Argentina’s President Milei Faces Impeachment After $LIBRA Crypto Crash

Argentina’s President Javier Milei Faces Impeachment Over $LIBRA Cryptocurrency Scandal

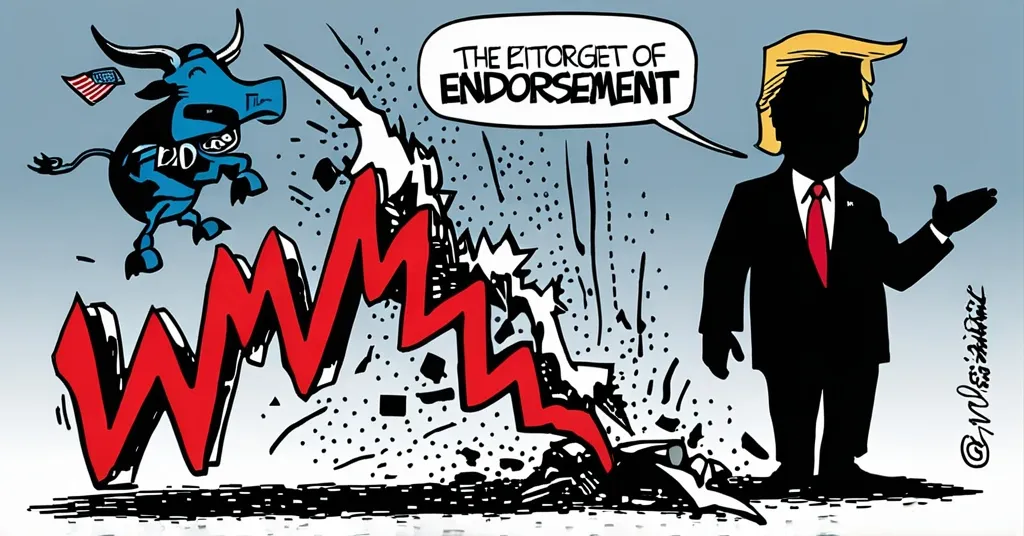

Argentina’s President Javier Milei is embroiled in controversy and faces potential impeachment after endorsing the $LIBRA cryptocurrency on social media, which subsequently crashed, causing significant investor losses.

- Milei endorsed $LIBRA, causing its value to surge.

- $LIBRA crashed, hinting at a possible “rug pull” scam.

- Impeachment proceedings suggested by opposition.

- Incident highlights risks of cryptocurrency investments.

The Endorsement and Rise

President Javier Milei, known for his controversial economic reforms, endorsed the $LIBRA cryptocurrency on social media, a token created on the Solana blockchain platform. Solana is a high-performance blockchain designed to support decentralized apps and cryptocurrencies like $LIBRA. Following Milei’s endorsement, $LIBRA’s market cap soared to a staggering $4.4 billion, equivalent to about $5 per token. Investors, lured by the promise of quick gains, jumped on board, hoping to ride the wave of Milei’s influence.

Milei’s tweet went from a dream to a nightmare faster than you can say ‘blockchain.’ His endorsement was like a presidential seal of approval, but it turned out to be more of a Pandora’s box, unleashing chaos on unsuspecting investors.

The Crash and Fallout

Within hours, the value of $LIBRA crashed dramatically, leaving many investors with significant losses. The token plummeted to under $1, hinting at a possible “rug pull” scam. A “rug pull” is a type of cryptocurrency scam where developers abandon a project, leaving investors with worthless tokens. Crypto security expert Pablo Sabbatella described the $LIBRA incident as a classic “pump and dump” scheme, where large holders buy at low prices, pump up the value, and then sell at a profit.

Milei quickly realized the gravity of the situation and deleted his tweet. He later explained that he was unaware of the details surrounding the coin before promoting it. Despite the crash, $LIBRA still holds a market value of around $250 million, but the damage to investor confidence and Milei’s political standing has been done.

Political Repercussions

The fallout from this incident has been swift and severe. Opposition lawmakers in Argentina have suggested that Milei could face an impeachment trial in Congress over the incident. The Union for the Homeland coalition has announced plans to move forward with an impeachment request, reflecting the political tension this scandal has caused.

“Milei quickly deleted the tweet and later explained that he was unaware of the details surrounding the coin before promoting it.”

Adding to the controversy, Argentine lawyers have filed fraud complaints against President Milei in a criminal court, leading to an investigation by a judge. The presidency has also announced an investigation into the matter, involving the Anti-Corruption Office.

Public and Expert Reactions

The fintech chamber of Argentina has acknowledged the possibility of foul play in the $LIBRA crash. Security Minister Patricia Bullrich defended Milei’s actions, emphasizing his freedom of expression and comparing his social media post to a presidential visit to a factory, suggesting no intent to create a lobby for the cryptocurrency.

The public reaction has been intense, with protests occurring outside the Casa Rosada presidential office. The national newspapers in Argentina have covered the scandal prominently, reflecting its impact on public perception and political discourse.

Implications for Cryptocurrency

This incident highlights the volatile nature of cryptocurrency investments and the influence public figures can have on market dynamics. It also raises questions about the need for stricter regulations on cryptocurrency promotions, particularly by public officials, to protect investors from similar scams.

From a bitcoin maximalist perspective, this debacle underscores the relative stability and reliability of Bitcoin compared to newer, less established cryptocurrencies like $LIBRA. Bitcoin’s decentralized nature and established infrastructure make it a more resilient option for investors seeking a safe haven in the crypto world.

However, it’s worth considering the potential benefits of politicians engaging with cryptocurrencies. While Milei’s endorsement was misguided, it could have been a well-intentioned effort to explore alternative financial solutions for Argentina’s economic challenges. Incidents like this also highlight the importance of decentralization and individual freedom in cryptocurrency investments, reminding us of the need to be wary of centralized control and the potential for manipulation.

From an effective accelerationism (e/acc) viewpoint, such incidents might accelerate the push for better regulations and more informed public engagement with cryptocurrencies. The chaos can serve as a catalyst for change, driving innovation and better practices in the crypto space.

Key Questions and Takeaways

What was the impact of Javier Milei’s endorsement on $LIBRA’s value?

Milei’s endorsement led to a rapid increase in $LIBRA’s market cap to $4.4 billion, followed by a sharp decline to under $1, suggesting a possible “rug pull” scam.

Why did Javier Milei delete his tweet about $LIBRA?

Milei deleted his tweet after realizing he was unaware of the details surrounding the coin and its potential for being a scam.

What are the political consequences faced by Javier Milei due to the $LIBRA incident?

Opposition lawmakers in Argentina have suggested that Milei could face an impeachment trial in Congress over his promotion of the $LIBRA cryptocurrency.

What does the $LIBRA incident highlight about cryptocurrency investments?

The incident underscores the high volatility and risks associated with cryptocurrency investments, particularly when influenced by public endorsements.

How has the fintech chamber of Argentina responded to the $LIBRA crash?

The fintech chamber of Argentina has acknowledged the possibility of foul play in the $LIBRA crash.