Coinbase CEO Hints at USDT Delisting Amid New U.S. Regulatory Push

Coinbase CEO Suggests Possible USDT Delisting Amid Regulatory Pressure

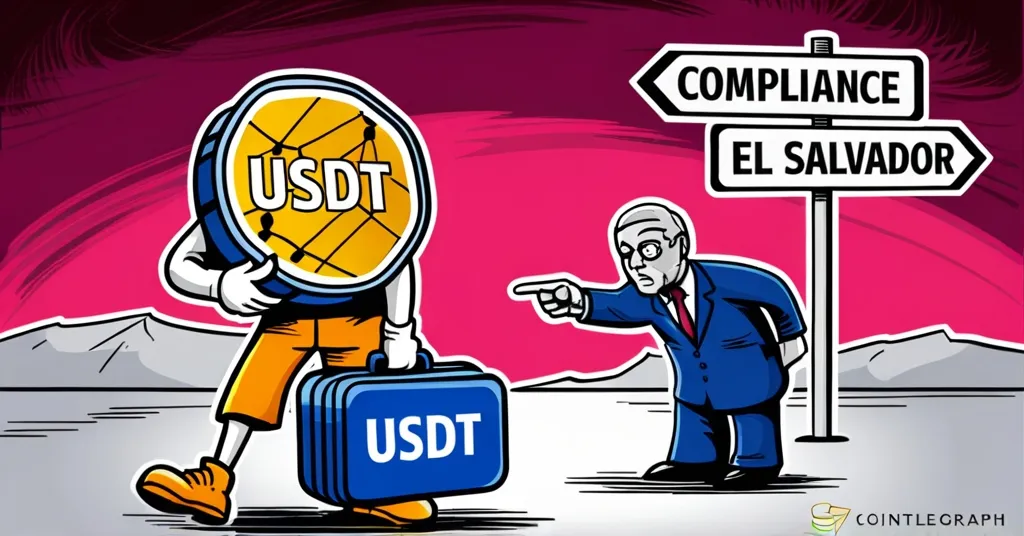

During the World Economic Forum in Davos, Coinbase CEO Brian Armstrong hinted at the potential delisting of USDT (Tether) from the platform due to upcoming regulatory changes in the U.S. These changes may mandate stablecoins to be entirely backed by U.S. Treasury bonds, which are government-backed securities often used for their stability and low risk, and subject them to regular audits. Armstrong emphasized Coinbase’s commitment to compliance, stating the exchange would assist users in transitioning to other compliant assets should USDT be delisted.

- New regulations may force USDT delisting

- Coinbase to support users through transition

- Tether’s strategic relocation to El Salvador

Stablecoins, like USDT, are cryptocurrencies designed to minimize volatility by maintaining a stable value, often pegged to a fiat currency like the US dollar. USDT dominates the stablecoin market with a 65% share, contributing to a sector valued at nearly $213 billion. Tether’s reserves are primarily composed of about 80% U.S. Treasury bills, with the remainder in assets such as gold and Bitcoin. Recently, Tether bolstered its reserves with an additional $700 million in BTC by the end of 2024, bringing its total Bitcoin holdings to $7.8 billion. That’s quite the stash of digital gold!

The U.S. is advancing the Payment Stablecoin Act, spearheaded by Senators Cynthia Lummis and Kirsten Gillibrand, which aims to establish a regulatory framework for these digital dollars. This Act seeks to set specific standards for stablecoin issuers to ensure transparency and security. Meanwhile, Coinbase has already begun delisting certain assets in Europe to meet the requirements of the Markets in Crypto-Assets (MiCA) regulations. Regulators worldwide are tightening their grip on stablecoins, pushing the industry to adapt quickly.

In response to these pressures, Tether has made a strategic pivot by relocating its operations to El Salvador, a country that’s not only embraced Bitcoin but also represents a potential haven from stringent regulations. Tether’s moving to El Salvador faster than you can say “Bitcoin Beach.” This move highlights Tether’s efforts to navigate outside the heavy regulatory zones of the U.S. and Europe.

So, what does this mean for the everyday crypto enthusiast? Armstrong’s comments might sound like a threat to USDT, but they underscore Coinbase’s dedication to both compliance and customer support. As Tether adjusts to these changes, Coinbase is ready to help its users navigate the evolving landscape.

Despite these challenges, stablecoins like USDT play a vital role in the crypto ecosystem, providing stability and liquidity. The push for regulation, while seen by some as stifling, aims to ensure these financial tools are safe and reliable. It’s a delicate balance between fostering innovation and maintaining oversight, and the industry continues to grapple with this reality.

But let’s not forget, the crypto world thrives on change. Whether it’s regulatory shifts or strategic moves to new countries, the game is always evolving. For those of us who live and breathe crypto, these developments are yet another thrilling chapter in the ongoing saga of decentralized finance.

Yet, it’s worth considering the broader implications. The potential delisting of USDT could ripple through the stablecoin market, affecting liquidity and possibly pushing users towards alternatives like USDC or other emerging stablecoins. Additionally, increased compliance costs might burden smaller issuers, potentially reshaping the competitive landscape.

On the flip side, some argue that tighter regulations could actually benefit the long-term stability of the crypto market by weeding out less secure or non-compliant players. It’s a complex issue with no easy answers, but one thing is clear: the crypto space is at a crossroads, and the path forward will be shaped by these regulatory battles.

Key Takeaways and Questions

- What regulatory changes might force Coinbase to delist USDT?

New U.S. regulations might require stablecoins to be fully backed by U.S. Treasury bonds and undergo regular audits, which could lead to USDT’s delisting if it does not comply.

- How is Coinbase planning to support its customers if USDT is delisted?

Coinbase plans to assist customers in transitioning to other compliant assets, ensuring they can continue their cryptocurrency activities securely.

- What is the current market position of USDT?

USDT currently holds about 65% of the stablecoin market, with the sector valued at nearly $213 billion.

- What recent actions has Tether taken regarding its reserves?

Towards the end of 2024, Tether added $700 million worth of BTC to its reserves, bringing its total Bitcoin holdings to $7.8 billion.

- What legislative efforts are being made regarding stablecoins in the U.S.?

Senators Cynthia Lummis and Kirsten Gillibrand introduced the Payment Stablecoin Act, aimed at creating a regulatory framework for fiat-pegged cryptocurrencies.

- Where is Tether relocating its operations, and why?

Tether is relocating to El Salvador, seen as a strategic move to operate outside major regulatory zones, given El Salvador’s Bitcoin-friendly policies.