Ethereum Validators Propose Gas Limit Hike to 40M Amid Network Demand Surge

Ethereum Validators Eye Gas Limit Hike to Meet Soaring Network Demand

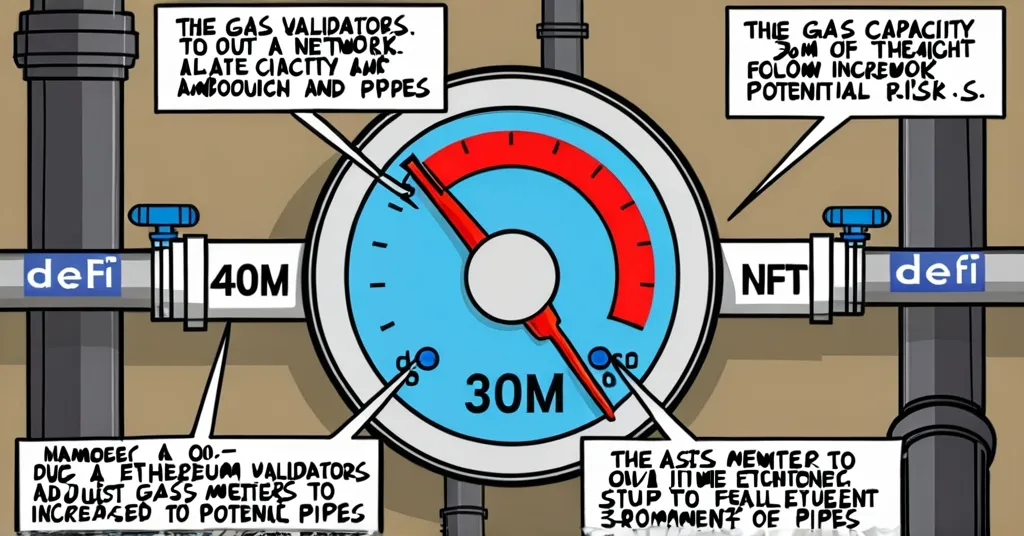

Ethereum’s validators are considering a significant change: increasing the gas limit from 30 million to 40 million to cope with the network’s surging demand. The gas limit, which determines the maximum computational effort allowed per block, is crucial for Ethereum’s transaction capacity. This potential adjustment aims to enhance scalability but carries risks of network instability and centralization.

- Ethereum validators consider gas limit increase

- Current limit at 30 million, proposed rise to 40 million

- Scalability boost vs. risk of instability and centralization

- Surge in demand from DeFi and NFTs

Ethereum is currently processing over a million transactions daily, pushing its limits. The gas limit is a key factor in this equation, as it sets the maximum amount of computation that can be performed per block. Proposals to raise it to 40 million are on the table, driven by the network’s growing demand, particularly from decentralized finance (DeFi) and non-fungible tokens (NFTs). DeFi offers financial services on the blockchain, while NFTs are unique digital assets representing ownership or proof of authenticity.

Increasing the gas limit could be likened to adding more lanes to a busy highway. It’s designed to streamline transaction processing, potentially boosting Ethereum’s scalability. For advocates of decentralization and disruption, this move represents a major step forward. More transactions mean more room for innovation and growth, keeping Ethereum at the cutting edge of the blockchain revolution.

However, not everyone is ready to celebrate. Cranking up the gas limit might just be playing with fire. Ethereum’s validators face a delicate balancing act. As one validator pointed out, “Increasing the gas limit could significantly improve Ethereum’s capacity to handle transactions, which is crucial for the network’s growth.” Yet, another cautioned, “However, we must be cautious about the potential risks, including network instability and increased centralization.” A higher gas limit could push the network to its breaking point, risking crashes or slowdowns. Moreover, there’s the specter of centralization—nodes with more powerful hardware could gain an advantage, undermining Ethereum’s decentralized ethos.

The demand surge from DeFi and NFTs underscores Ethereum’s vital role in these sectors. Both are hungry for more capacity, and a gas limit increase could satiate this hunger, fostering further growth and innovation. Yet, it’s a tightrope walk. Ethereum’s evolution, especially its transition to proof-of-stake with Ethereum 2.0, is about more than just scaling—it’s about maintaining the network’s robustness, security, and commitment to decentralization.

At this juncture, Ethereum’s validators are not just tweaking a dial; they’re shaping the future of one of the world’s most influential blockchains. Their decision will ripple through the crypto landscape, affecting everything from DeFi’s next big thing to the latest NFT craze. It’s a high-stakes game that could propel Ethereum forward or expose it to new vulnerabilities.

From a Bitcoin maximalist perspective, Ethereum’s ongoing scalability challenges highlight the strength and simplicity of Bitcoin’s design. Bitcoin advocates might argue that Ethereum’s complexity introduces unnecessary risks, and that the network’s scalability issues are a natural outcome of its more ambitious goals. Yet, it’s important to recognize that Ethereum’s complexity also enables a broader range of applications, filling niches that Bitcoin might not serve as effectively.

In the context of effective accelerationism (e/acc), the gas limit increase represents a bold step towards accelerating Ethereum’s growth and disruption of traditional finance. It aligns with the e/acc ethos of pushing boundaries and fostering innovation, even at the risk of instability. This move could be seen as Ethereum’s commitment to driving technological progress forward, despite potential challenges.

Key Takeaways and Questions

- What is the current gas limit on Ethereum, and what change is being proposed?

The current gas limit is 30 million, with proposals to increase it to 40 million.

- Why are Ethereum validators considering a gas limit increase?

Validators are considering this increase to address the growing demand on the network and improve transaction throughput.

- What are the potential benefits of increasing the gas limit?

The primary benefit is enhanced scalability, allowing the network to process more transactions and support more users and applications.

- What are the risks associated with increasing the gas limit?

Risks include potential network instability and an increased risk of centralization, as higher gas limits might favor nodes with greater computational power.

- How does this decision impact Ethereum’s role in DeFi and NFTs?

An increased gas limit could better support the high demand from DeFi and NFT projects, potentially fostering further growth in these sectors.

- What is the Bitcoin maximalist perspective on Ethereum’s scalability challenges?

Bitcoin advocates might view Ethereum’s scalability issues as a result of its complex design, contrasting it with Bitcoin’s simpler and more robust approach.

- How does the gas limit increase align with effective accelerationism?

The increase aligns with e/acc by pushing the boundaries of Ethereum’s capabilities, fostering growth and innovation despite potential risks.