Congressman Emmer Proposes Bill to Ban CBDCs, Citing Threats to Privacy and US Dollar

CBDCs: A Threat to American Values and Financial Privacy, Congressman Emmer Argues

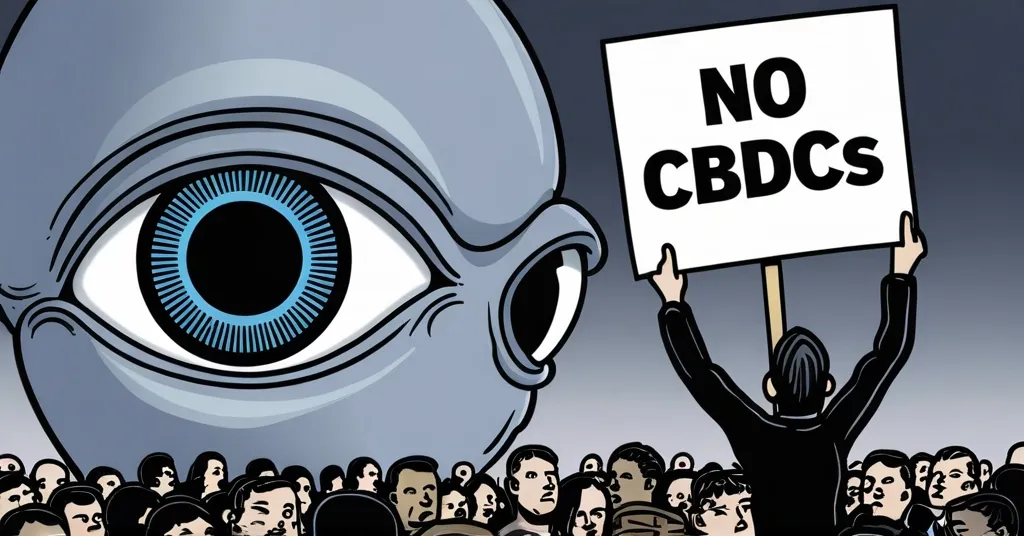

Republican Congressman Tom Emmer has introduced a bill aimed at banning central bank digital currencies (CBDCs) in the United States, arguing that they threaten American values and could enable financial surveillance. Emmer’s legislation seeks to turn a previous executive order into permanent law, reflecting significant domestic opposition to CBDCs.

- Tom Emmer introduces bill to ban CBDCs in the US

- Bill aims to codify Trump’s executive order into law

- CBDCs seen as a tool for financial surveillance

So, what exactly are CBDCs? Imagine them as digital versions of the dollar or euro, but issued directly by a country’s central bank. They’re designed to function like traditional money but in a digital format, which could streamline transactions and enhance financial inclusion. However, not everyone is on board with this idea, especially in the U.S.

Congressman Emmer’s bill, which has garnered support from over 100 members of Congress and various organizations, aims to solidify opposition to CBDCs. The bill seeks to codify what Emmer describes as President Donald Trump’s executive order banning CBDCs into law. However, it’s worth clarifying that Trump’s actual order focused on establishing a Strategic Bitcoin Reserve and U.S. Digital Asset Stockpile, not banning CBDCs.

“The bill is simple: It halts the efforts of unelected bureaucrats from ever issuing a central bank digital currency that could upend the American way of life.”

Emmer argues that CBDCs are “inherently un-American,” posing risks of weakening the power of the US dollar around the world, compromising financial privacy, and enabling government overreach by tracking citizens’ transactions. This stance aligns with broader crypto and blockchain advocacy for decentralized systems, which inherently resist government control over digital currencies.

The support for Emmer’s bill comes from a broad coalition, including the Independent Community Bankers Association, American Bankers Association, Club for Growth, Heritage Action, and the Blockchain Association. This widespread backing reflects a significant segment of political and economic thought in the US that views CBDCs with suspicion, particularly in the context of maintaining the US dollar’s global dominance and protecting individual freedoms.

However, the idea of CBDCs isn’t universally opposed globally. Many nations are exploring or implementing them, seeing potential benefits in transaction efficiency and financial inclusion. Yet, the potential for CBDCs to be used as a tool for financial surveillance remains a real concern. Emmer warns:

“CBDCs that fail to adhere to these three basic principles could enable an entity like the Federal Reserve to mobilize itself into a retail bank, collect personally identifiable information on users and track their transactions indefinitely.”

This is a chilling prospect for those who value financial privacy. While the Federal Reserve, under Chairman Jerome Powell, has also expressed opposition to pursuing a digital dollar, the global landscape presents a different picture. The European Union, for instance, is exploring its own digital euro, highlighting the varying approaches to digital currency policy worldwide.

Despite the global trend towards digital currencies, the U.S. remains focused on stablecoins, which some experts believe could help propagate the dollar’s status as a reserve currency. This focus aligns with Emmer’s concerns about maintaining the dollar’s dominance, yet it also underscores the evolving nature of the financial landscape. Congressman Emmer emphasizes the importance of financial privacy, maintaining the dollar’s dominance, and fostering innovation in digital currency policy.

While CBDCs present potential risks, they also offer possible benefits such as improved transaction efficiency and financial inclusion. However, these benefits are hotly debated, and the risks of financial surveillance and government overreach cannot be ignored. The debate over CBDCs reflects the broader theme of effective accelerationism, where disruptive technologies challenge traditional systems and push for greater innovation and decentralization.

In contrast, Bitcoin and other decentralized cryptocurrencies offer greater privacy and less government control, embodying the principles of decentralization that many in the crypto space champion. Navigating the world of digital currencies can feel like trying to solve a Rubik’s Cube blindfolded, but understanding these differences is crucial for informed decision-making.

Key Takeaways and Questions

-

What is the main purpose of Congressman Tom Emmer’s bill?

The main purpose of Congressman Emmer’s bill is to ban central bank digital currencies (CBDCs) in the United States, codifying a previous executive order into law.

-

Why does Congressman Emmer oppose CBDCs?

Congressman Emmer opposes CBDCs because he believes they threaten the US dollar’s dominance, compromise financial privacy, and enable financial surveillance.

-

Who supports Congressman Emmer’s bill?

The bill is supported by over 100 members of Congress and organizations such as the Independent Community Bankers Association, American Bankers Association, Club for Growth, Heritage Action, and the Blockchain Association.

-

What are the potential risks of CBDCs according to Emmer?

According to Emmer, CBDCs pose risks of undermining the US dollar, compromising financial privacy, and enabling government tracking of transactions.

-

How does this bill relate to previous actions by President Donald Trump?

The bill seeks to codify an executive order signed by President Donald Trump into law, ensuring that future administrations cannot reverse this stance without legislative action. However, Trump’s actual order focused on establishing a Strategic Bitcoin Reserve and U.S. Digital Asset Stockpile, not banning CBDCs.

-

What are the potential benefits of CBDCs?

CBDCs could offer improved transaction efficiency and financial inclusion, though these benefits are debated.

-

How do CBDCs contrast with Bitcoin and other cryptocurrencies?

Unlike CBDCs, Bitcoin and other cryptocurrencies are decentralized, offering greater privacy and less government control.