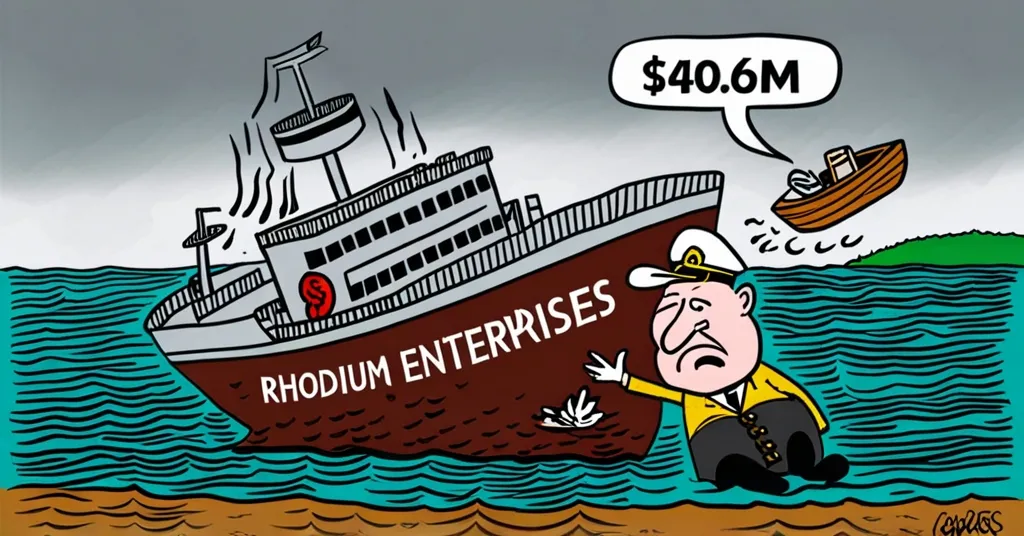

Rhodium Co-CEO Resigns Amid Bankruptcy, Sells Bitcoin Mine for $40.6M

Rhodium’s Co-CEO Resigns Amid Bankruptcy and Bitcoin Mining Asset Sale

Rhodium Enterprises, a prominent player in the Bitcoin mining sector, faces a tumultuous period as it navigates bankruptcy and the sale of key assets. Amidst these challenges, Co-CEO Nathan Nichols has resigned, adding further uncertainty to the company’s future.

- Nathan Nichols resigns amid fraud allegations

- Rhodium files for Chapter 11 bankruptcy

- Temple site sold for $40.6 million

- Legal victory against Riot Platforms

- Environmental impact of Bitcoin mining

Rhodium Enterprises, once hailed as a beacon in the Bitcoin mining world, is now navigating through turbulent waters. The company announced the resignation of its Co-CEO, Nathan Nichols, amidst ongoing bankruptcy proceedings. Nichols, embroiled in a lawsuit accusing him and other co-founders of fraud, leaves at a critical juncture. His departure signifies deeper issues within Rhodium, potentially disrupting its restructuring efforts as the company tries to keep its head above water.

Rhodium’s journey into bankruptcy began in August when it filed for Chapter 11 protection—a legal process that allows a company to reorganize its debts and try to stay in business. The company’s financial struggles can be traced back to broader industry challenges, including the rollercoaster ride of Bitcoin prices, the high cost of keeping those machines humming, and the cutthroat competition from other miners. It’s like trying to mine gold during a storm while everyone else is rushing to the same spot.

In a bid to address its financial woes, Rhodium completed the auction of its Temple site, selling it to Temple Green Data LLC for $40.6 million in cash. Rhodium sold its Temple site faster than you can say ‘HODL,’ but at what cost? This sale allowed the company to repay a $15 million debt to Galaxy Digital. However, offloading high-cost assets can be a double-edged sword in the quest for financial stability. It’s like selling your prized guitar to pay the rent—you get some cash, but you’ve lost something valuable.

Despite these setbacks, Rhodium secured a legal victory against Riot Platforms, allowing them to resume operations under the original contracts at Riot’s Whinstone facility in Rockdale, Texas. This move could provide a much-needed lifeline for the company, as it continues to explore ways to stabilize its operations and revenue stream. It’s a ray of hope in an otherwise gloomy picture.

The cryptocurrency mining industry is no stranger to such upheavals. As noted by Coinshares, mining profitability is under increasing pressure due to declining hash prices (the reward miners get for processing transactions) and rising operational costs. This broader trend underscores the need for companies like Rhodium to adapt and innovate to survive. Some are even exploring alternative funding sources and diversifying into AI, which is like trying to find a new dance move when the old one isn’t working anymore.

Amidst all this, it’s worth noting the environmental angle. Coinshares’ model suggests that by 2050, Bitcoin mining could significantly reduce carbon emissions from flared gas, adding an intriguing dimension to the industry’s future. While Rhodium’s current focus is on survival, these broader trends could shape the path forward for the entire sector. Imagine Bitcoin mining not just fueling the digital economy but also helping the planet breathe easier.

As Rhodium Enterprises continues to navigate through bankruptcy and asset sales, the resignation of its Co-CEO Nathan Nichols marks a pivotal moment in the company’s history. The road ahead remains uncertain, but the company’s actions in the coming months will be crucial in determining its fate in the ever-competitive world of cryptocurrency mining. While Rhodium’s struggles might signal distress, such events in the mining world could ultimately strengthen Bitcoin’s network and value, aligning with the principles of effective accelerationism (e/acc). It’s like pruning a tree to make it grow stronger.

Key Takeaways and Questions

- What led to Rhodium Enterprises’ financial difficulties?

Rhodium Enterprises faced financial difficulties due to the volatile cryptocurrency market, high operational costs, and intense competition within the industry.

- How might Nathan Nichols’ resignation impact Rhodium’s restructuring efforts?

Nichols’ resignation, linked to a fraud lawsuit, could signal deeper issues within Rhodium, potentially disrupting its restructuring plans and negotiations with creditors.

- What are the potential outcomes of the completed auction of Rhodium’s Temple site?

The sale to Temple Green Data LLC for $40.6 million helped Rhodium repay a $15 million debt to Galaxy Digital, aiding in its debt management strategy.

- How does Rhodium’s situation reflect broader trends in the cryptocurrency mining industry?

Rhodium’s financial struggles and bankruptcy are indicative of the challenges faced by many mining companies, including fluctuating Bitcoin prices, high energy costs, and intense competition.

- What steps is Rhodium taking to address its financial difficulties?

Rhodium is focusing on restructuring its operations, managing its debts through asset sales, and leveraging legal victories to continue operations at key facilities.

- What environmental impact could Bitcoin mining have in the future?

By 2050, Bitcoin mining could significantly reduce carbon emissions from flared gas, potentially transforming the industry’s environmental footprint.

- How could Rhodium’s challenges affect the broader Bitcoin network?

While Rhodium’s struggles might signal distress, such events in the mining world could ultimately strengthen Bitcoin’s network and value, aligning with the principles of effective accelerationism (e/acc).