BBK Merges Realme into Oppo: Chip Shortages Hit Smartphones and Crypto Hard

BBK Electronics Merges Realme into Oppo: Chip Shortages Ripple Through Tech and Crypto

BBK Electronics, the parent company of smartphone brands Realme, Oppo, and Vivo, dropped a bombshell on Wednesday by merging Realme into Oppo as a drastic cost-cutting measure. This consolidation comes as the global smartphone industry reels from skyrocketing production costs and bleak sales forecasts, driven by a severe memory chip shortage. But here’s the kicker for us at “Let’s Talk, Bitcoin”: these same hardware bottlenecks are slamming the crypto world too, from Bitcoin mining rigs to blockchain infrastructure.

- Merger Move: BBK Electronics folds Realme into Oppo to slash costs amid a smartphone market crisis.

- Chip Crunch: A global memory chip shortage, fueled by AI and data center demand, is jacking up costs across tech sectors.

- Crypto Impact: Bitcoin mining and decentralized tech face similar hardware struggles, revealing a shared supply chain mess.

BBK’s Desperate Pivot: Consolidation in a Crumbling Market

The smartphone sector is getting hammered, and BBK Electronics’ decision to merge Realme under Oppo is a loud cry for survival. Production costs are through the roof—budget phones under $200 have seen a 20-30% spike since January, while mid-to-high-end models are up 10-15%. Counterpoint Research delivers the bad news: global smartphone shipments are expected to drop 2.1% by 2026, a harsh pivot from earlier hopes of stability or slight growth. Worse, consumer prices are set to jump 6.9%, nearly double the previously forecasted 3.6%. Imagine a market shedding millions of buyers while the phones on the shelf get pricier by the day. That’s the reality BBK and its peers are staring down.

At the core of this disaster is a shortage of memory chips, specifically DRAM (Dynamic Random-Access Memory), a critical component for smartphone performance—think of it as the short-term memory that keeps your device running smoothly. Demand from AI technologies and data centers, led by giants like Nvidia, is sucking up supply faster than producers like SK Hynix can keep up. Prices for these chips could surge another 40% by Q2 2026, potentially hiking manufacturing costs by an additional 8-15%. For BBK, a Chinese tech powerhouse with a footprint in budget and mid-range markets through brands like Realme, this isn’t just a hiccup—it’s a full-blown emergency. Realme carved a niche as a scrappy, affordable option in places like India, Southeast Asia, and Europe. Now, under Oppo’s wing as part of a strategic merger to cut costs, can it keep that edge, or will BBK shove pricier models down consumers’ throats to save their margins?

Competition Heats Up: Huawei and Apple Hold Ground

The battle for market share isn’t making things easier, especially in China, where competition is cutthroat. Huawei has clawed its way back to the top, shipping 12.2 million units in Q2 2025 for an 18% market share, a 15% leap year-over-year, per Canalys data. Even Apple, often a fortress against market swings, notched a 4% sales bump in China with 10.1 million units shipped, grabbing fifth place and marking its first growth there since Q4 2023. Meanwhile, smaller or mid-tier players—think BBK’s budget-focused brands—are getting squeezed. As MS Hwang, Research Director at Counterpoint, bluntly noted:

“But it will be tough for others that don’t have as much wiggle room to manage market share versus profit margins.”

Translation: if you’re not Huawei, Apple, or Samsung (who also happens to produce memory chips themselves), you’re in deep trouble. BBK’s merger might streamline operations, but it’s also a glaring admission that playing in the low-cost arena is becoming unsustainable. Will they cut corners on quality—think downgraded cameras or screens—or recycle outdated parts to save a buck? If so, expect consumer backlash. We’ve seen this play out before: skimp too much, and brand loyalty vanishes quicker than a rug pull in a shady altcoin scam.

