Andreessen Horowitz Cuts UK Presence, Bets Big on US Amid Trump’s Crypto Push

Andreessen Horowitz Scales Back UK Operations Amid Trump’s Pro-Crypto Policy Push

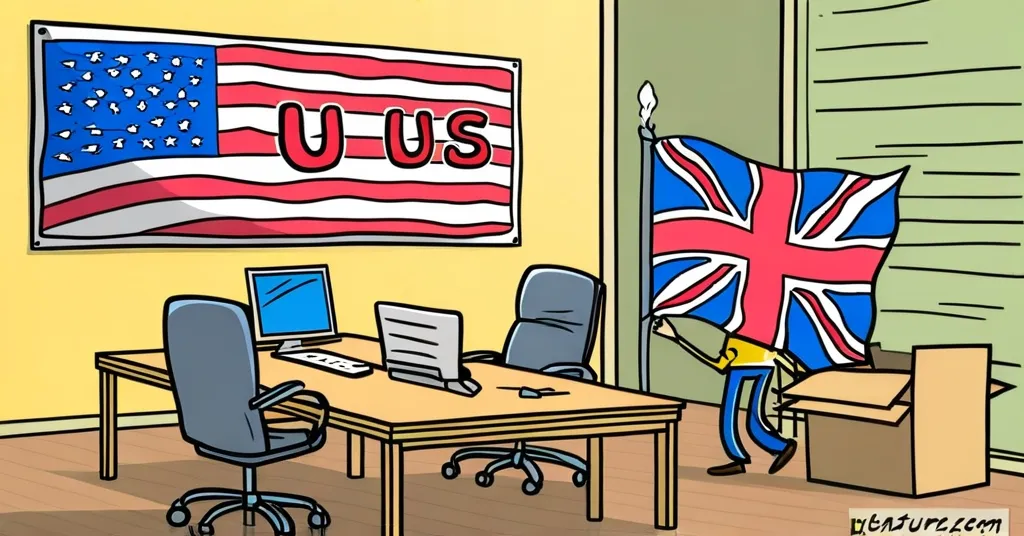

Andreessen Horowitz, a powerhouse in the venture capital world with a significant focus on cryptocurrencies, has announced it will scale back its UK operations to concentrate on the U.S. market. This strategic shift is driven by President Donald Trump’s aggressive pro-crypto policies, which are seen as a catalyst for a potential boom in the American crypto landscape.

- Andreessen Horowitz winding down UK operations

- Influence of Trump’s pro-crypto policies

- Confidence in UK’s crypto future remains

- Contrasting U.S. and UK crypto regulatory approaches

The decision was shared by Anthony Albanese, the Chief Operating Officer of Andreessen Horowitz’s crypto division, in a post on X on January 24. Despite this move, Albanese made it clear that the firm’s belief in the UK’s potential within the crypto and blockchain sector remains unshaken, stating, “This doesn’t change our confidence in the UK’s growing role in crypto and blockchain.” It’s a classic case of “keep calm and carry on” for UK crypto enthusiasts, with Andreessen Horowitz pledging to continue supporting UK entrepreneurs.

Andreessen Horowitz’s foray into the UK began in 2023 with the establishment of its London office, attracted by the country’s stable business environment. However, the political landscape has shifted since then. Following the Labour Party’s victory in July 2024, UK Prime Minister Keir Starmer announced plans for a comprehensive crypto regulatory framework by 2026. This approach contrasts sharply with the U.S., where Trump, on January 20, signed an executive order to explore regulations for stablecoins and establish a strategic crypto reserve. While the U.S. appears to be accelerating into the crypto future, the UK seems to be taking a more cautious approach.

The U.S. Securities and Exchange Commission (SEC) has also stepped up its game. Following Gary Gensler’s departure, the SEC announced the formation of a crypto task force, indicating a proactive stance on crypto regulation. Meanwhile, the UK has been busy with its own legislative efforts. In September, a bill was introduced to recognize digital assets as “things” and “personal property” under its property laws. Additionally, the UK’s Financial Conduct Authority (FCA) has tightened regulations, implementing new rules in 2023 that require crypto firms to register and have their marketing materials approved.

Marc Andreessen, the co-founder of Andreessen Horowitz, has been a vocal advocate for pro-crypto policies. He has put his money where his mouth is, contributing over $5 million to political action committees supporting Trump’s 2024 campaign and a staggering $22 million to the Fairshake PAC, which champions crypto-friendly congressional candidates. It’s evident that Andreessen is betting big on the U.S. becoming a crypto powerhouse.

While the UK’s slower regulatory approach might seem like a drag, it’s not without its merits. The focus on consumer protection and combating money laundering through the FCA’s new rules shows a commitment to building a stable and trustworthy crypto environment. But for a venture capital firm like Andreessen Horowitz, the allure of the U.S. market, spurred by Trump’s crypto-friendly policies, is simply too good to pass up.

As the global regulatory landscape for cryptocurrencies continues to evolve, the decisions made by firms like Andreessen Horowitz will play a pivotal role in shaping the future of the industry. The contrasting approaches of the U.S. and UK serve as a fascinating case study in how different countries are navigating the complex world of crypto regulation.

It’s worth noting that while the U.S. is racing ahead, its aggressive approach might lead to unintended consequences. The UK’s more measured approach, although slower, could result in a more robust regulatory framework, potentially offering long-term stability and growth. As for Andreessen Horowitz, their move might be seen as a vote of confidence in the U.S. market, but it also underscores the importance of adaptability in the fast-paced world of crypto.

In the end, it’s a high-stakes game where the rules are still being written. Andreessen Horowitz’s decision to scale back in the UK while doubling down on the U.S. is a bold move, but it’s one that reflects the firm’s belief in the power of effective accelerationism. Whether this gamble pays off remains to be seen, but one thing is clear: the crypto world is watching, and the stakes are higher than ever.

Key Takeaways and Questions

- Why did Andreessen Horowitz decide to scale back its UK operations?

Andreessen Horowitz decided to scale back its UK operations due to U.S. President Donald Trump’s strong pro-crypto policy momentum, which is driving the firm to refocus on the U.S. market.

- How does Andreessen Horowitz view the future of crypto in the UK?

Despite scaling back operations, Andreessen Horowitz remains confident in the UK’s growing role in crypto and blockchain and plans to continue supporting UK entrepreneurs.

- What are the key differences in crypto policies between the U.S. and the UK?

The U.S. under Trump’s leadership is rapidly advancing crypto initiatives, including stablecoin regulations and a strategic crypto reserve. In contrast, the UK, under new leadership, is planning a comprehensive crypto regulatory framework by 2026.

- What role does Marc Andreessen play in supporting pro-crypto policies?

Marc Andreessen has been a vocal supporter of pro-crypto policies, contributing over $5 million to political action committees backing Trump’s 2024 campaign and $22 million to the Fairshake PAC, which advocates for crypto-friendly congressional candidates.

- What recent legislative actions has the UK taken regarding cryptocurrencies?

The UK introduced a bill in September to recognize digital assets as “things” and “personal property” under its property laws, and the FCA implemented new rules in 2023 requiring crypto firms to register and have their marketing materials approved.