Bitcoin’s Decentralization at Risk: Sassano Highlights 7 Key Issues, Praises Ethereum

Bitcoin’s Decentralization Dilemma: Sassano’s Seven Points and Ethereum’s Rising Tide

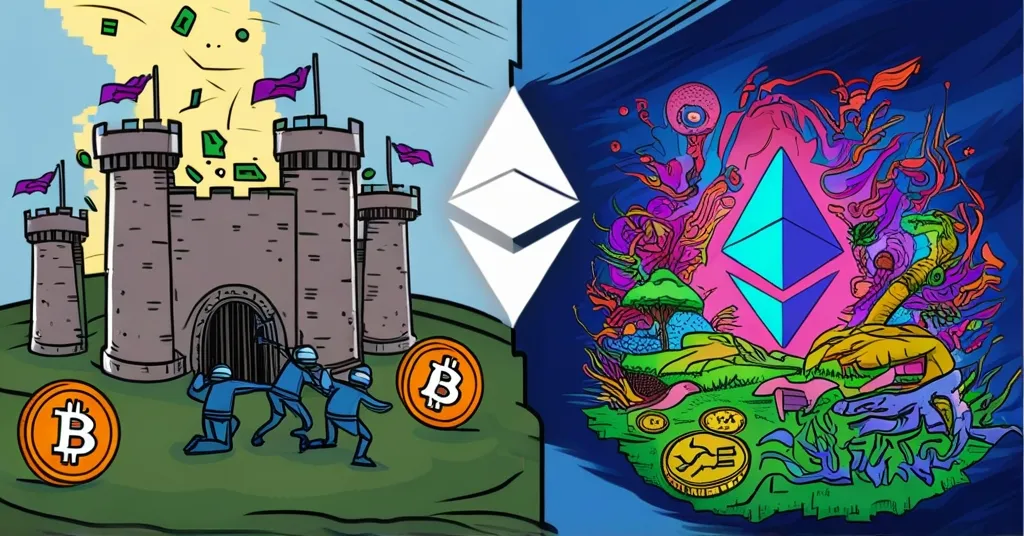

Ethereum advocate Anthony Sassano has sparked a heated debate by asserting that Bitcoin, the original cryptocurrency, is increasingly losing its edge in decentralization to Ethereum as of late 2024. Sassano’s critique pinpoints seven key areas where Bitcoin falters, while lauding Ethereum for its strides in maintaining a decentralized ecosystem.

- Bitcoin’s client diversity

- Mining pool centralization

- Home mining unprofitability

- Shrinking security budget

- Developer exodus from Bitcoin Core

- Bitcoin’s social layer

- Ethereum’s robust decentralization

Bitcoin Core remains the go-to software for running full nodes, leaving little room for alternatives. This lack of client diversity could undermine Bitcoin’s resilience and adaptability. To put it simply, client diversity refers to the variety of software used to run Bitcoin nodes, and having only one mainstream option is akin to putting all your eggs in one basket.

The centralization of mining pools, particularly with giants like Foundry and AntPool requiring Know Your Customer (KYC) checks, raises eyebrows. KYC, for those unfamiliar, is a process where users must verify their identities, potentially compromising the anonymity and decentralization ethos that Bitcoin was built upon. It’s like inviting Big Brother to the party when you thought it was supposed to be off the grid.

Home mining, what once felt like a DIY project for the crypto-curious, has become a relic of the past. The economics no longer pencil out, pushing mining into the hands of large-scale operations. It’s the difference between growing your own tomatoes in the backyard versus relying on industrial agriculture for your salad.

Bitcoin’s security budget, vital for keeping the network safe, is expected to fall to perilously low levels by 2028-2032, according to analyst Justin Bons. A shrinking security budget means less money is available to protect the network, making it more vulnerable to attacks. It’s like trying to guard a castle with fewer and fewer knights as time goes on.

The brain drain from Bitcoin Core, with fewer than five active developers remaining, is a red flag. These developers are the architects of Bitcoin’s future, and their departure could hinder Bitcoin’s ability to evolve and tackle its challenges head-on.

Sassano argues that Bitcoin’s narrative as “digital gold” is limiting its broader adoption and utility. While “digital gold” has its charm, it’s like wearing a tuxedo to a barbecue—sure, it’s classy, but it might not be the most practical choice for the occasion.

On the other side of the coin, Ethereum shines with over 170 active developers, anti-censorship measures, and a more diverse social layer. Despite these strengths, Ethereum’s price performance against Bitcoin has been lackluster, with the ETH/BTC ratio dipping to a multi-year low of 0.032 on November 21, 2024, before a slight recovery to 0.036. It’s like being the best player on the field but still losing the game.

“Bitcoin (BTC) fails to address its major decentralization threats: zero client diversity, poor ‘social layer’ narrative, exodus of Bitcoin Core devs and lack of censorship-resistance.” – Anthony Sassano

“In two or three halvings (equal to 8-12 years), Bitcoin (BTC) is set to become easier to attack since its security budget is shrinking.” – Justin Bons

“Ethereum (ETH) managed to oppose censorship, implemented powerful anti-centralization incentives and is backed by 170+ developers of its ecosystem.” – Anthony Sassano

While Sassano’s critique is bold, it’s crucial to remember Bitcoin’s undeniable strengths. Its network effect and status as “digital gold” are formidable assets, but the decentralization concerns are real and can’t be brushed under the rug. Bitcoin’s got a few hiccups in maintaining its decentralization mojo.

Ethereum’s transition to proof-of-stake, a move not mentioned by Sassano, is a game-changer for its decentralization efforts. By shifting from energy-intensive mining to a more inclusive staking system, Ethereum is putting its money where its mouth is. This, combined with its bustling developer community, positions Ethereum as a serious contender in the decentralization race.

Yet, the market’s response, as seen in the ETH/BTC ratio, shows that investors might not be fully sold on Ethereum’s decentralization narrative. It’s a reminder that in the wild west of crypto, technical prowess doesn’t always translate to market dominance.

The decentralization debate is far from settled, and it’s a journey that will continue to shape the future of finance. Bitcoin’s challenges are real, but so are its strengths. Ethereum’s advancements are promising, but it too faces its own set of hurdles.

Here are some key takeaways and questions to ponder:

- What are the main factors contributing to Bitcoin’s perceived lack of decentralization?

The main factors include the lack of client diversity, mining pool centralization due to KYC requirements, unprofitable home mining, a shrinking security budget, and the exodus of Bitcoin Core developers.

- How does Ethereum fare better in terms of decentralization according to Anthony Sassano?

Ethereum fares better due to its robust developer ecosystem, implemented anti-censorship measures, healthier tokenomics, and a more diverse and flexible social layer.

- What are the implications of Bitcoin’s security budget shrinking over time?

A shrinking security budget could make Bitcoin more vulnerable to attacks, particularly as it approaches future halvings, potentially compromising its security and trustworthiness.

- How does the ETH/BTC price ratio reflect the market’s perception of these decentralization concerns?

Despite Ethereum’s praised decentralization efforts, its price performance against Bitcoin remains weak, with the ETH/BTC ratio hitting multi-year lows, indicating that market dynamics may not fully reflect these decentralization concerns.

- What could be the long-term impact of the developer exodus from Bitcoin Core?

The exodus of developers from Bitcoin Core could hinder Bitcoin’s ability to innovate and address its centralization issues, potentially impacting its long-term viability and resilience.