Chip Shortages: A Tech-Wide Crisis with Crypto Consequences

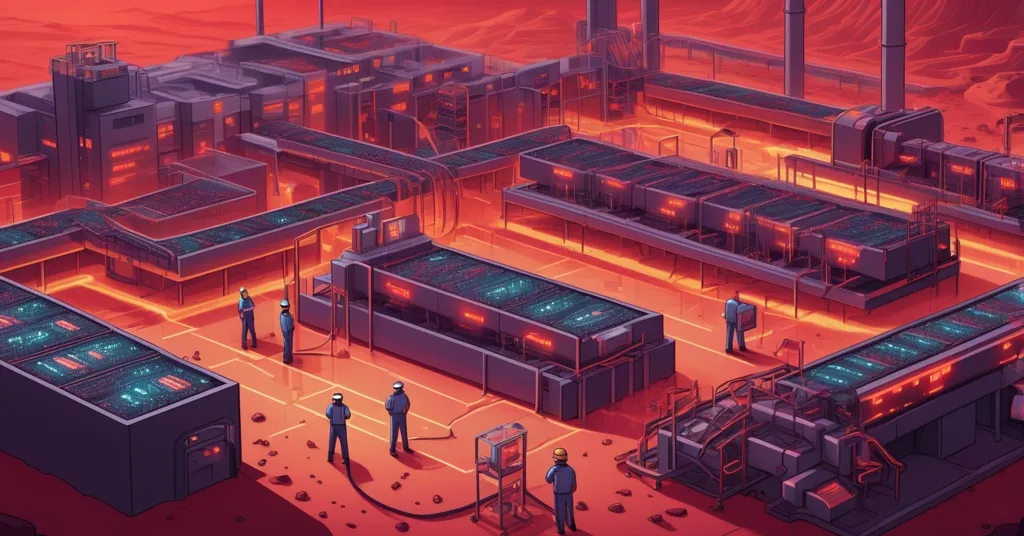

Let’s zoom out. This memory chip shortage isn’t just a smartphone problem—it’s a systemic tech crisis. AI and data centers are hogging resources, leaving everyone else scrambling. Smartphone makers might resort to pushing premium models or cheaping out on hardware, but the ripple effects hit our corner of the world too. Bitcoin miners, for instance, rely on specialized hardware like ASICs (Application-Specific Integrated Circuits) and GPUs, which face similar supply chain bottlenecks. Ethereum’s ecosystem, even post-merge with its shift to staking, still depends on robust hardware for node operators and decentralized app development. Solana and other altcoin platforms powering smart contracts? Same deal. When chips are scarce, prices soar, and delays mount, it’s not just your next phone that’s at risk—it’s the rigs and servers underpinning the decentralized revolution we champion.

Think about it: the same forces driving up DRAM costs are throttling crypto mining operations. A 40% spike in chip prices by next year could mean fewer miners online, slower network growth, or higher barriers to entry for small players. For blockchain infrastructure projects, from Bitcoin’s Lightning Network to Ethereum’s layer-2 solutions, hardware delays could stall scaling efforts. Sure, Bitcoin’s resilience as a decentralized store of value doesn’t hinge on a single chip factory, but the ecosystem around it—miners, wallets, nodes—feels the pinch. And let’s not kid ourselves: if data center demand keeps outpacing supply, the big dogs like Nvidia will get first dibs, leaving crypto’s grassroots warriors to fight over scraps. It’s a brutal reminder that even decentralized tech isn’t immune to centralized supply chain screw-ups.

Playing Devil’s Advocate: Could Consolidation Spark Innovation?

Before we write off BBK’s merger as a centralized cop-out, let’s flip the script. Could streamlining Realme into Oppo actually free up resources for something useful? Fewer brands mean less overhead—marketing, R&D, and production can consolidate under one roof. If BBK plays it smart, they might channel those savings into better hardware or partnerships that indirectly benefit decentralized tech. Imagine a world where tighter budgets force smartphone makers to prioritize efficiency, driving down costs for chips over time. Crypto hardware could ride that wave, with cheaper rigs and servers making mining or node-running more accessible. It’s a long shot, but disruption often hides in unexpected corners—a core tenet of effective accelerationism we stand by.

On the flip side, don’t hold your breath. Mergers like this often signal retreat, not reinvention. Fewer players in the budget tech space could choke competition, stifling the kind of scrappy innovation Realme once brought to the table. Less choice for consumers, higher prices, and a market tilted toward premium junk—hardly the decentralized dream. Plus, if BBK or others start shilling blockchain integration as a gimmick to hype their phones without real substance, we’ll call that nonsense out faster than you can say “ICO scam.” No tolerance for fake hype here. We’re all about real adoption, not marketing stunts.

Future Outlook: A Silicon Desert for Tech and Crypto Alike

Looking ahead, the road is rough. With memory chip prices poised to climb and smartphone shipments dwindling, BBK’s gamble to merge Realme into Oppo might keep them afloat, but at what cost? Consumers could face a double whammy: pricier devices with questionable quality. For the crypto space, the shared hardware crisis looms large. Bitcoin maximalists might argue the king of crypto doesn’t need fancy chips to hold value—and they’re right—but the ecosystem’s growth, from mining to merchant adoption, still hinges on accessible tech. Altcoins like Ethereum or Solana, with their heavy reliance on dApp infrastructure, might feel the squeeze even harder.

Historically, BBK’s brands thrived by filling niches—Realme disrupted budget markets, while Oppo chased mid-range flair. Merging them risks diluting that edge, especially in price-sensitive regions like India where affordable tech is a lifeline for millions entering the digital economy (and often, their first crypto wallet). If BBK botches this, they’re not just losing phone sales—they’re ceding ground to giants like Huawei who’ve already proven they can bounce back. Meanwhile, the crypto community watches from the sidelines, knowing that every chip diverted to a data center is one less for a mining rig or node. It’s a silicon desert out there, and no one’s got a map.

Key Takeaways and Burning Questions

- Why is BBK Electronics merging Realme into Oppo?

They’re cutting costs to survive a brutal smartphone market slump, with production expenses soaring 20-30% for budget phones and 10-15% for premium ones due to a memory chip shortage. - How does the chip shortage hit both smartphones and crypto?

It’s spiking costs and delaying production for phones while hammering Bitcoin mining rigs and blockchain infrastructure with the same supply chain chaos, driven by AI and data center demand. - What’s the competitive fallout in the smartphone space?

Huawei dominates China with an 18% market share in Q2 2025, Apple’s up 4%, and smaller players like BBK’s brands are forced to consolidate or risk getting crushed. - Could this merger fuel tech innovation for crypto?

Possibly, if BBK redirects savings into R&D that eases hardware costs long-term, benefiting decentralized tech—but it’s just as likely to reduce competition and jack up prices. - Are crypto ecosystems at risk from hardware bottlenecks?

Absolutely, as Bitcoin mining, Ethereum staking nodes, and altcoin dApp platforms all rely on chips now scarce due to competing tech sectors, potentially slowing adoption and growth.

The BBK Electronics merger is a stark snapshot of a tech industry on edge, but it’s also a mirror for the crypto world. Hardware shortages don’t discriminate—whether you’re building a budget phone or a Bitcoin mine, the silicon struggle is real. We’re rooting for disruption and decentralization to win out, but damn, it’s an uphill fight when the building blocks themselves are in short supply. BBK’s playing defense; let’s hope the crypto space can play smarter offense.