Gensler’s Exit: Bitcoin Not a Security, Ethereum’s Fate Unclear

SEC Never Classified Bitcoin or Ethereum as Securities: Gary Gensler’s Final Stance

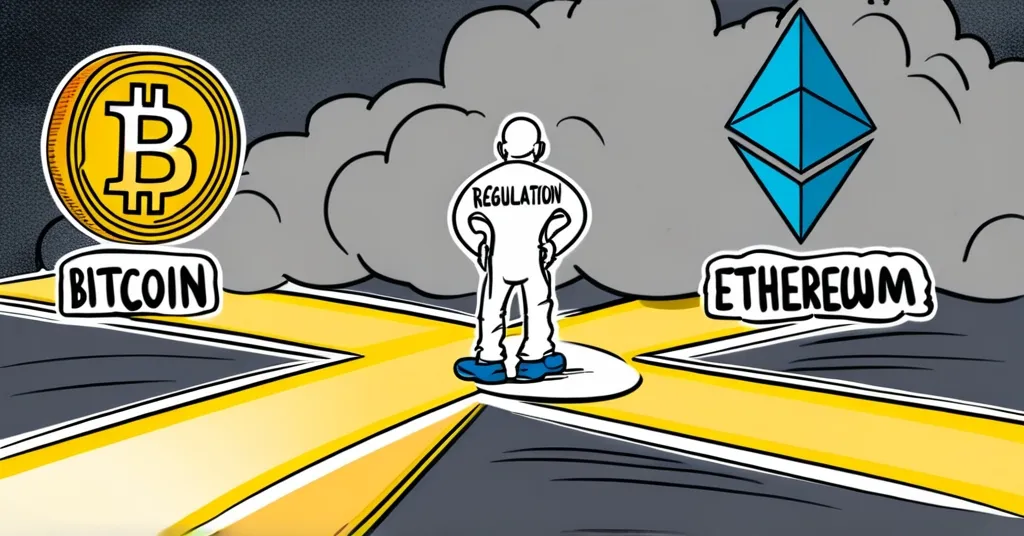

As SEC Chair Gary Gensler steps down, he leaves behind a legacy of regulatory ambiguity that continues to shape the future of cryptocurrencies like Bitcoin and Ethereum.

- Gensler: Bitcoin and Ethereum not classified as securities

- Bitcoin likened to assets like gold

- Ethereum’s status remains ambiguous

- Thousands of other cryptocurrencies need to prove their worth

- SEC’s enforcement approach defended

Gensler’s Final Word

In his final interviews before stepping down as the SEC Chair, Gary Gensler clarified the agency’s stance on cryptocurrencies. The SEC, or Securities and Exchange Commission, is the U.S. agency responsible for regulating securities markets. Securities are financial instruments that represent ownership or debt, and the SEC’s role is to protect investors by regulating these instruments. Gensler emphasized that under his leadership, the SEC never officially classified Bitcoin or Ethereum as securities. “My predecessor and I, we’ve never said Bitcoin is a security. We haven’t said Ethereum is a security,” he stated, setting the record straight. However, despite this public stance, internal SEC documents have suggested that Ethereum might not be legally recognized as a security, adding a layer of ambiguity to the debate.

Gensler’s exit feels like the final act of a regulatory drama that’s left the crypto audience on the edge of their seats. Cryptocurrency, in simple terms, is a digital or virtual form of currency that uses cryptography for security. His comments on Bitcoin and Ethereum’s classification are crucial for understanding the future of these assets in the financial landscape.

Bitcoin’s Golden Path

Gensler likened Bitcoin to assets like gold, suggesting it could carve out a similar niche in the future. Just as gold is valued for its scarcity and use as a store of value, Bitcoin could serve a similar role in the digital realm. “These other thousands of projects need to show their use case and show that they actually have fundamentals underlying them, or they won’t persist,” he remarked, casting doubt on the longevity of many other cryptocurrencies. While Bitcoin might shine as digital gold, its journey may be fraught with regulatory hurdles, but its potential as a ‘digital gold’ remains undimmed.

