Ethereum Plunges 7.7% on March 11: Navigating Bearish Trends and Key Support Levels

Ethereum’s Price Drop: Navigating the Bearish Waters on March 11

On March 11, Ethereum (ETH) experienced a significant decline of 7.7%, reflecting the volatility that crypto enthusiasts know all too well. This dip is part of a broader bearish trend in the cryptocurrency market, but let’s not forget the bigger picture: Ethereum’s role in the financial revolution is far from over.

- Ethereum’s price fell by 7.7% on March 11.

- A false breakout at $1,929 signaled bearish momentum.

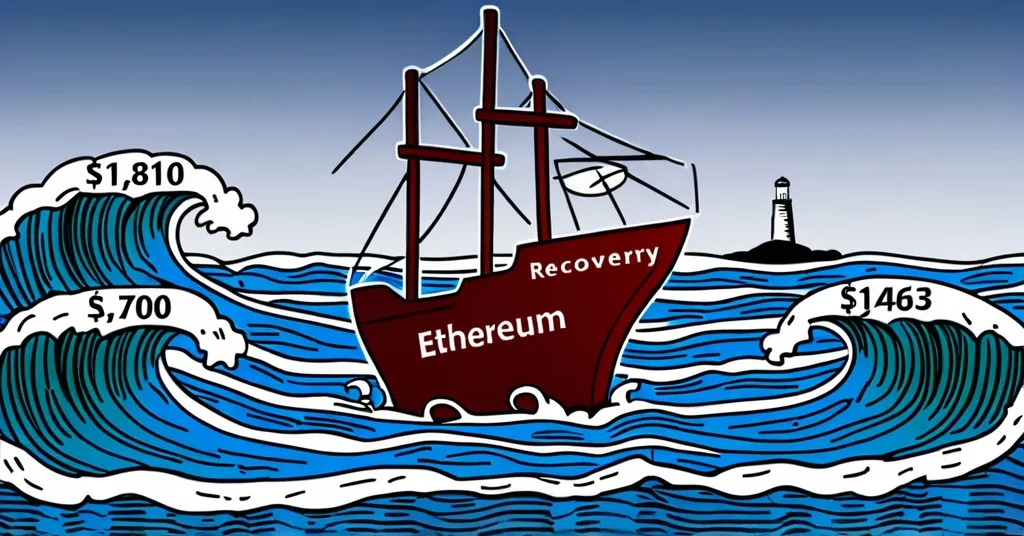

- Key support levels to watch: $1,810, $1,700, and $1,463.

- No midterm reversal signals; potential drop looms if $2,000 isn’t breached.

- ETH traded at $1,853 at the time of this report.

Let’s break down what happened on that day. Ethereum’s false breakout at $1,929 on the hourly chart meant that the bullish momentum couldn’t stick around. If the day’s close remained far from this level, traders might have seen Ethereum testing the $1,810 support by the following day. This level had already been touched on larger time frames, showing a potential bounce or a further test of resilience.

The looming threat is a deeper drop to $1,700 if seller pressure doesn’t ease up. In the midterm, the absence of reversal signals means ETH holders shouldn’t hold their breath for a quick recovery. Should the price fail to climb back above $2,000, the next major support at $1,463 becomes a real possibility.

For those new to crypto, a “false breakout” occurs when a price briefly exceeds a key level but quickly falls back. Think of it like a sprinter who leaps out of the blocks but trips and falls flat on their face. “Support levels” are like price floors where the price tends to stop falling, and “resistance levels” are like ceilings where the price stops rising.

But what’s behind this drop? The broader market conditions are playing a part. Fears of a US recession and escalating trade tensions between major economies have led to a risk-off sentiment in the market, impacting risk assets like cryptocurrencies. On top of that, the sharp decline in ETH’s price has triggered significant liquidations of long positions and increased the risk of loans backed by ETH being liquidated, adding to the selling pressure. For more detailed analysis on the factors influencing this decline, you can refer to this report.

Despite the bearish indicators, Ethereum’s price movements are highly correlated with Bitcoin’s, suggesting that a recovery or further decline in Bitcoin could significantly impact ETH’s price trajectory. And while Ethereum has taken a hit, it’s shown resilience by rebounding from certain levels, indicating potential support at lower prices. This resilience could be a glimmer of optimism for investors.

While the reported 7.7% decline might be conservative, other sources indicate a more significant drop, with one suggesting an 11.75% decline over the last 24 hours, bringing ETH to around $1,900. Keep an eye on additional support levels at $1,904, $1,750, and $1,640, and resistance at $2,076, $2,310, and $2,550, which could indicate potential upward targets if ETH breaks above $2,000. Some optimistic predictions even suggest a potential rally to $2,250-$2,400 or even $2,695.91-$2,814.40 in the coming weeks, though these are often met with skepticism given the current market conditions.

As a Bitcoin maximalist, one might argue that this volatility underscores Bitcoin’s value as a more stable store of value within the crypto ecosystem. Yet, Ethereum’s role in enabling smart contracts and decentralized finance (DeFi) cannot be understated. It’s the platform that’s pushing the boundaries of what’s possible in finance, and its ups and downs are just part of the ride. For those interested in the risks associated with DeFi on Ethereum, this discussion provides further insight.

In the context of effective accelerationism (e/acc), Ethereum’s volatility is seen as a necessary part of the journey towards a more decentralized and technologically advanced future. Each dip and rally is a step along the path of financial and technological revolution. So, while we navigate these turbulent waters, let’s not forget the bigger picture: the revolution is just getting started. For expert opinions on Ethereum’s midterm price outlook following this drop, check out this analysis.

Key Takeaways and Questions

- What was the percentage decline of Ethereum on March 11?

Ethereum saw a 7.7% decline on this day, though some sources report a more significant drop of up to 11.75%. - What is a false breakout, and why is the $1,929 level significant for Ethereum?

A false breakout occurs when a price briefly exceeds a key level but then quickly reverses. The $1,929 level for Ethereum was significant because it marked a local resistance where a false breakout occurred, indicating a lack of sustained bullish momentum. - What are the key support and resistance levels for Ethereum?

The key support levels are $1,810, $1,700, $1,463, $1,904, $1,750, and $1,640. The resistance levels are $2,076, $2,310, and $2,550. - What is the midterm outlook for Ethereum?

The midterm outlook for Ethereum is bearish, with no reversal signals and a potential drop to $1,463 if the price does not recover above $2,000. - At what price was Ethereum trading at the time of this report?

Ethereum was trading at $1,853, though other sources indicated it may have been as low as $1,900. - How does Ethereum’s role in DeFi and smart contracts impact its long-term potential?

Despite short-term volatility, Ethereum’s crucial role in enabling smart contracts and decentralized finance (DeFi) suggests strong long-term potential. This potential should be weighed against immediate market conditions. - What broader market conditions are contributing to Ethereum’s price decline?

Economic concerns such as fears of a US recession and escalating trade tensions between major economies are contributing to a risk-off sentiment in the market, impacting cryptocurrencies like Ethereum. - How does the concept of effective accelerationism (e/acc) relate to Ethereum’s price volatility?

Effective accelerationism views Ethereum’s volatility as part of the journey towards a more decentralized and technologically advanced future, seeing each dip and rally as a step in the financial and technological revolution.