GOPAX’s Uncertain Future: Regulatory Hurdles and Stalled Megazone Acquisition

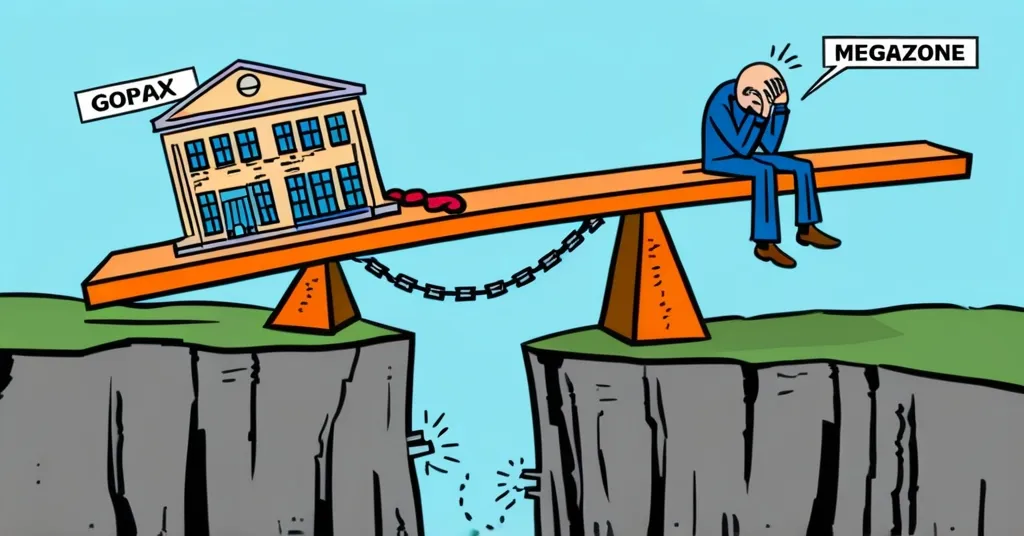

GOPAX, a significant player in South Korea’s cryptocurrency exchange landscape, finds itself grappling with financial and regulatory turbulence, as a potential acquisition by Megazone teeters on the brink of collapse. This precarious situation is underscored by Binance, GOPAX’s major stakeholder, facing regulatory orders to slash its ownership stake. The future of GOPAX hangs in the balance amidst these complications.

- GOPAX is one of the five South Korean exchanges trading in fiat currencies.

- Binance holds a majority stake in GOPAX, acquired to bolster its market presence in South Korea.

- Regulatory pressure demands Binance to reduce its stake from over 70% to just 10%.

- Acquisition talks with Megazone have stagnated, with no progress since October.

- The financial quagmire stems from debts linked to GOPAY services, compounded by the collapse of Genesis and FTX.

- Binance’s proposal to cover GOPAX’s debts hinges on completing the acquisition.

- The surge in Bitcoin prices presents challenges in stabilizing GOPAX’s debt repayment strategies.

- GOPAX’s status as a Virtual Asset Service Provider (VASP) is under regulatory review.

Initially, Binance’s acquisition of a substantial stake in GOPAX was a strategic move to deepen its foothold in the South Korean crypto market. Nonetheless, the country’s strict regulations regarding foreign investment in the crypto sector have imposed a heavy burden, requiring Binance to dramatically decrease its stake. This regulatory hurdle, combined with GOPAX’s mounting financial troubles, has hindered Megazone’s acquisition efforts.

GOPAX’s debts are primarily tied to its GOPAY staking services, which faced significant setbacks following the bankruptcies of Genesis and FTX, both crucial industry associates. Despite these challenges, Binance has indicated its willingness to assume GOPAX’s financial liabilities, contingent upon receiving approval to finalize the takeover. In the meantime, the rising Bitcoin prices have only complicated matters, as they contribute to the volatility of GOPAX’s crypto-denominated debts.

“Megazone and Binance have not spoken directly of late. And industry sources have come to the conclusion that Megazone has effectively given up on the acquisition deal.”

“If the authorities do not accept the renewal application, citing the change in major shareholders as a problem, GOPAX will have to go through the process of closing down.”

The ongoing review of GOPAX’s status as a Virtual Asset Service Provider is crucial for its continued operation. Failing to secure this status could lead to the exchange’s closure, impacting its users and potentially sending shockwaves through the South Korean crypto market.

While the increasing Bitcoin prices could theoretically boost the value of GOPAX’s holdings, they pose additional hurdles in stabilizing the exchange’s financial footing. This chaotic scene of regulatory pressure, market unpredictability, and corporate negotiations highlights a critical juncture for South Korea’s crypto industry, where foreign players like Binance must skillfully navigate a labyrinth of regulatory landscapes.

Key Questions and Takeaways

- What is the main issue facing GOPAX?

- Why has the takeover deal stalled?

- How has Binance responded to the situation?

- What are the implications of the stalled takeover for GOPAX?

GOPAX is entangled in a stalled takeover, financial debts from GOPAY services, and regulatory challenges over Binance’s majority stake.

The deal is stuck due to regulatory demands for Binance to decrease its stake, GOPAX’s debt challenges, and Megazone’s hesitancy amid these complexities.

Binance is open to clearing GOPAX’s debts if it can finalize the takeover, indicating its commitment to the South Korean market.

If the Megazone deal collapses with no alternative buyer, GOPAX might face severe financial and operational hurdles, possibly leading to closure without regulatory approval for its VASP status.

As Megazone appears to withdraw from its acquisition bid, GOPAX’s future is uncertain. The interplay between regulatory policies, market dynamics, and corporate strategies in this scenario highlights the intricate challenges faced by cryptocurrency exchanges in South Korea.