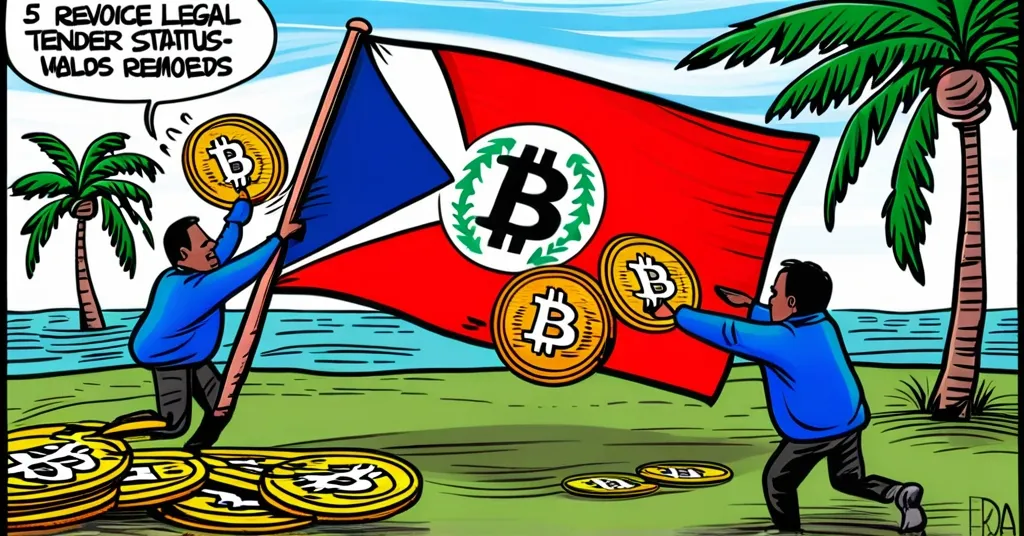

El Salvador Revokes Bitcoin Legal Tender Amid Economic Woes

El Salvador Reverses Course: Bitcoin No Longer Legal Tender Amid Economic Struggles

El Salvador has made a significant policy shift by revoking Bitcoin’s status as legal tender, marking a major change in its cryptocurrency policy. This decision follows economic challenges and public backlash against the initial adoption in 2021, sparking a debate on the future of cryptocurrency integration into national economies.

- El Salvador revokes Bitcoin’s legal tender status

- Move follows economic difficulties and public opposition

- Decision may impact global cryptocurrency adoption

In September 2021, El Salvador made history by becoming the first country to embrace Bitcoin as legal tender. This bold move was spearheaded by President Nayib Bukele, who aimed to modernize the economy and attract foreign investment. Legal tender means that a currency must be accepted as payment for debts and taxes, and in El Salvador’s case, Bitcoin was intended to be used alongside the US dollar. However, the initial enthusiasm quickly gave way to economic instability and public resistance.

The decision to revoke Bitcoin’s status as legal tender comes after months of economic struggles. A survey from San Salvador University Francisco Gavidia revealed that a staggering 92% of Salvadorans did not use Bitcoin in 2023, showing the disconnect between the government’s ambitions and the reality for its citizens. Economic instability and the volatility of Bitcoin made it challenging for everyday transactions, leading to widespread skepticism.

The International Monetary Fund (IMF) played a crucial role in this policy reversal. The IMF’s conditionality for a $1.4 billion credit line required El Salvador to scale back its Bitcoin agenda. “Fiat currency dominance” refers to the preference and control given to traditional government-issued money over cryptocurrencies, and the IMF’s involvement is seen by some as an attempt to maintain this dominance. Critics argue that this move stifles the potential for financial liberation through cryptocurrencies. Kadan Stadelmann, CTO of Komodo Platform, commented, “El Salvador’s decision to revoke Bitcoin’s legal tender status is a stark reminder of the challenges cryptocurrencies face in mainstream adoption.”

Interestingly, despite the revocation, El Salvador continues to purchase Bitcoin for its reserves, recently adding 12 more coins to its holdings. This suggests a nuanced approach to cryptocurrency, where the government still sees long-term value in Bitcoin, even as it acknowledges the challenges of integrating it into the national economy. This dual approach highlights the complexity of cryptocurrency policy, balancing innovation with economic stability.

The future of the Chivo wallet, launched to facilitate Bitcoin transactions, remains uncertain. Plans to either privatize or shutter it indicate a potential shift in strategy, further complicating the landscape for cryptocurrency in El Salvador.

This policy reversal raises important questions about the integration of cryptocurrencies into national economies. It serves as a cautionary tale for other countries contemplating similar moves, illustrating the challenges of adopting volatile digital currencies amidst public resistance and economic instability. While Bitcoin maximalists may lament this development, it’s a reminder that the path to mainstream adoption is fraught with obstacles. The balance between innovation and stability, between disrupting the status quo and ensuring economic security, remains a delicate one.

Yet, it’s not all doom and gloom. The fact that El Salvador continues to buy Bitcoin for its reserves shows a belief in its long-term value. Perhaps this is the silver lining – a government that still sees the potential in Bitcoin, even as it navigates the turbulent waters of economic policy.

Key Questions and Takeaways

- What led El Salvador to initially adopt Bitcoin as legal tender?

El Salvador adopted Bitcoin as legal tender in 2021 under President Nayib Bukele’s initiative to modernize the economy and attract foreign investment.

- Why did El Salvador revoke Bitcoin’s legal tender status?

The revocation was prompted by economic challenges and public backlash against the initial adoption, reflecting the difficulties of integrating a volatile cryptocurrency into a national economy.

- What are the potential broader implications of this policy change for cryptocurrency adoption?

This move may cause other countries to reconsider their cryptocurrency policies, potentially slowing the integration of cryptocurrencies into national economies.

- How has public sentiment in El Salvador towards Bitcoin changed since its adoption?

Public sentiment has shifted from cautious optimism to significant opposition, driven by economic instability and the challenges of using Bitcoin in everyday transactions.

- What does this mean for the future of Bitcoin and other cryptocurrencies in national economies?

The revocation suggests that the integration of cryptocurrencies into national economies faces substantial hurdles, potentially leading to more cautious approaches by other countries.

“The initial enthusiasm for Bitcoin as legal tender has been overshadowed by economic realities and public sentiment.”

As we move forward, it’s crucial to keep a balanced perspective. While El Salvador’s U-turn on Bitcoin is a setback, it’s not the end of the story. The journey towards a decentralized financial future continues, with its share of twists and turns, but also with the promise of innovation and empowerment.