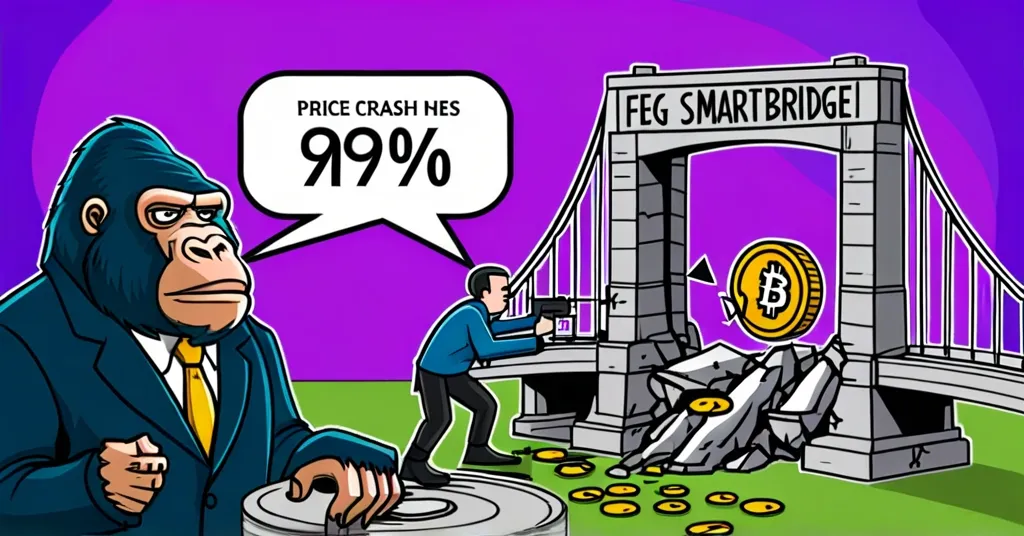

FEG Hacked Again: $1.07M Stolen, Token Crashes 99% – DeFi Security in Question

Feed Every Gorilla Falls Victim to Third Hack, Losing $1.07 Million

In a recurring nightmare for the Feed Every Gorilla (FEG) project, hackers have struck again, exploiting a flaw in the project’s bridge and stealing tokens worth approximately $1.07 million. This latest breach has led to a catastrophic 99% drop in the FEG token price, leaving many in the community disheartened.

- Third hack targets FEG’s bridge

- $1.07 million in tokens stolen

- FEG token price crashes 99%

The FEG project, known for its efforts to build a decentralized ecosystem, has been hit hard by this latest exploit. The “SmartBridge,” a tool designed to facilitate token transfers across different blockchain networks, was manipulated by attackers who crafted malicious messages to fraudulently withdraw FEG tokens from Ethereum, Base, and BNB Chain. This not only led to the theft of tokens but also triggered a massive sell-off, causing the token’s price to plummet.

As reported by Protos, “FEG token holders in despair after third hack causes 99% dump.” This sentiment echoes throughout the community, which has been grappling with the project’s recurring security issues.

FEG’s history with hacks is troubling. In May 2022, the project suffered a flash loan attack—a type of exploit where large loans are borrowed and repaid within a single transaction to manipulate prices—resulting in a $1.3 million loss. Later that year, in October, an issue with Team Finance’s liquidity locks led to nearly $2 million in losses, although $1.9 million was later returned. These incidents have left many questioning the project’s ability to secure its platform effectively.

Despite an audit by PeckShield, a respected blockchain security firm, the bridge’s vulnerability went undetected. PeckShield later identified the issue as a “composability issue from the integration with the underlying Wormhole bridge,” underscoring the complexities and risks of cross-chain operations. Decentralized Finance (DeFi), which refers to financial services built on blockchain technology without central authorities, continues to be a prime target for attackers, with over $3 billion stolen across 125 hacks in 2022 alone.

The repeated breaches at FEG are a microcosm of the larger security challenges facing the DeFi ecosystem. As advocates for decentralization, we must confront the harsh reality that security remains a critical hurdle. It’s a wild west out there in DeFi land, and while the promise of innovation and disruption is thrilling, the risks are real and can be devastating.

The FEG community’s reaction has been a mix of frustration and a glimmer of hope. Some members have expressed support for the team’s efforts to address the issue, recognizing that the path to securing decentralized systems is fraught with challenges. Pavlo Horbonos, Head of Security Department at a leading DeFi security firm, noted, “Even with audits, the complexity of DeFi systems means that vulnerabilities can still slip through.” This statement highlights the need for continuous vigilance and improvement in security protocols.

The latest hack at FEG also shines a spotlight on the risks associated with cross-chain bridges. These bridges, which enable token transfers between different blockchain networks, are a common feature in DeFi but also a frequent point of attack. The Solana hack, for instance, demonstrated the importance of using cold wallets—offline storage solutions—over hot wallets to mitigate risks.

While these incidents can erode user trust and hinder adoption, they also serve as valuable lessons for the entire DeFi ecosystem. By learning from these breaches and implementing stronger security measures, projects can work towards a more secure and resilient future. The FEG team, for example, has promised to enhance their security protocols and engage in more frequent and thorough audits.

In the spirit of effective accelerationism (e/acc), which champions the rapid advancement of technology to drive societal progress, we must push for innovation in security as much as we do in other areas of blockchain technology. While FEG’s bridge turned out to be more like a drawbridge for hackers—easy to lower and steal the treasures—this incident should fuel our determination to build better, more secure systems.

Key Takeaways and Questions

- What is the Feed Every Gorilla (FEG) project?

The FEG project is a cryptocurrency initiative aimed at building a decentralized ecosystem, but it has been repeatedly hacked, with the latest incident involving a flaw in its bridge.

- How much was stolen in the latest FEG hack?

Approximately $1.07 million worth of FEG tokens were stolen and sold by the attacker.

- What caused the 99% drop in the FEG token price?

The 99% drop in the FEG token price was caused by the sale of a large amount of stolen FEG tokens by the attacker.

- What were the previous hacks that affected FEG?

Previous hacks included a flash loan attack in May 2022 costing $1.3 million and an issue with Team Finance’s liquidity locks in October 2022, resulting in nearly $2 million in losses.

- Who audited the FEG project’s bridge?

The FEG project’s bridge was audited by PeckShield, a blockchain security firm.

- What does this series of hacks suggest about the security of DeFi projects?

The series of hacks suggests that despite audits and efforts to enhance security, DeFi projects like FEG remain vulnerable to sophisticated attacks, highlighting the need for ongoing security improvements.

- What can be done to improve DeFi security?

Projects can enhance security by avoiding single points of failure, using cold wallets, conducting regular and thorough audits, and staying vigilant against new threats.

- How does this impact the broader DeFi ecosystem?

These incidents can erode user trust and hinder adoption, but they also provide valuable lessons for improving security across the entire DeFi ecosystem.