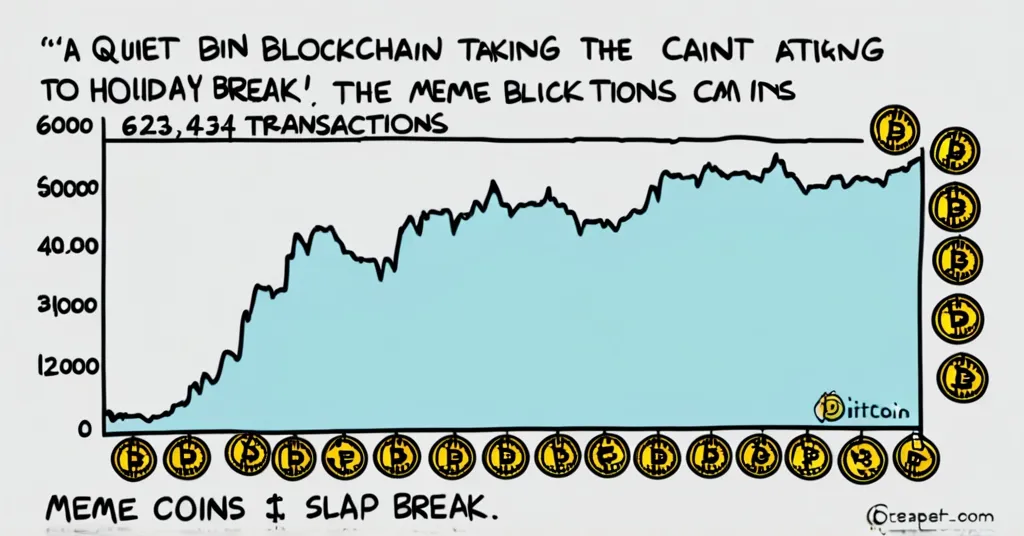

Bitcoin Transactions Plummet to Yearly Low of 623,434 on Dec 26, 2024

Confirmed Bitcoin Payments Hit Yearly Low During Holiday Season

On December 26, 2024, the number of confirmed Bitcoin transactions reached a yearly low of 623,434, reflecting a typical holiday season dip in activity. This followed a peak earlier in the month when Bitcoin hit an all-time high price of $108,000 and saw 857,000 transactions.

- Yearly low of 623,434 transactions on Dec. 26, 2024.

- Bitcoin hit $108,000 with 857,000 transactions on Dec. 17, 2024.

- Expected price recovery above $105,000 post-holidays.

- Social sentiment at a yearly low.

- Donald Trump’s inauguration eyed as a potential catalyst.

- Exploring meme coins like WEPE and SLAP suggested.

As the holiday season draws to a close, Bitcoin’s blockchain has been quieter than usual. On December 26, 2024, the number of confirmed Bitcoin transactions (transactions that have been verified and added to the blockchain) fell to a yearly low of 623,434. This dip follows a significant increase to a record-breaking $108,000 earlier in the month, which coincided with a bustling 857,000 transactions. While some might see this as a cause for concern, seasoned crypto investors know that holiday seasons often bring a lull in the markets. It’s like the blockchain taking a well-deserved break after a wild ride. But don’t let the quiet fool you; analysts are betting on a price recovery above $105,000 as the holiday festivities wind down. Who doesn’t want to kick off the new year with a bang?

Bitcoin’s Yearly Low

Historically, Bitcoin transactions tend to decrease during holiday periods due to lower trading volumes as people focus on celebrations rather than trading. This year’s low of 623,434 transactions on December 26 is a testament to this trend. However, it’s crucial to recognize that this dip is part of the decentralized nature of Bitcoin, where no single entity controls transaction volumes. This reflects the resilience and independence of Bitcoin, even amidst market fluctuations.

