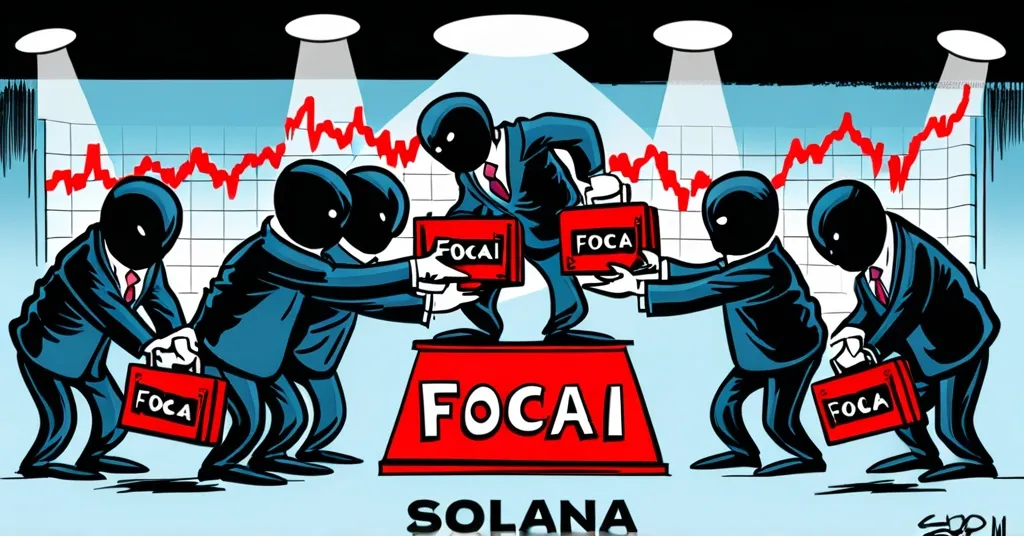

FOCAI.fun Insider Trading Scandal: $20M Profit on Solana Launch Exposed

Insider Trading Scandal: FOCAI.fun Launch on Solana Nets $20M for Insiders

The launch of the FOCAI cryptocurrency on the Solana blockchain was supposed to herald a new era of AI and blockchain integration. Instead, it exposed a major insider trading scheme that netted insiders over $20 million, raising serious questions about the integrity of new crypto projects.

- Insider Trading Profits: $20 million

- Initial Investment: 67.16 SOL ($14.6K)

- FOCAI’s Peak Market Cap: Over $50 million

- Post-Scam Price Drop: $0.327

Blockchain analytics firm Lookonchain uncovered the scheme, revealing that 15 suspected insider wallets initially spent just 67.16 SOL, equivalent to about $14,600, to acquire a staggering 605 million FOCAI tokens. This represented 60.5% of the total supply. The insiders then sold these tokens for a whopping 94,175 SOL, valued at $20.5 million at the time of sale. SOL, the native cryptocurrency of the Solana blockchain, facilitates transactions on the platform.

The FOCAI token made headlines upon its launch, soaring to a market capitalization of over $50 million within a mere 11 minutes. Trading volumes hit $48.2 million within 47 minutes, showcasing the initial frenzy around the project. But the excitement was short-lived. As details of the insider trading emerged, the price crashed to $0.327, slashing the market cap to just $32.7 million.

Crypto analyst @olegmetaverse was quick to sound the alarm on FOCAI’s questionable practices. He pointed out several red flags, including the project being a clone of another cryptocurrency called Eliza. Despite heavy marketing around AI and blockchain integration, FOCAI lacked substantial technical backing. @olegmetaverse even went as far as to label FOCAI as a “larp” (live action role play) and gave it a high-risk score of 75/100.

“Correction: Yes, it appears the team used other insider wallets to acquire the supply.” – Lookonchain

“$focai is larp lol… Overall Risk Assessment Score: 75/100 (High Risk)…” – @olegmetaverse

The project’s documentation was inconsistent, and its token economics were unclear. It also failed to implement proper smart contracts—self-executing contracts with the terms directly written into code—and decentralized operations, hallmarks of a legitimate blockchain project. This lack of transparency and technical substance, coupled with the insider trading, paints a grim picture of FOCAI’s true intentions.

The Solana blockchain, known for its high throughput and low transaction costs, has been a platform for numerous high-profile projects. However, incidents like this one raise questions about the platform’s ability to prevent such schemes. Raydium, the decentralized exchange on Solana where the insider trading occurred, facilitated the rapid trading of FOCAI tokens through its automated market maker (AMM) system—an algorithm that automatically sets prices for trades.

The FOCAI scandal is a stark reminder of the challenges facing the cryptocurrency industry. It underscores the need for due diligence and transparency, especially as new projects continue to emerge with ambitious but often unfulfilled promises. The rapid rise and fall of FOCAI highlight the potential for market manipulation and the importance of investor education in navigating the crypto market.

As the crypto community grapples with this latest scandal, it’s clear that the path to a decentralized financial future is fraught with challenges. Yet, it’s also an opportunity to learn, grow, and strengthen the industry against fraud and manipulation. The promise of Bitcoin and blockchain technology remains, but it’s up to all of us to ensure that promise is fulfilled with integrity and transparency.

Here are some key takeaways and questions for you to ponder:

- What was the scale of the insider trading involving FOCAI?

The insider trading scheme involving FOCAI resulted in approximately $20 million in profits for the insiders.

- How did FOCAI perform upon its launch?

FOCAI quickly surged to a market capitalization of over $50 million within 11 minutes of its launch, with trading volumes reaching $48.2 million within 47 minutes.

- What were the red flags identified by analysts regarding FOCAI?

Analysts flagged FOCAI as a potential scam due to its status as a clone of another cryptocurrency, misleading marketing about AI and blockchain integration, inconsistent documentation, unclear token economics, and lack of proper smart contract implementation.

- What was the impact of the insider trading on FOCAI’s market value?

Following the insider trading activity, FOCAI’s price dropped to $0.327, resulting in a market cap of $32.7 million.

- What role did Lookonchain play in this situation?

Lookonchain conducted the investigation that uncovered the insider trading scheme and provided critical updates on their findings, confirming the involvement of the FOCAI team in the manipulation.

While incidents like these can dampen the crypto community’s spirits, they also serve as a wake-up call. The promise of decentralization, freedom, and disrupting the status quo remains strong. As we champion Bitcoin and the broader blockchain ecosystem, let’s remain vigilant and push for greater transparency and accountability. After all, the FOCAI token promised the moon, but it turns out the only thing they delivered was a crater.