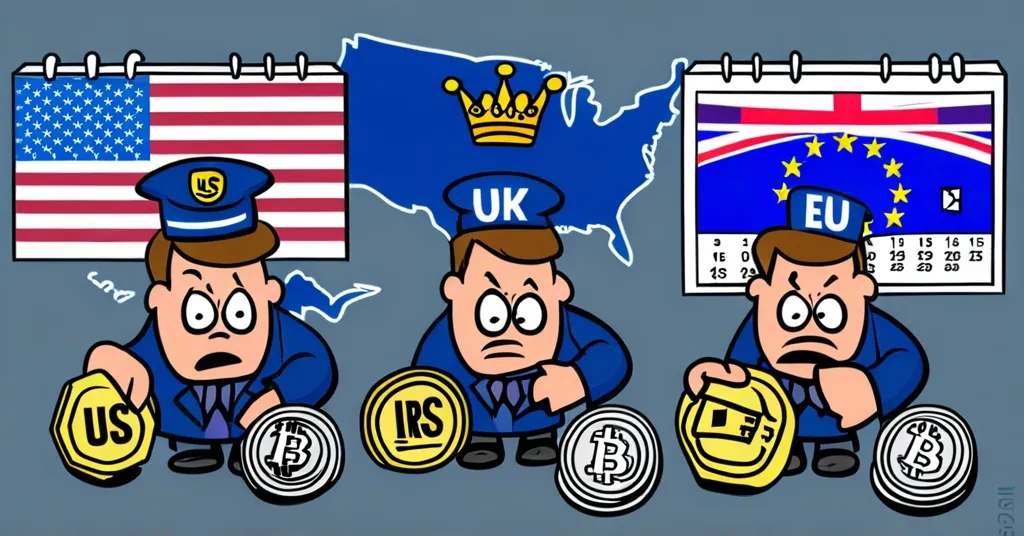

Crypto Tax Rules in US, UK, EU: What 2025 Means for Investors

This is how crypto tax rules in the US, UK, and EU could impact 2025 investments

Cryptocurrency’s growing mainstream presence has put it squarely in the crosshairs of tax authorities worldwide, with the US, UK, and EU stepping up their game to ensure that crypto activities contribute their fair share to public coffers. As 2025 approaches, these regions are set to intensify their scrutiny of crypto transactions, albeit each with its own flavor of regulation.

- US Taxation: The IRS treats cryptocurrencies like stocks and bonds, with tax implications based on usage, holding period, and income generation.

- UK Taxation: Crypto assets are subjected to Capital Gains Tax on disposal, while income tax applies to profits from mining or compensation.

- EU Taxation: Although varied across nations, a push towards harmonization under MiCA is underway, with Germany offering a unique twist of tax-free gains after a year of holding.

In the United States, the IRS views cryptocurrencies as property, akin to stocks and bonds. This classification entails tax liabilities contingent on how the crypto is used, the duration it is held, and whether it produces income. For instance, using crypto for purchasing goods or services is considered a sale event, triggering capital gains tax. As Konstantin Vasilenko, CEO of Paybis, notes, many crypto adopters initially overlook the necessity of tax reporting, leaving them vulnerable to unpleasant surprises come tax season.

Across the Atlantic, the UK’s approach offers its own set of challenges. Her Majesty’s Revenue and Customs (HMRC) is relentless in ensuring that individuals account for Capital Gains Tax (CGT) on disposals and income tax on earnings from activities such as mining. Myrtle Lloyd from HMRC stresses the significance of including crypto income in tax returns, underscoring the UK’s dedication to compliance.

In the European Union, the dance towards a standardized approach is gaining momentum. The impending Markets in Crypto-Assets Regulation (MiCA) is set to align member states’ regulations, with an eye toward fortifying anti-money laundering (AML) defenses. Although the regulation is still taking shape, Germany’s leniency for long-term holders—waiving taxes on gains after a year—offers a glimpse into potential future frameworks.

“Many individuals who have dabbled in crypto were not initially aware that they would need to account for tax reporting and holdings.” – Konstantin Vasilenko

With these regions tightening their grip, investors must not only stay informed about local regulations but also anticipate the potential impact of MiCA’s implementation across the EU. The amplified scrutiny and associated compliance costs could pose a deterrent to would-be investors.

Here are some key questions and answers:

How are cryptocurrencies taxed in the US?

They are treated as digital assets similar to stocks, with taxes depending on the nature of transactions and holding periods.

What distinguishes the UK’s approach to crypto taxation?

The UK applies Capital Gains Tax to disposals and income tax to earnings from crypto activities such as mining and compensation.

How does the EU plan to regulate crypto taxation by 2025?

Through the MiCA Regulation, aiming for harmonized regulations across member states with a focus on AML.

What are the tax implications of using crypto to purchase goods in the US?

It is considered a sale, and capital gains tax is applied.

Why might investors be concerned about crypto regulations in the EU?

The tightening of tax oversight could discourage investments due to increased scrutiny and compliance requirements.

For savvy cryptocurrency investors, navigating the labyrinth of tax regulations will be crucial. By understanding the intricacies of each jurisdiction, they can aim to maximize their gains while minimizing risks amidst these tightened regulations.