Is Bitcoin’s Cypherpunk Spirit at Risk Amidst Tail Emission and Supply Cap Debates?

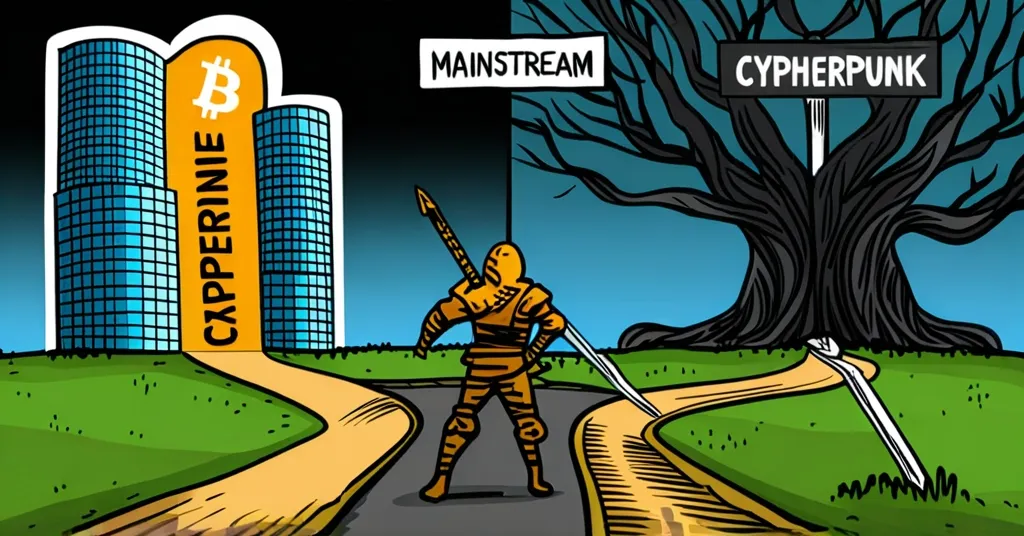

Is Bitcoin Losing Its Cypherpunk Identity?

Bitcoin’s path from a radical, decentralized currency to a mainstream financial asset has sparked questions about its adherence to cypherpunk ideals. Recently, this debate has centered around Bitcoin developer Peter Todd’s advocacy for “tail emission”, as diminishing block rewards threaten Bitcoin’s stability.

- Cypherpunk Movement: Emphasizes privacy and decentralization through cryptography.

- Supply Cap Debate: BlackRock’s disclaimer raises doubts about Bitcoin’s 21 million cap.

- Tail Emission Proposal: Todd suggests this model for stability, inspired by Monero.

- Implementation Hurdles: Requires a hard fork and extensive community consensus.

The Cypherpunk Vision

The cypherpunk movement champions the use of cryptography to ensure privacy and decentralization in societal structures. Bitcoin, with its fixed supply cap of 21 million coins, has stood as a symbol of this vision, offering scarcity as a pillar of value. Yet, recent corporate maneuvers have thrown this certainty into doubt.

BlackRock, a financial behemoth, has sparked controversy with a disclaimer questioning the immutability of Bitcoin’s supply cap. This has reignited debates about Bitcoin’s future and its ability to stay true to its foundational ethos.

Current Challenges

Peter Todd has put forth the concept of “tail emission” as a potential safeguard against the dwindling block rewards Bitcoin faces. This involves granting miners continuous, albeit small, rewards even after the supply cap is reached, a model successfully employed by Monero. This approach aims to offset lost coins with new issuance, thereby maintaining a stable supply.

“There is no guarantee that Bitcoin’s 21 million supply cap will not be changed.” – BlackRock disclaimer

However, implementing tail emission on Bitcoin isn’t straightforward. Such a change demands a hard fork—a significant modification to Bitcoin’s protocol and structure, requiring broad community agreement. For a currency as vast and varied as Bitcoin, this consensus is dauntingly elusive.

“While Monero was able to get sufficiently broad consensus in the community to implement tail emission, it’s unclear at best if it would ever be possible to achieve that for the much larger Bitcoin.” – Peter Todd

The Tail Emission Proposal

To date, no proof-of-work currency has thrived solely on transaction fees, as Peter Todd points out, underlining the inherent instability of block generation under such a regime. Monero’s use of tail emission offers a case study in maintaining currency stability through a perpetual issuance model.

Monero’s success in gaining community consensus for tail emission raises questions about whether Bitcoin could follow suit. The challenge lies in Bitcoin’s larger, more diverse user base, which may not align with such a proposal’s ideological and technical implications.

Future Implications

The debate over Bitcoin’s supply cap and potential tail emission unfolds in an environment increasingly dominated by institutional players. BlackRock’s involvement signifies a shift in Bitcoin’s landscape, where corporate influences could challenge the purity of its cypherpunk roots.

CEO Michael Saylor of MicroStrategy, a staunch Bitcoin supporter, amplified the debate by sharing BlackRock’s stance, while influential figures like Adam Back have chosen silence, adding layers of intrigue to the discourse.

The community now faces the critical task of reconciling Bitcoin’s foundational principles with the realities of mainstream adoption. The question remains: Can Bitcoin preserve its cypherpunk identity while evolving in a world where corporate interests loom large?

As we ponder Bitcoin’s trajectory, it’s crucial to explore alternative solutions alongside Todd’s proposal. Engaging in this discourse not only reflects on technical possibilities but also challenges us to align Bitcoin’s evolution with its philosophical origins—privacy, decentralization, and resistance to control. The outcome of these discussions could well determine Bitcoin’s future identity.