IRS Classifies DeFi Platforms as Brokers: Navigating New Regulatory Challenges

DeFi at a Crossroads: Navigating Crypto Regulations and Compliance

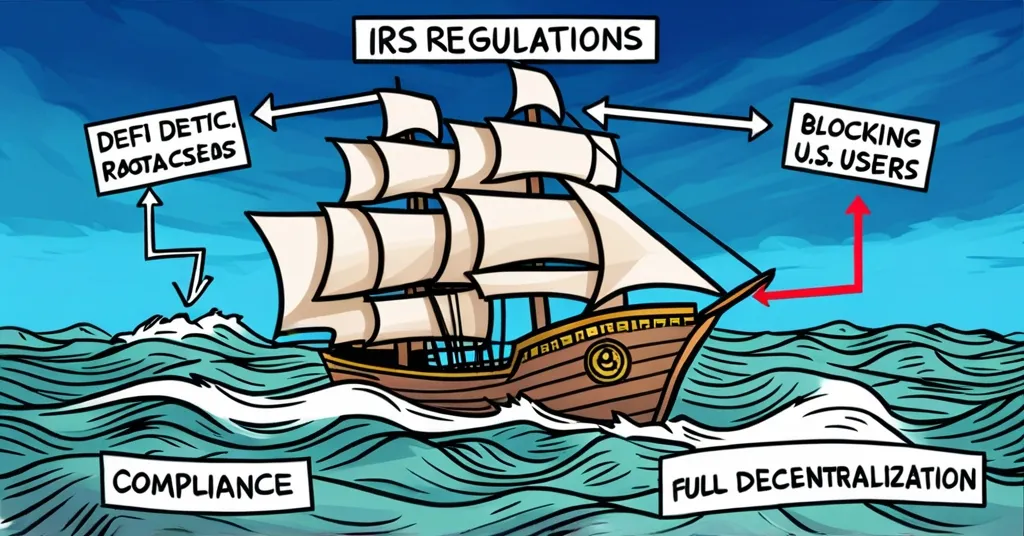

The future of decentralized finance (DeFi) hangs in the balance as the IRS unleashes a regulatory storm with new rules that could reshape the industry. On December 27, 2024, the IRS dropped a regulatory bombshell by classifying DeFi platforms and front-ends, the user interfaces of these platforms, as brokers. This means that platforms like Uniswap will need to implement Know Your Customer (KYC) procedures—verifying the identity of clients—and report user transaction data. For those new to the crypto world, decentralization means operating without a central authority, a principle that has made DeFi attractive to many.

- IRS classifies DeFi platforms as brokers

- Three options: compliance, block U.S. users, or full decentralization

- Rules could stifle U.S. DeFi innovation

Alex Thorn, head of research at Galaxy Digital, has outlined three paths forward for DeFi platforms in the face of these new regulations. The first option is to comply with the IRS rules, which would mean implementing KYC and reporting transactions. This could be a tough pill to swallow for a sector built on privacy and decentralization. As Alex Thorn puts it, “These regulations pose very serious challenges to DeFi applications because most of them were founded on the principles of decentralization and privacy.”

The second option is to block U.S. users entirely, thereby avoiding the regulatory obligations altogether. However, this could severely limit market exposure for DeFi platforms and might fragment the global DeFi ecosystem. It’s a bitter choice, especially for platforms that have thrived on the dynamism of the U.S. market.

The third and perhaps most radical option is to pursue full decentralization, eliminating centralized control and the ability to make money. This approach could preserve the core principles of DeFi but at the cost of potentially hindering innovation and making the platforms less user-friendly. It’s a move that could make DeFi more true to its roots but risk becoming less accessible to the average user.

Compliance with the IRS rules could also have some benefits. It might increase trust among mainstream users and facilitate broader adoption by aligning DeFi more closely with traditional financial systems. However, implementing KYC on decentralized platforms is technically challenging. It’s like trying to fit a square peg into a round hole—decentralized systems are inherently designed to avoid central points of control, making it difficult to enforce identity verification.

The Blockchain Association has been vocal in its criticism of these rules, branding them a “privacy violation.” They argue that the regulations could deter developers from advancing the DeFi space, potentially driving innovation offshore. Marisa Coppel of the Blockchain Association stated,

“The IRS is overstepping its authority and infringing on privacy rights with this rule, which could push DeFi innovation offshore.”

This sentiment is echoed by other industry groups, including the DeFi Education Fund and Texas Blockchain Council, who are considering legal action against the IRS.

With compliance deadlines looming in 2025, the DeFi industry is at a critical juncture. Approximately 875 DeFi operators and 2.6 million U.S. taxpayers are expected to be impacted by these rules. The public has until October 30, 2025, to comment, and a hearing is scheduled for November 7, 2025. These deadlines mark crucial points for the industry to rally and potentially influence the final shape of these regulations.

Some argue that stricter regulations could protect users and prevent scams, potentially benefiting the industry in the long run. However, the IRS rules are a sledgehammer to the delicate balance of DeFi innovation and privacy. They could drive development overseas, impacting U.S. competitiveness in the digital economy.

It’s worth noting how these regulations might affect Bitcoin differently from other cryptocurrencies and DeFi platforms. Bitcoin, often seen as the gold standard of cryptocurrencies, has a unique position in the market. While it may face similar regulatory pressures, its widespread adoption and established infrastructure could make it more resilient to these changes.

In the high-stakes game of regulatory chess, DeFi players are known for their long game. Will they checkmate the IRS, or will they have to adapt to a new set of rules? The future of DeFi in the U.S. hangs in the balance, and the community’s response will be crucial in shaping the path forward.

Key Takeaways and Questions

- What are the new IRS regulations for DeFi platforms?

The IRS has classified DeFi platforms as brokers, requiring them to implement KYC procedures and report user transaction data.

- What are the three options for DeFi platforms in response to the IRS rules?

Compliance with the IRS rules, blocking U.S. users, or pursuing full decentralization.

- What challenges do DeFi platforms face with each option?

Compliance: Difficulty in implementing KYC on decentralized platforms, potential exclusion of privacy-focused users, and operational overhead. Blocking U.S. Users: Limiting market exposure and potentially fragmenting the global DeFi ecosystem. Full Decentralization: Loss of revenue generation, reduced user-friendliness, and potential constraints on innovation.

- How might the new IRS rules impact DeFi innovation in the U.S.?

Critics argue that the rules could drive DeFi innovation offshore, deter developers, and hinder the growth of the U.S. crypto industry.

- What are the estimated numbers of affected DeFi operators and U.S. taxpayers?

Approximately 875 DeFi operators and 2.6 million U.S. taxpayers are expected to be impacted.

- When are the key deadlines for public comments and hearings on the IRS rules?

The public comment period ends on October 30, 2025, and a public hearing is scheduled for November 7, 2025.