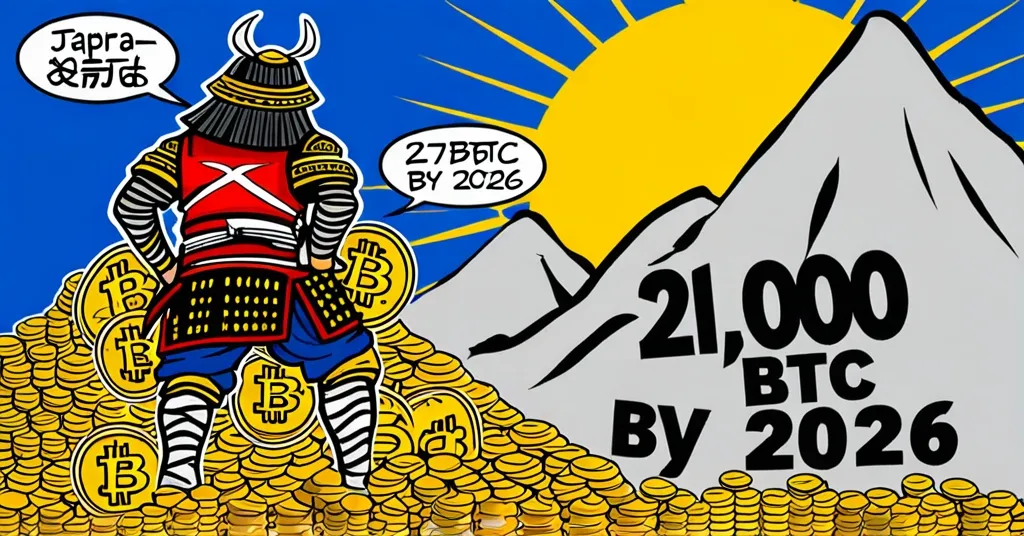

Metaplanet Surges to 3,050 BTC, Aims for 21,000 by 2026

Metaplanet Accelerates Bitcoin Accumulation, Now Holding 3,050 BTC

Japanese investment firm Metaplanet is ramping up its Bitcoin strategy, surpassing 3,000 BTC with a recent purchase of 162 BTC at an average price of ¥12.39 million ($83,635) per Bitcoin. The firm plans to reach 10,000 BTC by 2025 and 21,000 BTC by 2026, aiming to become one of the world’s largest corporate Bitcoin holders. Since adopting the Bitcoin Standard in April 2024, Metaplanet’s market capitalization has surged by 7,000%, and its shareholder base has grown to over 50,000.

- Metaplanet now holds 3,050 BTC.

- Recent purchase of 162 BTC at ¥12.39 million per Bitcoin.

- Plans to reach 10,000 BTC by 2025 and 21,000 BTC by 2026.

- Market cap up 7,000% since adopting Bitcoin Standard.

- Over 50,000 shareholders on board.

Metaplanet’s aggressive Bitcoin accumulation isn’t just a bold move; it’s a statement. They’ve hoarded over 3,050 BTC, valued at nearly $250 million, with their latest acquisition of 162 BTC showing their unwavering commitment to the cryptocurrency. This isn’t just stacking sats; it’s building a fortress of digital gold. Their ambition? To reach 10,000 BTC by the end of 2025 and a staggering 21,000 BTC by the end of 2026. That’s not just a goal; it’s a war cry in the world of corporate Bitcoin ownership.

The Bitcoin Standard, a financial strategy where Bitcoin is used as a primary reserve asset much like gold in the past, has been a game-changer for Metaplanet. Since adopting it in April 2024, their market cap has skyrocketed by approximately 7,000%. That’s not just growth; that’s a meteoric rise that has investors flocking in droves. Over 50,000 shareholders now ride the Metaplanet rocket, drawn by the promise of unrealized gains of $36 million in 2024. Think of it like this: if your house doubled in value overnight, but you didn’t sell it, that’s the kind of unrealized gain we’re talking about.

But why Bitcoin? Metaplanet sees it as the ultimate hedge against economic uncertainty and inflation. They’re not alone in this view. Companies like MicroStrategy, with its 499,096 BTC, have paved the way, but Metaplanet is rapidly catching up. Japan’s progressive stance on cryptocurrencies has certainly helped fuel this fire, allowing Metaplanet to blaze a trail in the Japanese investment landscape.

Metaplanet isn’t just throwing cash at Bitcoin; they’re using a sophisticated arsenal of financial instruments. From secured bonds, which are essentially loans, to equity issuance, or selling investment shares, they’re funding their Bitcoin buying spree with a masterclass in capital management. This isn’t just about hoarding; it’s about spreading the Bitcoin gospel in Japan and beyond.

But with great ambition comes great risk. The crypto market’s volatility can turn those unrealized gains into unrealized nightmares overnight. And let’s not forget the discrepancies in reported holdings. Accurate and timely updates are crucial to keeping the trust of those 50,000+ shareholders. Regulatory scrutiny looms large, with authorities wary of the wild west nature of cryptocurrencies.

While Metaplanet’s strategy is bold, it’s also a potential catalyst for broader market dynamics. Their aggressive accumulation could drive demand and affect Bitcoin’s price, encouraging other firms to follow suit. It’s a risky bet, but one that could reshape the corporate landscape’s approach to Bitcoin investment.

As Metaplanet continues its march to become a Bitcoin behemoth, the question remains: will this strategy pay off? Only time will tell, but one thing’s clear: Metaplanet is betting big on the future of money and finance, and they’re not afraid to go all-in on Bitcoin.

Key Questions and Takeaways:

- What is Metaplanet’s current Bitcoin holding?

Metaplanet currently holds 3,050 BTC.

- What are Metaplanet’s future Bitcoin holding goals?

The company aims to hold 10,000 BTC by the end of 2025 and 21,000 BTC by the end of 2026.

- How has adopting the Bitcoin Standard impacted Metaplanet?

Since adopting the Bitcoin Standard in April 2024, Metaplanet’s market capitalization has increased by about 7,000%, and it now has over 50,000 stockholders.

- What was Metaplanet’s Bitcoin yield in Q4 2024?

Metaplanet reported a 310% Bitcoin yield in the fourth quarter of 2024.

- How does Metaplanet’s Bitcoin strategy compare to other companies?

While not yet at the scale of companies like MicroStrategy, Metaplanet’s rapid accumulation of Bitcoin sets it apart from many other investment firms in Japan.

- Why does Metaplanet believe in Bitcoin as an investment?

Metaplanet views Bitcoin as a hedge against economic uncertainty and inflation, aligning with a broader trend of companies adopting Bitcoin as a strategic asset.