HIVE Digital Targets 25 EH/s with Hydro-Cooling and AI Post-Halving

HIVE Digital Technologies: Hydro-Cooling and AI as Post-Halving Survival Tools

With the 2024 Bitcoin halving slashing block rewards and tightening margins across the mining industry, HIVE Digital Technologies is making bold moves to not just survive but lead the pack. In a revealing interview with their CFO, Darcy Daubaras detailed how HIVE is leveraging hydro-cooled mining tech, renewable energy, and a surprising dive into AI cloud services to aim for a staggering 25 EH/s hashrate by the end of 2025. But is this ambition a masterstroke or a risky overreach in a cutthroat landscape?

- Hashrate Ambition: Targeting a jump from 5.0 EH/s (May 2024) to 25 EH/s by late 2025.

- Tech Innovation: Hydro-cooled S21+ ASICs for superior efficiency and sustainability.

- Dual Revenue: Diversifying into AI and high-performance computing (HPC) to hedge crypto volatility.

Navigating the Post-Halving Battlefield

The 2024 Bitcoin halving cut the block reward from 6.25 BTC to 3.125 BTC, turning the mining sector into a ruthless game of survival. Network difficulty has soared to record highs, and for many, profitability is a distant memory. Smaller or over-leveraged miners are dropping like flies—historically, 20-30% exit the game post-halving, as seen in 2016 and 2020 cycles. HIVE, however, is betting on a mix of tech savvy and financial discipline to weather the storm. Their current hashrate sits at 5.0 EH/s as of late May 2024, per their latest press release, with a near-term goal of 5.5 EH/s before the massive push to 25 EH/s by 2025. For context, hashrate is like the horsepower of a mining operation—the higher it is, the more Bitcoin they can crank out. A 5x increase in under two years is no small feat, and Daubaras knows it.

“Scaling to 25 EH/s is an ambitious objective, but we are firmly on track… We actively manage these risks through a combination of disciplined project planning, phased deployments, and strong local execution.” – Darcy Daubaras

Execution risks loom large, though. Supply chain snarls, hardware delays, and tight construction timelines could trip up even the best plans. HIVE’s strategy hinges on phased rollouts and local expertise in regions like Paraguay and Canada, but one misstep could cost them dearly. And let’s not sugarcoat it—Bitcoin’s price swings could make or break their funding model, even with their cautious approach.

