Crypto Execs Lobby for Stablecoin Interest Amid Congressional Clash

Crypto Executives Push for Stablecoin Interest Payments Amid Congressional Debate

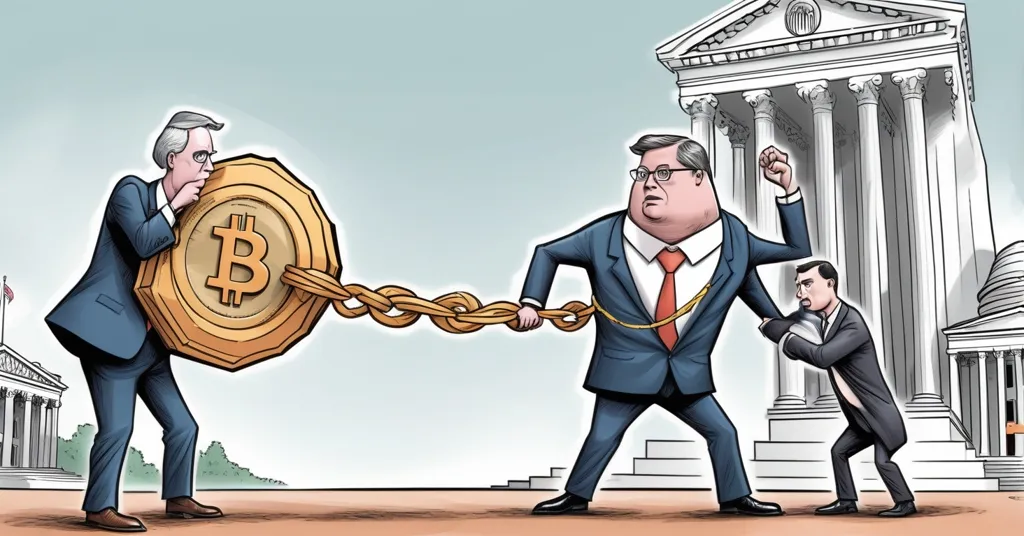

Crypto executives are advocating for the ability to pay interest on their U.S. dollar-pegged stablecoins, sparking a heated debate among lawmakers, financial institutions, and industry leaders. This move could reshape the traditional banking landscape and advance decentralized finance.

- Crypto executives lobby for stablecoin interest payments.

- Concerns over impact on traditional banking.

- Congress considers regulatory approaches.

Stablecoins, digital currencies designed to maintain a steady value by being tied to the U.S. dollar, have become integral to the crypto ecosystem. They act as a bridge between the often volatile world of cryptocurrencies and the stability of traditional finance. Now, crypto executives are pushing for a pivotal change: the ability to offer interest on these stablecoins. They argue that this would level the playing field with traditional banks, which can offer interest on deposits.

Coinbase CEO Brian Armstrong has been a vocal advocate for this change, criticizing the government’s current stance.

“The government shouldn’t put its thumb on the scale to benefit one industry over another,” Armstrong stated.

He believes that allowing stablecoin issuers to pay interest could not only equalize the financial playing field but also increase stablecoin adoption and drive financial innovation. Armstrong’s stance on this issue is detailed in his recent public statements.

However, this proposal faces strong opposition from the banking sector. The American Bankers Association (ABA) fears that interest-bearing stablecoins could draw deposits away from banks, potentially destabilizing the traditional financial system. “We’re not just talking about a new player in the game; we’re talking about a whole new game,” an ABA spokesperson remarked, highlighting the potential for disruption. The ABA’s position is clearly outlined in their policy report.

Congress is currently wrestling with these issues, considering different regulatory approaches. On April 2, 2025, the House Financial Services Committee approved a bill that explicitly prohibits stablecoin issuers from paying interest. In contrast, the Senate Banking Committee passed the GENIUS Act in March 2025, which does not address the issue of interest payments, leaving room for further debate. This ongoing regulatory discussion is critical for the future of stablecoins.

The growth of stablecoins has been remarkable, with non-yield-bearing stablecoins seeing a 46% increase in market cap over the past year. Meanwhile, yield-bearing stablecoins, such as those issued by Ethena and Ondo Finance, have surged, surpassing a $13 billion market cap. This rapid expansion underscores the demand for such financial instruments and adds urgency to the regulatory discussions.

The crypto industry has been actively lobbying Congress, spending over $119 million on pro-crypto candidates in the last election cycle. This financial muscle could influence legislative outcomes, but the path forward remains uncertain. If stablecoin issuers were allowed to pay interest, these assets might be subjected to securities laws, adding another layer of complexity to their regulation. The industry’s stance and the ongoing debate on this topic are widely discussed online.

Industry experts have varying perspectives on this issue. Chen Arad, Co-founder of Solidus Labs, suggests that since stablecoin issuers already earn yield on reserve assets, sharing that with depositors makes sense. Conversely, Dante Disparte, Circle’s Chief Strategy Officer, argues that interest-bearing features should be a market-driven innovation rather than directly managed by issuers.

Arthur Wilmarth, Professor Emeritus of Law at George Washington University, warns that allowing interest-paying crypto products could pose an existential threat to the banking system by attracting deposits away from banks. On the other hand, Navin Gupta, CEO of Crystal Intelligence, sees potential benefits for consumers, despite the risks of financial instability.

The debate over interest payments on stablecoins is more than a financial argument; it’s a clash of visions for the future of money. It raises questions about whether the crypto world can coexist with, or even challenge, traditional banking. As Congress grapples with these questions, the crypto community remains hopeful for a regulatory framework that embraces innovation without compromising stability.

Yet, we must remain vigilant about the darker side of the crypto space. Scammers and opportunists often exploit new developments to lure in unsuspecting investors with promises of unrealistic returns. As we push for interest payments, we must call out the bullshit and ensure that this advancement doesn’t become a playground for the unscrupulous.

So, where do we stand? The regulatory landscape is as volatile as the crypto markets themselves, yet there’s a clear direction towards embracing the potential of stablecoins while safeguarding the financial system. It’s a delicate balance, but one that’s crucial for the future of decentralized finance.

Key Takeaways and Questions

- What are stablecoins?

Stablecoins are digital currencies designed to maintain a steady value, often tied to the U.S. dollar, making them a more predictable option in the volatile crypto market.

- Why are crypto executives pushing for interest payments on stablecoins?

Crypto executives argue for equal treatment with traditional banks, believing that allowing interest payments could boost stablecoin adoption and drive financial innovation.

- What are the concerns of the banking sector regarding interest payments on stablecoins?

The banking sector fears that interest-bearing stablecoins could attract deposits away from banks, potentially destabilizing the financial system.

- What is the current status of stablecoin regulation in Congress?

Congress is considering different regulatory approaches, with the House prohibiting interest payments and the Senate’s GENIUS Act leaving the issue ambiguous.

- How could the allowance of interest payments on stablecoins impact the broader financial ecosystem?

Allowing interest payments could boost stablecoin adoption and spur financial innovation, but it could also disrupt traditional banking by attracting deposits away from banks.