While Gensler sees Bitcoin as a potential ‘digital gold,’ critics argue that its volatility makes it more akin to a rollercoaster than a safe haven asset. This perspective highlights the ongoing debate about Bitcoin’s true value and its place in the financial ecosystem. As Bitcoin advocates, we at Let’s Talk, Bitcoin recognize its potential to revolutionize finance, yet we must also acknowledge the challenges it faces in achieving widespread adoption.

Ethereum’s Uncertain Future

Despite Gensler’s public stance, Ethereum’s status remains shrouded in regulatory fog. The SEC’s journey with cryptocurrencies began with the infamous DAO report in 2017, which set the stage for ongoing regulatory debates. While Bitcoin’s classification is clear, Ethereum’s ambiguous status highlights the need for a more defined regulatory path forward. This uncertainty is a double-edged sword for Ethereum, potentially stifling innovation while also allowing for flexibility in its development.

Ethereum, unlike Bitcoin, allows for the creation of smart contracts and decentralized applications, playing a critical role in the broader blockchain ecosystem. Its ambiguous status could impact its growth and adoption, yet it also underscores the need for regulatory clarity to foster innovation and disrupt the status quo.

The Regulatory Crossroads

Throughout his tenure, Gensler has championed an enforcement-focused approach to crypto regulation, a strategy he defended in his final days. “Not liking the law and not liking rules doesn’t mean there aren’t laws and rules,” he asserted, responding to an appellate court’s demand that the SEC better explain its rejection of Coinbase’s request for crypto-specific rules. Gensler placed the responsibility for crafting new regulatory frameworks squarely on Congress, leaving the industry in a regulatory limbo as he steps down with the incoming Trump administration.

This approach has drawn criticism from those within the crypto community who argue that the SEC’s focus on a crackdown on rule-breakers rather than providing clear regulatory guidelines stifles innovation and growth. Gensler’s leaving the crypto party just as the music’s about to change, and everyone’s wondering what dance comes next. The need for clearer regulatory guidelines is evident, yet the onus on Congress to act leaves the industry in a precarious position.

Implications and Outlook

As we bid farewell to Gensler, the crypto world remains at a crossroads. Bitcoin’s bright future as a potential ‘digital gold’ offers hope, while the fate of Ethereum and countless other projects hangs in the balance, subject to the whims of regulatory clarity and market validation. The principles of decentralization, freedom, privacy, and disrupting the status quo are at the heart of the crypto revolution. While Bitcoin may lead the charge, altcoins and other blockchains like Ethereum play crucial roles in filling niches and fostering innovation.

The future of the crypto industry post-Gensler hinges on regulatory developments and the industry’s ability to demonstrate real-world value. As champions of effective accelerationism (e/acc), we believe in the transformative power of technology to push boundaries and drive progress. Yet, we must remain vigilant and critical, ensuring that the crypto space evolves responsibly and sustainably.

Key Questions and Takeaways

- What is the SEC’s stance on Bitcoin and Ethereum as securities?

Bitcoin and Ethereum have never been officially classified as securities by the SEC under Gensler, though internal documents suggest ambiguity about Ethereum’s status.

- How does Gensler view the future of Bitcoin?

Gensler views Bitcoin as highly speculative but acknowledges its potential to become an asset similar to gold.

- What criticism has been leveled against the SEC’s approach to cryptocurrency regulation during Gensler’s tenure?

Critics argue that the SEC focused too heavily on enforcement rather than providing clear regulatory guidelines.

- What role does Gensler believe Congress should play in cryptocurrency regulation?

Gensler believes Congress should take the lead in crafting new regulatory frameworks for cryptocurrencies.

- How did Gensler respond to the appellate court’s demand regarding Coinbase’s request?

Gensler stated that disliking existing laws and rules does not negate their existence, responding to the court’s demand for clarity on Coinbase’s request for crypto-specific rules.