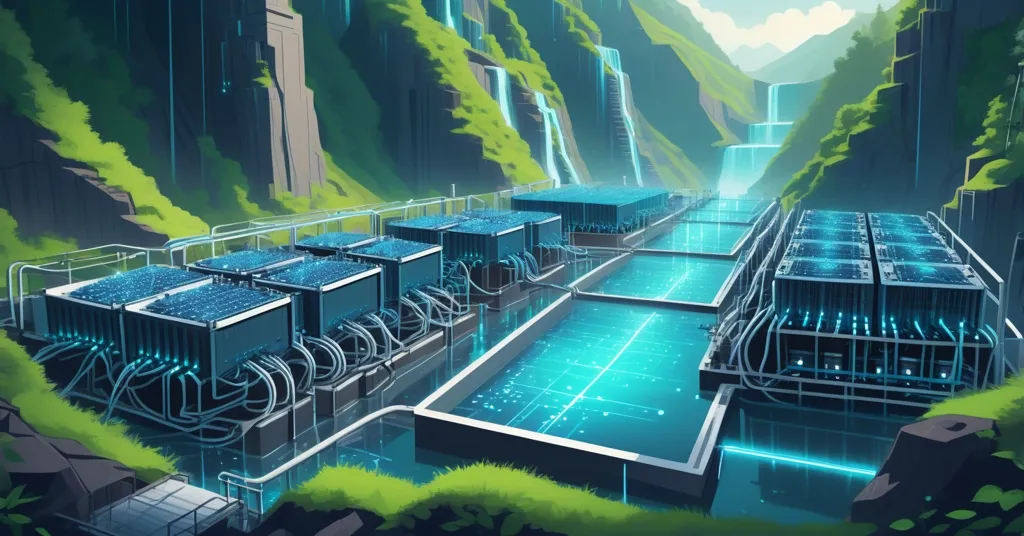

Hydro-Cooling: A Tech Edge in a Power-Hungry Industry

At the heart of HIVE’s operational playbook is their adoption of S21+ Hydro ASICs, a breed of mining hardware that swaps noisy, energy-guzzling fans for water-cooling systems. ASICs—short for Application-Specific Integrated Circuits—are purpose-built for Bitcoin mining, offering unmatched efficiency over general-purpose gear like GPUs. HIVE’s hydro-cooled technology could cut energy use by 20-30% compared to traditional air-cooled setups, based on industry benchmarks. That’s a massive win when every watt directly hits the bottom line post-halving. Plus, it slashes noise pollution and extends hardware lifespan, making their rigs more community-friendly.

“Hydro-cooled ASIC miners are environmentally responsible due to their superior energy efficiency and reduced environmental impact… These systems also eliminate high-speed fans, cutting noise pollution and making them more suitable for community integration.” – Darcy Daubaras

Recent moves bolster their tech edge. HIVE snapped up 1,000 Bitmain S21 Pro Antminers, boasting 234 TH/s at a lean 15 J/TH efficiency, and tweaked their firmware for long-term gains, even taking a temporary 120 PH/s hashrate hit to optimize performance. Financially, it’s paying off—at a Bitcoin price of $120K, their gross mining margin hits 65%, with a breakeven hash price of $20. Not sure what hash price means? It’s the revenue per unit of computing power, and breakeven is where costs are just covered. For fiscal 2024, HIVE posted a 35% gross operating margin, numbers that scream resilience compared to competitors bleeding out. But here’s the rub: if Bitcoin stumbles, those shiny margins could evaporate fast. Efficiency isn’t a bulletproof shield against market chaos.

AI and HPC: A Lifeline Beyond Bitcoin

HIVE isn’t banking solely on Bitcoin’s rollercoaster. They’ve carved out a second revenue stream in AI and high-performance computing (HPC) cloud services, a move sparked by Ethereum’s 2022 shift to proof-of-stake which left GPU mining rigs obsolete for crypto. Instead of scrapping them, HIVE repurposed these rigs for AI workloads—think training machine learning models or crunching data for research firms. With the global AI compute market projected to grow at over 30% CAGR through 2030, their BUZZ HPC division is already outpacing revenue targets. It’s a smart hedge; when crypto tanks, AI demand keeps the lights on.

“Our entry into HPC and AI cloud services isn’t a pivot… When crypto markets soften, AI compute demand remains robust. Over time, we expect our green data centres to power both the blockchain and AI economies.” – Darcy Daubaras

Here’s where skepticism creeps in. The AI market isn’t a quiet playground—tech giants and pure-play cloud providers are already entrenched. HIVE’s late entry and split focus between mining and AI could stretch their expertise thin, not to mention the hefty upfront costs of scaling data centers. Are they biting off more than they can chew, risking their core Bitcoin mining strength for a shiny new toy? Even Bitcoin maximalists have to admit, though, that repurposing old Ethereum rigs shows how altcoin infrastructure can fuel innovation elsewhere. It’s a rare nod to the broader crypto ecosystem’s utility.

Green Mining: Noble Goal or Tough Sell?

Bitcoin mining’s reputation for guzzling energy—about 0.1% of global electricity by some estimates—has drawn fire from environmentalists and regulators alike. HIVE is countering this with a renewable-first stance, powering operations in Iceland, Sweden, Canada, and a flagship hydro-powered data center in Paraguay with cheap, abundant hydropower. They argue mining can stabilize grids by monetizing stranded power, turning excess energy into profit while supporting local communities, a concept explored in discussions on hydro-cooling benefits.

“HIVE has always been a renewable-first miner… Bitcoin mining can provide a net benefit to energy systems by stabilizing grids, monetizing stranded power, and supporting local communities.” – Darcy Daubaras

Let’s cut through the feel-good rhetoric. Mining still consumes vast power, green or not, and scaling to 25 EH/s won’t exactly shrink their footprint. In Paraguay, regulatory debates over mining’s energy drain are heating up, and grid constraints could cap expansion. HIVE’s geographical spread mitigates some risk, but global ESG scrutiny isn’t going away. Their pitch sounds noble, but the real test is scaling without drawing the ire of policymakers. Can they truly turn mining into a grid-friendly hero, or is this just PR polish on a power-hungry beast?

