IRS Unveils 2025 Crypto Tax Rules: Impact on Exchanges, ETFs, and DeFi

IRS to Implement New Crypto Transaction Reporting in 2025: What You Need to Know

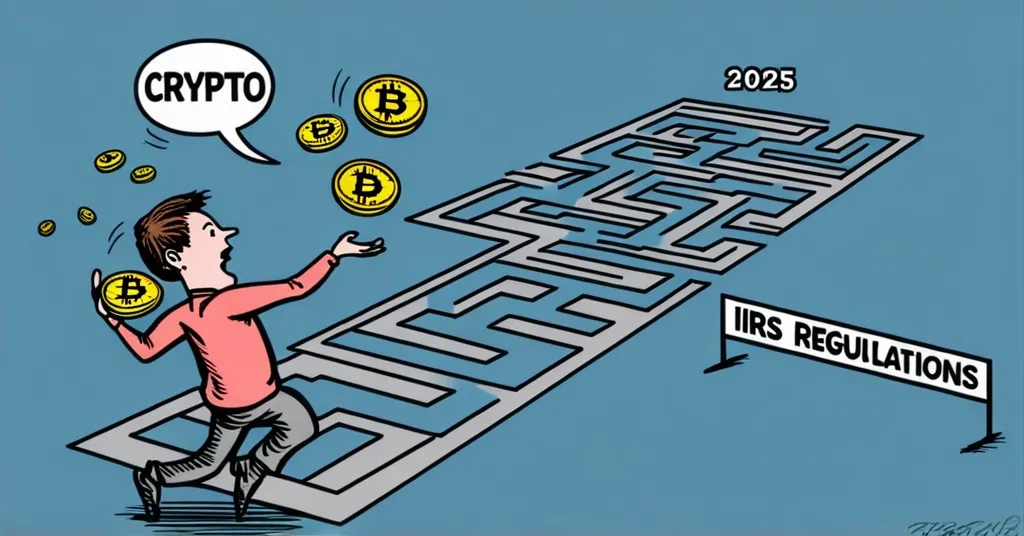

The Internal Revenue Service (IRS) is set to usher in a new era of crypto regulation with third-party reporting requirements starting in 2025. These changes will impact centralized and decentralized platforms, as well as Bitcoin ETF investors, aiming to enhance tax compliance in the crypto space. The IRS has also provided temporary relief to ease the transition for centralized finance users.

- Centralized exchanges to report via 1099-DA starting 2025

- Decentralized platforms to report gross proceeds in 2027

- Cost basis reporting delayed until 2026

- Bitcoin ETF investors to receive detailed tax forms

- Automatic relief for centralized finance users until 2026

Centralized Exchanges

Starting in 2025, platforms like Coinbase and Gemini will have to report all digital asset transactions using the new 1099-DA form. This form will be sent to both taxpayers and the IRS by early 2026, detailing all purchases and sales. However, the cost basis—the price you originally paid for the cryptocurrency—won’t be reported until the 2026 tax year. This delay could complicate the process of calculating gains or losses, as Jessalyn Dean, vice president of tax information at Ledgible, explains, “Cost basis reporting, which refers to the original purchase price of a digital asset, will not be required from brokers until the 2026 tax year.”

Think of this like a restaurant now requiring you to submit receipts for every meal you’ve ever eaten there, instead of just the final bill. It’s a bit of a headache, but it’s the IRS’s latest move to shine a spotlight on the shadowy world of crypto transactions.

Decentralized Platforms

Decentralized platforms, such as Uniswap and Sushiswap, will start reporting transactions in 2027. They’ll focus on gross proceeds—the total amount received from selling a digital asset—rather than the cost basis. This delay acknowledges the complexities of decentralized systems, but it’s another step towards a more regulated crypto landscape. Ever wondered how the IRS will track your crypto trades? Let’s just say they’re playing catch-up in the digital currency sprint.

Bitcoin ETFs

Investors in spot Bitcoin ETFs will also feel the impact. They’ll receive forms detailing their proceeds and taxable events from the fund’s internal management activities. Jessalyn Dean advises seeking guidance from tax advisers, as “taxable gains or losses can arise from the fund’s internal management activities, even if the underlying assets are held long-term.” It’s like trying to navigate a maze blindfolded, but with a good guide, you might just make it out unscathed.

Relief Measures

The IRS has thrown a lifeline to centralized finance users, offering automatic relief until 2026. This allows them to use alternative accounting methods, avoiding the default First-In-First-Out (FIFO) method, which could otherwise increase their tax liabilities. FIFO means you sell your oldest coins first, which might not be the most tax-efficient strategy for everyone. It’s a small win for those juggling their crypto investments like a circus act.

Counterpoints and Challenges

While these regulations aim to bring clarity and compliance, they’re not without controversy. Privacy concerns loom large, with many in the crypto community wary of increased surveillance. Tracking transactions on decentralized platforms is like trying to herd cats; it’s challenging and often leads to heated debates about the very essence of decentralization. There’s also the risk of stifling innovation, as the regulatory noose tightens around what was once the Wild West of finance.

Yet, it’s not all doom and gloom. These rules could foster increased transparency and protect investors from scams and fraud. They’re a clear sign of the crypto sector’s growing mainstream acceptance, even if it feels like a regulatory dance with the decentralized ethos of cryptocurrencies.

Benefits of Regulation

On the flip side, these regulations could bring much-needed transparency to the crypto market. By ensuring that all transactions are reported, we might see fewer scams and a more secure environment for investors. It’s a step towards mainstream acceptance, showing that cryptocurrencies are here to stay, despite the paperwork they now entail.

Key Questions and Takeaways

What are the new IRS reporting requirements for cryptocurrency transactions?

Starting in 2025, centralized exchanges must report crypto transactions on the new 1099-DA form, detailing all digital asset purchases and sales.

How will decentralized platforms be affected by these changes?

Decentralized platforms like Uniswap and Sushiswap will start reporting transactions in 2027, focusing on gross proceeds rather than cost basis.

What is the significance of cost basis reporting and when will it be implemented?

Cost basis reporting is crucial for calculating taxable gains or losses. It will not be required from brokers until the 2026 tax year.

How are Bitcoin ETF investors impacted by these new regulations?

Bitcoin ETF investors will receive forms like the 1099-B or 1099-DA, detailing proceeds and taxable events from the fund’s internal management activities.

What relief has the IRS provided for centralized finance users?

The IRS has offered automatic relief, allowing centralized finance users to use alternative accounting methods until 2026 to avoid defaulting to FIFO, which could increase tax liabilities.

As we navigate these new waters, remember that the crypto revolution continues, but now with a bit more paperwork. The IRS is playing a game of catch-up, but the dance between decentralization and regulation is far from over. Stay informed, and perhaps chuckle at the irony of a system meant to disrupt now becoming part of the very structure it sought to challenge.