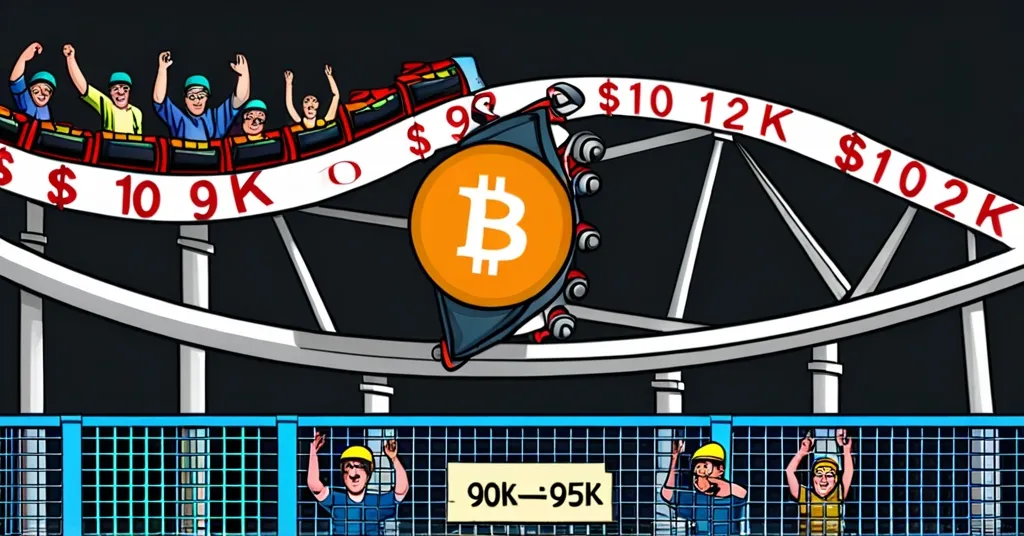

Bitcoin Plunges 4.41% to $102,850: Critical Support at $90K-$95K Tested

Bitcoin’s Critical Zone Exposed Amid Market Downturn

Bitcoin recently took a nosedive from its peak of $109,114 to $102,850, a drop that’s sent ripples across the crypto world. This plunge isn’t just numbers on a screen; it’s a stark reminder of the wild ride that is cryptocurrency investing.

- Bitcoin drops 4.41% from its high.

- Over $576 million in leveraged positions wiped out.

- Critical support zone at $90,000 to $95,000.

- Short-term holders selling at a loss.

- Miners still in the green despite the chaos.

The sell-off was brutal, with more than $576 million in leveraged positions liquidated in the last 24 hours. That’s enough to buy a small country’s GDP! But let’s break it down: $407 million of that came from bullish bets that went sour. It’s like watching a high-stakes poker game where the chips are flying off the table. This event underscores the volatility that comes with the territory in crypto investing.

Glassnode, a trusted blockchain data and intelligence platform, has pinpointed a crucial support zone for Bitcoin between $90,000 and $95,000. Think of this range as a safety net that catches Bitcoin when it falls, preventing it from dropping further. As Glassnode puts it:

Glassnode highlights a crucial range that Bitcoin needs to hold to prevent major selling: the $90,000 to $95,000 range.

Whenever Bitcoin dips into this zone, the market’s nerves start to fray, with realized losses spiking above $100 million per hour. It’s like a fire alarm going off, signaling traders to take action. If Bitcoin can’t hold this support, we might see a deeper correction.

Meanwhile, CryptoQuant, another analytics firm, sheds light on the behavior of short-term holders. Their analysis reveals that the Short-Term Holder SOPR (a measure that shows whether people are selling their Bitcoin at a profit or loss) has entered the negative zone. This means short-term holders are now selling their Bitcoin at a loss. It’s a pivotal moment where these holders’ decisions could either bolster support or trigger further market corrections. CryptoQuant’s data suggests:

The Short-Term Holder (STH) SOPR indicator has entered the negative zone, indicating that short-term holders are now selling their BTC at a loss.

Despite the market’s turbulence, Bitcoin miners are holding their ground. The Difficulty Regression Model estimates that the cost to mine one Bitcoin is around $33,900. With the current market price still above $100,000, miners are raking in revenue. The Miner Revenue per Exahash, a measure of mining profitability, stands at a robust $60,800. As one miner quipped, “The game’s tough, but the rewards are sweeter than ever.” This profitability underscores the enduring strength of Bitcoin’s fundamentals, even amidst market volatility.

While the market grapples with these dynamics, the broader implications for Bitcoin and the crypto ecosystem are clear. The resilience of the $90,000 to $95,000 support zone will be a key indicator of market sentiment. The actions of short-term holders could tip the scales in either direction, and miners continue to play a crucial role in maintaining the network’s integrity and security.

But here’s a counterpoint: Is this drop a buying opportunity or a sign of a more significant correction? While some might see this as a chance to scoop up Bitcoin at a discount, others might be wary of further declines. The decentralized nature of Bitcoin means that no single entity can control its price, which aligns with the principles of effective accelerationism and the drive towards disrupting the status quo. Bitcoin’s rollercoaster ride might be fun for thrill-seekers, but it’s not for the faint-hearted.

Key Takeaways and Questions

- What caused the recent Bitcoin price drop?

The Bitcoin price drop from $109,114 to $102,850 was influenced by a broader market sell-off that liquidated over $576 million in leveraged positions, including $407 million from bullish bets.

- What is the significance of the $90,000 to $95,000 price range for Bitcoin?

This range is identified by Glassnode as a critical zone where realized losses spike above $100 million per hour, indicating high selling pressure and potential for further market corrections if it is breached.

- How are short-term holders impacting the market?

Short-term holders are currently selling their Bitcoin at a loss, as indicated by the negative Short-Term Holder SOPR, which could either provide strong support or lead to deeper market corrections depending on their actions.

- What is the current state of Bitcoin mining profitability?

Despite the rising mining difficulty, Bitcoin miners remain profitable with mining costs at around $33,900 per BTC, while the market price is above $100,000. However, the competitive nature of mining is reflected by the Miner Revenue per Exahash at $60,800.

- What potential scenarios could unfold following the current market conditions?

Two scenarios are possible: short-term holders may hold onto their Bitcoin to avoid realizing losses, potentially bolstering support at current levels, or they may continue selling, leading to further market declines.