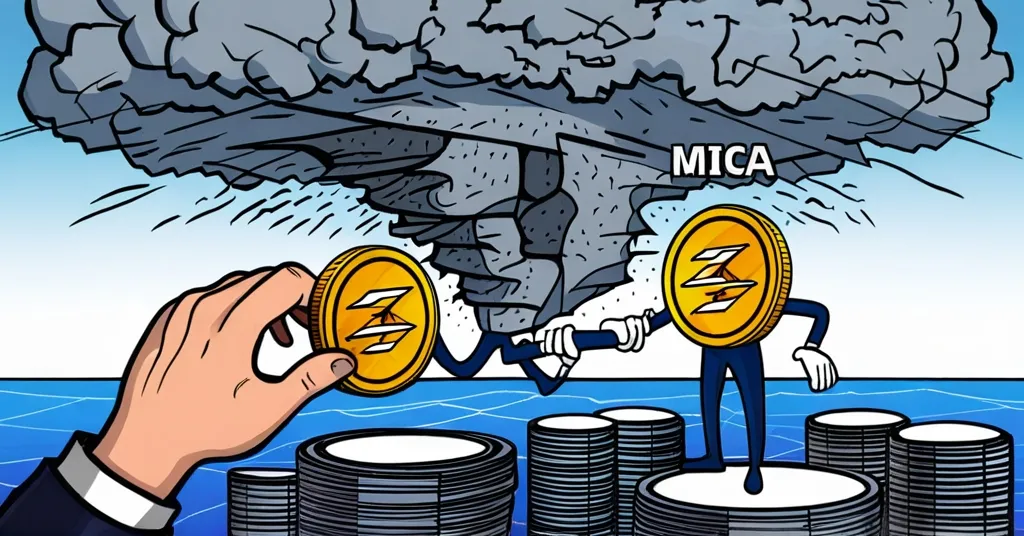

Crypto.com Delists Tether by 2025 Due to EU’s MiCA Regulations

Crypto.com Delists Tether: Navigating the EU’s Regulatory Storm

Crypto.com’s decision to delist Tether (USDT) by January 31, 2025, marks a significant shift in the crypto world, driven by the EU’s stringent Markets in Crypto-Assets (MiCA) regulations.

- Crypto.com delisting Tether (USDT) by January 31, 2025

- EU’s MiCA regulations demand compliance

- USDT’s non-compliance raises concerns

- Shift towards more compliant stablecoins like USDC

- Political scrutiny adds complexity

Regulatory Pressure

Crypto.com has taken a decisive step in delisting Tether (USDT), following in Coinbase’s footsteps. This move is a direct response to the EU’s new Markets in Crypto-Assets (MiCA) regulations. MiCA, short for Markets in Crypto-Assets, is a regulatory framework designed to oversee crypto assets within the European Union. Under these rules, stablecoins like Tether must hold over 60% of their reserves in recognized banks and obtain an e-money license—a special financial license from the government. Tether, despite being the world’s most-used stablecoin, has failed to meet these criteria, resulting in its delisting from major platforms.

Tether’s lack of transparency and frequent audits has been a persistent concern, and now, with MiCA’s implementation, the pressure is mounting. Is this the beginning of the end for non-compliant stablecoins, or just another round in the ongoing game of regulatory cat and mouse?

Market Impact

As USDT faces the chopping block, the spotlight shifts to more compliant alternatives like USD Coin (USDC). USDC is favored for its regular audits and adherence to strict financial regulations, making it a more trustworthy option in the eyes of regulators and traders. This shift could lead to a more dominant role for USDC in the European market, potentially impacting the liquidity and trading efficiency of the broader crypto ecosystem.

The delisting of Tether might usher in a period of increased market volatility as traders pivot to fiat trading pairs or more compliant stablecoins. This transition period will test the resilience of the crypto market and its ability to adapt to regulatory pressures. Amidst this, the crypto revolution continues to surge forward, with Bitcoin at the helm and altcoins like Ethereum pushing the boundaries of innovation.

Political Scrutiny

Tether’s challenges extend beyond regulatory issues into the realm of political scrutiny. Senator Elizabeth Warren has raised concerns about Howard Lutnick, Trump’s Commerce Secretary nominee, due to his firm Cantor Fitzgerald’s ties to Tether. Warren’s worries stem from national security risks and Tether’s alleged links to illicit activities, adding a complex layer to this unfolding story.

While some argue that Tether’s delisting is a step towards a more regulated and transparent crypto market, others see it as a blow to the decentralization ethos that many in the crypto community cherish. The ongoing debate over whether regulatory compliance stifles innovation or fosters trust remains as fierce as ever.

The Future of Stablecoins

The delisting of USDT could lead to significant shifts in market dynamics, with traders increasingly turning to fiat trading pairs or compliant stablecoins like USDC. This transition period may test the resilience of the crypto market and its ability to adapt to regulatory pressures.

The future of stablecoins in Europe hinges on compliance with MiCA regulations. Non-compliant stablecoins like Tether risk being sidelined, while compliant alternatives like USDC may rise to prominence, shaping the stablecoin market in the coming months. Amidst these regulatory shifts, Bitcoin’s established track record and robust network continue to stand as a beacon of decentralization, highlighting the ongoing tension between regulation and the decentralized nature of cryptocurrencies.

Key Takeaways and Questions

- Why did Crypto.com delist Tether?

Crypto.com delisted Tether due to the EU’s MiCA regulations, which require stablecoins to maintain over 60% of reserves in recognized banks and obtain an e-money license. Tether’s failure to comply with these regulations prompted the delisting.

- How will Tether’s delisting impact the broader crypto market?

The delisting of Tether could lead to increased market volatility and a shift towards more compliant stablecoins like USDC or fiat trading pairs, potentially affecting liquidity and trading efficiency in the crypto market.

- What sets Tether apart from USD Coin (USDC)?

Tether lacks transparency and frequent audits, raising concerns about its reserve backing, while USDC undergoes regular audits and complies with strict financial regulations, making it a more trusted option under the MiCA framework.

- What’s driving Senator Elizabeth Warren’s challenge to Howard Lutnick regarding Tether?

Senator Warren is challenging Howard Lutnick, Trump’s Commerce Secretary nominee, over his firm Cantor Fitzgerald’s ties to Tether, citing concerns about Tether’s links to illicit activities and potential national security risks.

- What does the future hold for stablecoins in Europe?

The future of stablecoins in Europe hinges on compliance with MiCA regulations. Non-compliant stablecoins like Tether risk being marginalized, while compliant alternatives like USDC may gain prominence, shaping the stablecoin market in the coming months.

- What can Tether do to regain compliance?

Tether could regain compliance by increasing its reserve holdings in recognized banks and applying for an e-money license, though its history of opacity may make this challenging.

- How can investors protect themselves during this transition?

Investors can protect themselves by diversifying their holdings, focusing on compliant stablecoins, and staying informed about regulatory developments in the crypto space.