FDIC Sues 17 SVB Execs for $294M Dividend and Risky Bets Leading to Collapse

FDIC Sues 17 Silicon Valley Bank Execs Over Role in Bank’s Collapse

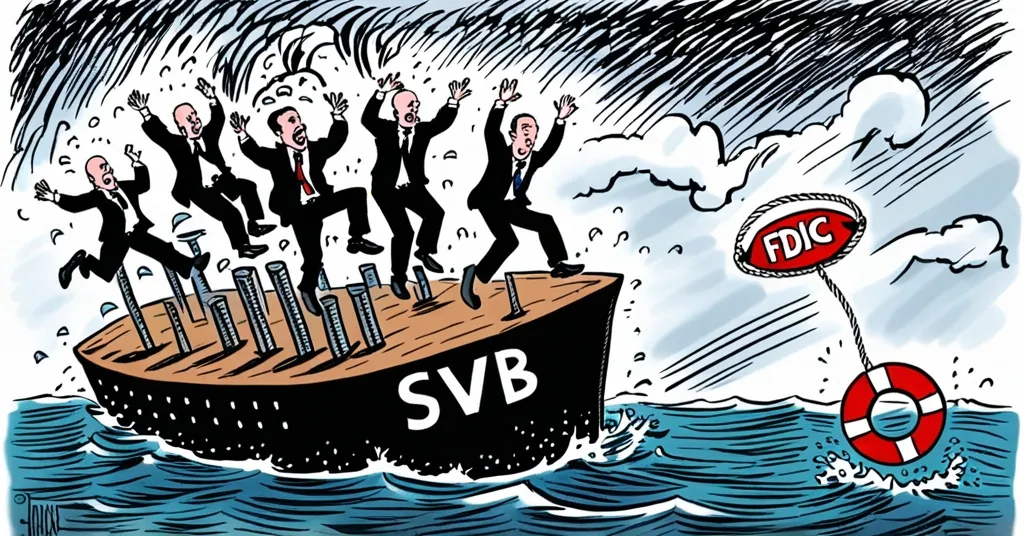

Silicon Valley Bank (SVB), a stalwart in the tech and crypto sectors, met its dramatic downfall in March 2023, thanks to what the Federal Deposit Insurance Corporation (FDIC) calls gross negligence and fiduciary failures by its former executives. The FDIC has now launched a lawsuit against 17 of these former leaders, accusing them of risky investment strategies and a $294 million dividend payout that left the bank vulnerable during a period of rising interest rates.

- FDIC sues 17 SVB executives for negligence

- Risky investments and $294M dividend blamed

- SVB collapse impacts crypto market, other banks

The Lawsuit Details

The FDIC has pulled no punches in its legal action against the former executives of Silicon Valley Bank. At the center of the storm are former CEO Gregory Becker and CFO Daniel Beck, accused alongside 15 other key figures of putting profits before stability. The allegations are serious: failing in their duty to manage the bank responsibly, or what’s known as “fiduciary failures.” In banking terms, this means they didn’t do what they were supposed to do to protect the bank and its clients.

The FDIC’s stark assessment of the situation is captured in their statement:

The FDIC, acting as SVB’s receiver, says the defendants ignored basic banking principles and internal risk policies.

This paints a picture of a bank that was steered into dangerous waters by its own leaders.

SVB’s Risky Investments

What led SVB down this path? The bank made significant bets on long-term government bonds and mortgage-backed securities. These investments can be lucrative, but they come with a catch: when interest rates rise, the value of these bonds falls. And rise they did, leaving SVB with a financial hit as these assets lost value.

To make matters worse, in December 2022, SVB paid out a hefty $294 million dividend. In a move that could be described as ‘celebrating while the ship is sinking,’ this payout further drained the bank’s capital, making it even more vulnerable to the rising tide of interest rates.

The Collapse and Bank Run

The crisis came to a head on March 8, 2023, when SVB announced a staggering $1.8 billion loss from selling $21 billion in securities. In a desperate attempt to stay afloat, the bank planned to raise $2.25 billion through a stock sale. This announcement, however, sparked panic among depositors, leading to a massive $42 billion in withdrawal requests within a single day. By March 10, SVB’s cash balance had plummeted to nearly $1 billion in the red, prompting regulators to step in and seize the bank.

Impact on the Crypto Market and Beyond

The collapse of SVB sent shockwaves through the financial world, particularly hitting the crypto market hard. Over 90% of SVB’s deposits were uninsured, which meant a significant portion of the crypto sector’s funds were at risk. The ripple effect was immediate, leading to the downfall of other banks like Signature Bank and First Republic Bank.

SVB was a key player in the tech and crypto ecosystems, with many startups and venture capital firms relying on its services. The sudden collapse was a harsh lesson in the vulnerability of even seemingly robust financial partners.

Responses and Mitigation Efforts

In the aftermath, First Citizens BancShares stepped in to acquire most of SVB’s assets and deposits on March 26, 2023, in a bid to stabilize the situation. However, $90 billion in securities remained under FDIC receivership. The FDIC moved swiftly to assure depositors that all funds would be accessible by March 13, 2023, a move aimed at preventing further panic.

Not all defendants are taking the allegations lying down. Laura Izurieta, SVB’s former Chief Risk Officer, who left the bank in April 2022, nearly a year before the meltdown, has her legal team pushing back hard. They argue that she provided sound risk management advice during her tenure, contesting her inclusion in the lawsuit against the 17 Silicon Valley Bank executives.

Lessons Learned and Future Outlook

The collapse of SVB is a stark reminder of the importance of sound risk management and fiduciary responsibility in the banking sector. It also underscores the interconnectedness of financial institutions and the potential domino effect that can ensue when one falls.

For the crypto community, the event is a sobering reminder that no institution is immune to the consequences of poor management and reckless decision-making. As we continue to explore the frontiers of decentralized finance and blockchain technologies, events like these highlight the need for vigilance and robust risk assessment.

While the crypto market pushes the boundaries of traditional finance, the lessons from SVB’s downfall are clear: even in a world championing decentralization and disruption, the basics of sound financial management remain critical.

Key Takeaways and Questions

- What were the primary reasons for Silicon Valley Bank’s collapse?

The collapse was primarily due to risky investments in long-term government bonds and mortgage-backed securities, which lost value amid rising interest rates, and a $294 million dividend payment that drained the bank’s capital.

- Who are the main defendants in the FDIC lawsuit against SVB?

The main defendants include former CEO Gregory Becker, ex-CFO Daniel Beck, and 15 other former executives and directors.

- How did the collapse of SVB impact the broader financial and crypto markets?

The collapse led to significant withdrawals and panic, affecting the crypto market due to SVB’s high percentage of uninsured deposits. It also triggered the failure of other banks like Signature Bank and First Republic Bank.

- What steps were taken to mitigate the effects of SVB’s collapse?

The FDIC assured depositors that all funds would be accessible by March 13, 2023, and First Citizens BancShares acquired most of SVB’s assets and deposits to stabilize the situation.

- How did SVB’s former Chief Risk Officer, Laura Izurieta, respond to the allegations?

Izurieta’s legal team contested her inclusion in the lawsuit, asserting that she provided sound risk management advice before leaving the bank nearly a year before its collapse.