Price Recovery Expectations

While some might be skeptical about a quick recovery, analysts remain optimistic. The decrease in Bitcoin transactions during the holiday season is a common trend in the crypto market. As the holiday festivities wind down, experts expect Bitcoin’s price to recover above $105,000. This optimism is based on historical trends and the resilience of Bitcoin as a store of value. For those new to the crypto space, Bitcoin’s ability to bounce back from these holiday lows underscores its potential as digital gold.

Social Sentiment and Price Movement

However, it’s not all eggnog and cheer in the Bitcoin world. Social sentiment has hit a yearly low, with a gloomy ratio of four positive comments to every five negative ones. Yet, not all doom-and-gloom is bad news in the crypto sphere. According to Santiment, a crypto analytics firm, this negative sentiment might just be the calm before the storm, hinting at a potential price breakout. As they noted on X on December 26, 2024, “When considering Bitcoin price, other factors are more important than ‘the short-term social impact of greed and fear.'” This highlights that while social sentiment can be a useful indicator, it’s the broader market fundamentals and institutional adoption that often drive Bitcoin’s price movements.

When considering Bitcoin price, other factors are more important than ‘the short-term social impact of greed and fear.’ – Santiment, Dec. 26, 2024 X post.

Potential Catalysts

Looking ahead, the crypto community is buzzing about potential catalysts on the horizon. One such event is Donald Trump’s inauguration on January 20, 2025. While some believe it could send Bitcoin soaring, others, like Arthur Hayes, predict a sell-off due to unmet regulatory expectations. It’s a classic case of “wait and see” in the unpredictable world of crypto. However, it’s important to consider why some might be skeptical about the inauguration’s impact on Bitcoin. Regulatory changes and political shifts can be unpredictable and might not always align with market expectations. This reflects the speculative nature of the market, where external events can have significant but uncertain impacts.

Exploring Alternative Investments

In the meantime, for those looking to diversify their portfolio, exploring presale meme coins like Wall Street Pepe (WEPE) and CatSlap (SLAP) might be an option. WEPE aims to empower small retail traders, while SLAP introduces a novel “slap-to-earn” feature. But remember, meme coins are as unpredictable as a cat’s next move, so tread carefully. It’s crucial to understand the risks associated with these investments, as they can be highly volatile and may not provide the stability that Bitcoin offers. For those new to the crypto space, meme coins are often driven by community hype and can experience rapid price swings, making them a high-risk, high-reward proposition.

As Bitcoin navigates these holiday doldrums, it’s clear that the crypto world never sleeps. From yearly lows to potential highs, the journey is as thrilling as it is unpredictable. So, buckle up, stay informed, and maybe, just maybe, consider giving those meme coins a playful swipe. But always remember, Bitcoin remains the cornerstone of the crypto ecosystem, with its resilience and potential as a store of value unmatched by other cryptocurrencies.

Key Takeaways and Questions

- What was the lowest number of confirmed Bitcoin transactions in the past year?

The lowest number of confirmed Bitcoin transactions in the past year was 623,434, recorded on December 26, 2024.

- How does the number of transactions on the day Bitcoin reached its all-time high compare to the yearly low?

On the day Bitcoin reached its all-time high of $108,000, there were 857,000 confirmed transactions, which is 37% more than the 623,434 transactions recorded on the yearly low day.

- What is the expected price recovery for Bitcoin?

Analysts expect Bitcoin’s price to recover above $105,000 as the holiday season ends.

- How does social sentiment affect Bitcoin’s potential price movement?

A yearly low in social sentiment, with more negative comments, is seen by some analysts as a potential indicator of an upcoming price breakout, as other factors may be more significant in influencing Bitcoin’s price.

- What upcoming event is mentioned as a possible catalyst for Bitcoin?

Donald Trump’s inauguration on January 20, 2025, is mentioned as a potential catalyst for Bitcoin.

- What alternative investment options are suggested?

Exploring presale meme coins such as Wall Street Pepe (WEPE) and CatSlap (SLAP) are suggested for alternative investment opportunities.