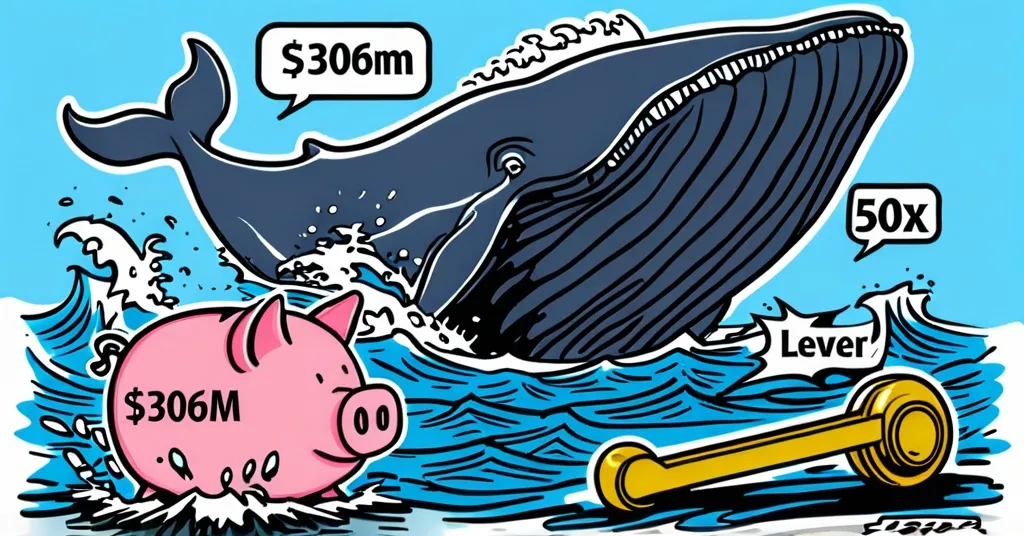

Ethereum Whale Loses $306M on Hyperliquid: The Perils of 50x Leverage

Ethereum Whale’s $306M Liquidation: A Cautionary Tale of High Leverage

A crypto whale betting heavily on Ethereum (ETH) suffered a staggering $306.85 million loss due to a massive liquidation event on Hyperliquid. The trader, using 50x leverage, saw their position wiped out when ETH’s price plummeted below the critical liquidation level. This incident serves as a stark reminder of the risks associated with high-leverage trading in the volatile cryptocurrency market.

- Crypto whale loses $306.85M on ETH

- 50x leverage on Hyperliquid

- ETH price drop triggers liquidation

The saga began on March 10, 2025, when the whale sold 947 ETH for $1.95 million in USDC, using these funds to initiate a long position in ETH on Hyperliquid. What started as a calculated risk quickly escalated into a high-stakes gamble as the trader ramped up their position, reaching a peak of 175,179 ETH valued at approximately $335.6 million. At one point, the trader was sitting on a profit of $3.65 million. However, the dream of massive gains turned into a nightmare when ETH’s price fell below $1,805, triggering the complete wipeout of their position.

This event underscores the dangers of high leverage in the cryptocurrency market. Lookonchain, a crypto analytics firm, reported the liquidation, stating,

“This whale just got liquidated for 160,234 ETH ($306.85M)!”

The scale of the loss has ignited discussions across social media platforms like X, where one user aptly summed it up:

“High leverage, high consequences. Whale’s $300M+ ETH position just got wiped at $1,877. This is why trading with leverage is basically gambling – one wrong move and it’s game over. Let this be a lesson in risk management.”

Hyperliquid faced significant fallout from the event, with $166 million in net outflows and over 16 whales withdrawing their funds. In response, Hyperliquid reduced its maximum leverage to 40x for Bitcoin and 25x for Ethereum, reflecting a move towards more conservative trading practices. This adjustment highlights the platform’s commitment to mitigating future risks, a crucial step in the right direction.

The liquidation event coincided with bearish technical indicators for ETH. The Relative Strength Index (RSI), which measures the speed and change of price movements, dropped from 62 to 55 within 35 minutes, signaling a move into oversold territory. Additionally, the Moving Average Convergence Divergence (MACD) showed a bearish crossover, and trading volume during the event was 80% higher than the average over the past week. These indicators suggest that the market was primed for a significant price movement, which ultimately led to the whale’s liquidation.

The ripple effects were felt across other Ethereum-based tokens, with Chainlink (LINK) and Aave (AAVE) also experiencing declines. Additionally, Hyperliquid’s native HYPE token dropped by over 8%, reflecting investor concerns about the platform’s stability. While the market sentiment around AI and cryptocurrency remained positive, with slightly increased AI-driven trading volumes, the liquidation event highlighted the inherent volatility and risks of the crypto market.

Expert opinions shed further light on the implications of this event. Ben Zhou, CEO of Bybit, suggested that centralized exchanges (CEXs) could benefit from a system where leverage decreases as a trader’s position grows, as opposed to the high leverage allowed on platforms like Hyperliquid. He noted,

“On a CEX, a position as large as the one on Hyperliquid would typically have its leverage reduced to around 1.5x.”

Aaron S., Editor-In-Chief at BitDegree, emphasized the importance of understanding and educating traders about the risks associated with high-leverage trading in the FinTech industry, stating,

“Data-driven and fact-based content is crucial to educate both Web3 natives and newcomers about the dangers of such trading strategies.”

This liquidation has sparked speculation about the possibility of insider information or market manipulation. However, Hyperliquid dismissed these concerns, attributing the issue to the size of the liquidated position rather than any exploit. While the event raises questions about the ethics of high-stakes trading, it also underscores the need for robust risk management strategies in the crypto market.

But let’s not forget the allure of quick gains that drives many to take such risks. It’s like playing financial Russian roulette – exhilarating, but with potentially catastrophic consequences. As we navigate this financial revolution, it’s crucial to balance the excitement of potential profits with the discipline of risk management.

Key Takeaways and Questions

- What caused the crypto whale to lose $306.85 million?

The whale’s massive loss was due to a liquidation event triggered by a drop in Ethereum’s price below the liquidation level while trading with 50x leverage.

- How did the whale’s trading strategy evolve over time?

The whale started trading on March 10, 2025, by selling 947 ETH and using the proceeds to long ETH on Hyperliquid, gradually increasing their position to 175,179 ETH.

- What is the significance of using 50x leverage in trading?

Using 50x leverage means that even small price movements can lead to significant gains or losses, amplifying the risk of the investment.

- Why is this event considered one of the biggest single liquidations in crypto history?

The event is notable due to the significant loss of $306.85 million, highlighting the extreme risks of high leverage.

- What lessons can traders learn from this event?

Traders should be cautious with high leverage due to the potential for rapid and significant losses. Proper risk management and understanding of market volatility are crucial.

- Is there speculation about the whale having insider information?

Yes, some traders speculated about the possibility of the whale having insider information, though this remains unconfirmed and speculative.

This epic tale of a crypto whale’s downfall is a sobering reminder of the risks that come with chasing the crypto dream. While the allure of quick gains can be tempting, the crypto market’s volatility demands a disciplined approach to risk management. As we continue to navigate this financial revolution, let’s keep our eyes on the prize but our feet firmly planted on the ground. What steps can we take to ensure the crypto market remains a space for innovation, not just high-stakes gambling?