Financial Fortitude and Industry Shakeout

Unlike many miners drowning in debt, HIVE’s no-debt philosophy stands out. They fund growth through operational cash flow and strategic use of their Bitcoin treasury, which held 2,468 BTC—over $170 million—as of June 9, 2024. Unlike MicroStrategy’s hoard-for-the-sake-of-hoarding approach, HIVE ties its treasury to mining ops with downside protection mechanisms to cushion price drops. Details are vague, but it’s clear they’re not betting the farm on Bitcoin’s next moonshot.

The post-halving landscape is brutal, and HIVE smells opportunity. With smaller players buckling under unprofitability, they’re ready to swoop in on distressed assets—think bankrupt rigs or cut-rate data centers—if the ROI and ESG boxes are ticked. It’s survival of the fittest, and HIVE’s got sharp claws to grab stragglers’ gear at bargain-bin prices.

“A shakeout is not only likely, but also healthy. The post-halving landscape has separated efficient operators from the rest, and HIVE is uniquely positioned to benefit.” – Darcy Daubaras

Still, macro headwinds could spoil the feast. US tariffs on $1.3 trillion of goods, flagged by macro trader Geo Chen, signal prolonged volatility for risk assets like Bitcoin. A price dip could hammer HIVE’s treasury value, even with their safeguards. Compared to peers like Marathon Digital or Riot Platforms, HIVE’s hashrate growth and green focus stand out, but they’re not immune to industry-wide turbulence. Geopolitical risks in Paraguay, like regulatory pushback, add another layer of uncertainty. Diversification across regions helps, but it’s a tightrope walk.

What’s Next for HIVE?

HIVE’s blend of hydro-cooling, AI diversification, and renewable energy paints them as a dark horse in Bitcoin mining. If they hit 25 EH/s by 2025, they could redefine sustainable mining while bolstering network security—a win for Bitcoin’s core ethos. But the road is riddled with potholes: execution hiccups, market swings, and regulatory curveballs could derail their plans. Unlike some miners spewing moonshot fantasies of $200K Bitcoin windfalls, HIVE sticks to hard metrics, and that’s a rare breath of fresh air in a space choking on hot air. Their next hashrate updates and AI revenue reports will be telling—keep a close watch, because their moves might just rewrite the mining playbook, or stumble under Bitcoin’s wild ride. For more insights into their operations, check out HIVE’s official site or community discussions on platforms like Reddit.

Key Takeaways and Burning Questions

- How is HIVE tackling Bitcoin mining challenges after the 2024 halving?

They’re pushing for a 25 EH/s hashrate by 2025 with hydro-cooled S21+ ASICs, phased expansions in renewable-rich areas like Paraguay, and disciplined planning to dodge supply chain and execution pitfalls. - Why is hydro-cooling a big deal for HIVE’s mining strategy?

It cuts energy costs by up to 30%, reduces noise for community harmony, and prolongs hardware life, giving HIVE a vital edge when post-halving margins are razor-thin. - What’s the significance of HIVE’s shift into AI and HPC cloud services?

Repurposing old Ethereum mining GPUs for AI workloads offers a steady revenue buffer against Bitcoin’s volatility, tapping into a booming market while showcasing blockchain infrastructure’s versatility. - Can HIVE make Bitcoin mining truly sustainable with renewable energy?

Their green focus in Iceland, Sweden, and Paraguay pushes the envelope, but scaling power-hungry operations under global ESG and regulatory pressure remains a daunting challenge. - Will the post-halving miner shakeout favor HIVE, or is it a risky gamble?

Positioned to grab distressed assets with low costs and no debt, HIVE stands to gain, but macro volatility and geopolitical risks could turn this opportunity into a costly misstep. - Are there hidden downsides to HIVE’s dual Bitcoin and AI focus?

Splitting attention risks diluting mining expertise, and high upfront AI costs or competitive pressures could strain their cash-flow-driven, no-debt growth model in unpredictable ways.