Solana’s SIMD-228 Proposal Fails: Impact on Inflation and Decentralization Explored

Solana’s SIMD-228 Proposal Falls Short: A Deep Dive into the Vote and Its Implications

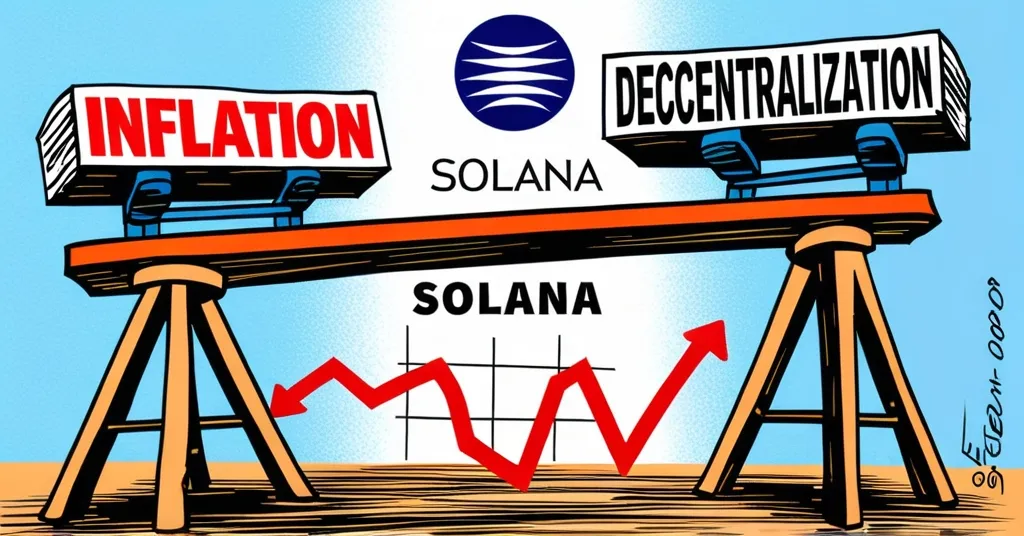

Solana’s SIMD-228 proposal, which aimed to slash its inflation rate by a whopping 80%, failed to pass despite garnering 61.39% approval. The vote, concluding during Solana Epoch 755, highlighted the network’s struggle to balance economic incentives with the challenges of maintaining decentralization.

- SIMD-228 aimed to cut SOL inflation by 80%

- Proposal received 61.39% support, but failed to pass

- Concerns over impact on small validators and network decentralization

- Solana’s market struggles amidst declining prices and activity

The SIMD-228 proposal, a bold move to reduce the amount of new SOL tokens minted through staking rewards, aimed to ease supply pressures and potentially bolster SOL’s price. But let’s not kid ourselves—it’s not all sunshine and rainbows. The proposal sparked heated debate over its potential impact on network decentralization. Smaller validators, the backbone of the network’s diversity, expressed fears that lower rewards could push them out, leading to a centralized playground for the big fish.

Meanwhile, Solana’s market performance has been anything but stellar. As of March 13, SOL was trading at a measly $126, a steep dive from its early January peak of $293. Network activity has also hit the skids, with total value locked (TVL) plummeting from $12 billion to $7 billion, and monthly fees tanking from $250 million to $89 million. It’s clear that slashing inflation alone won’t be the magic wand Solana needs to wave for a strong recovery. For more on recent trends, check out the latest data.

The voting process itself was a spectacle, with over 281 quadrillion votes cast, representing a 74% turnout. While the proposal didn’t make the cut, the vote was hailed by some as a triumph of community engagement. Tushar Jain of Multicoin Capital likened it to a “significant social stress test” for Solana, reminiscent of the Bitcoin blocksize wars of 2017.

“If SIMD-228 were approved, it would drastically cut staking rewards, reducing the amount of fresh SOL tokens entering circulation.”

The opposition from small validators was loud and clear, with over 60% of those holding up to 500,000 SOL voting against the proposal. Their concerns shed light on a universal crypto conundrum: how to keep the little guys in the game without handing over the keys to the castle. For more insights on the impact of reduced staking rewards, check out expert analysis.

“Lowering staking rewards might reduce supply, and possibly increase the value of SOL. However, smaller validators with low or no commission rates would find it difficult to remain profitable and might even be forced out.”

Looking ahead, Solana’s stakeholders are shifting gears from economic proposals to technical wizardry. Plans are in the works to double blockspace, achieve faster finality, and beef up MEV infrastructure. It’s a clear signal that the path to recovery and growth lies in performance tweaks, not just economic juggling. For more details on these technical improvements, see Solana’s roadmap.

“Reducing inflation by itself might not be enough to drive a strong recovery in the absence of more users and activity.”

The SIMD-228 saga, though unsuccessful, offers a masterclass in the delicate dance of managing a decentralized network. It’s a reminder that economic incentives are crucial, but they must harmonize with the broader goals of decentralization and network security. For more on the SIMD-228 proposal, see the wiki.

The Solana community’s response to the vote’s outcome has been surprisingly upbeat. Many see the process as a testament to the network’s resilience and the diverse voices within it. This spirit of engagement could be the secret sauce as Solana charts its course forward. For a broader discussion on the Solana inflation rate, visit the relevant Reddit thread.

Key Takeaways and Questions

-

What was the outcome of the SIMD-228 proposal?

The SIMD-228 proposal failed to pass, receiving 61.39% of votes in favor, short of the required 66.67% threshold.

-

How did small validators react to the proposal?

Over 60% of small validators voted against the proposal, concerned about the financial sustainability of their operations with reduced staking rewards.

-

What is the current inflation rate of Solana?

There is a discrepancy in reported figures, with sources mentioning either 6.8% or 4.7%. The accurate rate needs confirmation.

-

How has the Solana community responded to the vote’s outcome?

Despite the proposal’s failure, the community views the vote as a success, highlighting the network’s strength and decentralization.

-

What are Solana’s future priorities following the vote?

Solana stakeholders are focusing on technical improvements, including doubling blockspace, faster finality, and enhancing MEV infrastructure. For more on the impact of decentralization on Solana, see the expert discussions on Quora.

As Solana navigates its future, the lessons from the SIMD-228 proposal will be invaluable. The network’s ability to adapt and innovate will be the key to maintaining its edge in the blockchain race. And let’s not forget, while Solana has its struggles, Bitcoin continues to stand tall as the beacon of decentralization and economic stability. The crypto space is a wild ride, and we’re here for every twist and turn. For more on Solana’s network activity decline, see the latest reports.