Capital One Outage Sparks Debate: Can Decentralized Finance Prevent Future Banking Glitches?

Capital One Outage Leaves Thousands Struggling: Is Decentralization the Answer?

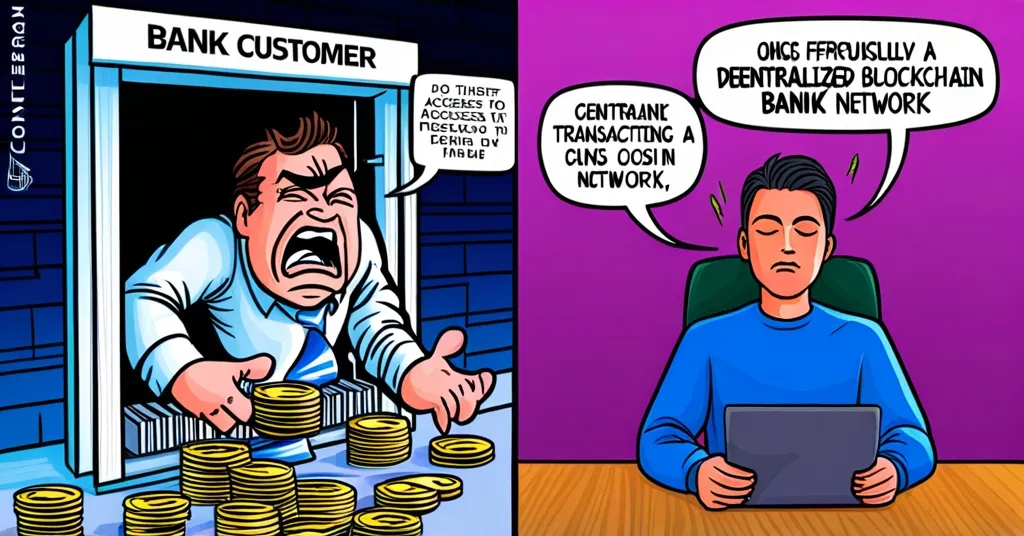

Capital One, a major US bank, experienced a widespread technical malfunction that left thousands of customers unable to access their money or make deposits. This issue, stemming from a third-party vendor, FIS Global, sheds light on the vulnerabilities of centralized banking systems and raises questions about the potential of decentralized finance.

- Capital One technical glitch

- Thousands unable to access funds

- FIS Global’s role

- Decentralized finance potential

Impact on Customers

Starting Thursday, Capital One customers encountered a barrage of error messages when attempting to access their accounts. The inability to process payments or make deposits affected consumer, small business, and commercial banking clients alike. Downdetector, an app monitoring service, noted that the primary issue was related to deposits, leaving many customers in a financial bind.

One frustrated customer shared, “I’ve been trying to access my account all day, and all I get is an error message. How am I supposed to pay my bills?” This sentiment was echoed across social media platforms, highlighting the real-world impact of the outage.

The Role of FIS Global

The root cause of Capital One’s troubles lies with FIS Global, a fintech firm that provides digital banking solutions. A fintech firm, in simple terms, is a company that develops and provides financial technology services. Capital One’s reliance on this third-party vendor for crucial banking functions underscores the potential risks of outsourcing key operations.

Capital One issued a statement to CNN, saying, “Capital One says it’s working on a technical issue that’s preventing thousands of customers from accessing their money. The firm says a ‘technical issue experienced by a third-party vendor’ is to blame.”

Broader Implications for Banking

This incident is a stark reminder of the fragility of centralized banking systems. When a single point of failure, like a third-party vendor, can disrupt the entire service, it’s clear that vulnerabilities abound. This isn’t the first time such issues have surfaced; history is littered with examples of banks facing similar technical challenges.

In the world of centralized banking, it seems like the only thing more reliable than the next outage is the one after that. But what if there were a better way?

The Decentralized Alternative

Enter Bitcoin and blockchain technology. Bitcoin, a decentralized digital currency, isn’t controlled by any central authority. Blockchain, the technology behind Bitcoin, enables secure, transparent transactions without the need for intermediaries. These technologies could potentially prevent the kind of outages experienced by Capital One.

Unlike traditional banking systems, which rely on centralized servers and third-party vendors, decentralized systems distribute data across a network of computers. This means there’s no single point of failure—a glitch at one node doesn’t bring down the entire network. Banks like JPMorgan have already begun exploring blockchain for secure, efficient transactions, showing the potential of this technology.

However, it’s not all smooth sailing. Bitcoin and other cryptocurrencies face challenges like volatility and regulatory hurdles. While they offer a compelling alternative, they’re not a panacea for all banking woes.

Counterpoints and Challenges

While decentralized technologies hold promise, they come with their own set of challenges. The volatility of cryptocurrencies can be a double-edged sword, offering potential for high returns but also significant risk. Regulatory frameworks are still catching up, creating uncertainty for businesses and investors alike.

Moreover, scalability remains a hurdle for many blockchain networks. As the technology evolves, these challenges need to be addressed to fully realize its potential in the banking sector.

Case Study: Successful Implementation of Blockchain in Banking

One example of blockchain’s potential in banking is the use of smart contracts by banks like Santander. Smart contracts automate transactions and agreements, reducing the need for intermediaries and increasing efficiency. This example demonstrates how blockchain can enhance traditional banking systems, offering a glimpse into a more resilient financial future.

The Future of Finance

As we look to the future, it’s clear that decentralized technologies will play an increasingly important role in finance. While Bitcoin and blockchain may not solve every issue, they offer a path to a more robust and transparent financial ecosystem. For those interested in exploring these technologies further, visit “Let’s Talk, Bitcoin” for more insights.

Key Questions and Takeaways

What caused the technical issues at Capital One?

A glitch from their third-party vendor, FIS Global, caused the technical issues at Capital One.

How have Capital One customers been affected by the technical issues?

Thousands of Capital One customers have been unable to access their money or make deposits due to these technical issues.

What role does FIS Global play in this situation?

FIS Global, a fintech firm that provides digital banking solutions, is the third-party vendor responsible for the technical glitch affecting Capital One’s banking services.

What are the broader implications of this incident for the banking industry?

This incident highlights the vulnerabilities in centralized banking systems that rely on third-party vendors, potentially driving interest in decentralized financial technologies like Bitcoin and blockchain.

How could decentralized technologies like Bitcoin and blockchain prevent such outages?

Decentralized technologies distribute data across a network, eliminating single points of failure and reducing the risk of widespread outages.

What challenges do decentralized technologies face?

Decentralized technologies face challenges such as volatility, regulatory uncertainty, and scalability issues.

Can you provide an example of blockchain used successfully in banking?

Santander uses blockchain and smart contracts to automate transactions, reducing the need for intermediaries and increasing efficiency.