Japan and Russia Reject Bitcoin Reserves, U.S. Explores Strategic Asset

Japan and Russia Firmly Reject National Bitcoin Reserves Amid Global Uncertainty

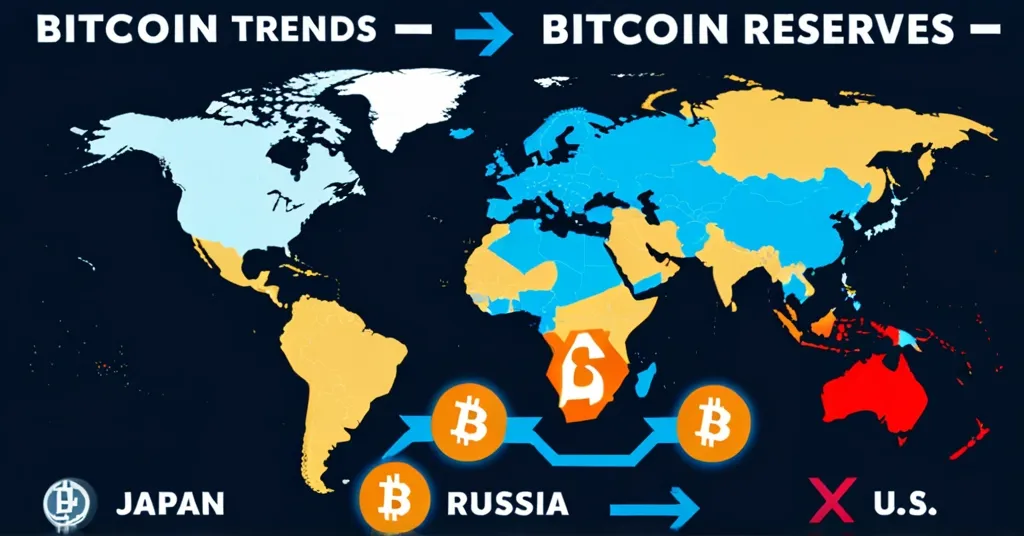

Japan and Russia have both taken a cautious stance by rejecting the establishment of national Bitcoin reserves, primarily due to concerns over cryptocurrency volatility and legal frameworks. Meanwhile, the United States and Brazil are actively exploring Bitcoin acquisition as part of their financial strategies.

- Japan and Russia reject national Bitcoin reserves.

- Caution driven by volatility and legal issues.

- U.S. and Brazil explore Bitcoin as strategic assets.

Japan’s Stance

Japanese authorities have firmly rejected the notion of a national Bitcoin reserve, with Prime Minister Shigeru Ishiba’s office citing a lack of detailed understanding of global trends and the sharp rises and falls in cryptocurrency prices. In Japan, current legal frameworks are not designed to accommodate the unpredictable nature of digital currencies. This cautious approach contrasts sharply with the actions of Japan’s private sector, where companies like Metaplanet are boldly investing in Bitcoin. This move reflects a broader trend of corporate treasury diversification into cryptocurrencies, showcasing a stark contrast between governmental caution and private sector enthusiasm.

So, would you trust your country to hold Bitcoin reserves if it meant embracing such volatility? For now, Japan seems content to watch from the sidelines, perhaps waiting for a more stable legal environment that can support such a bold move.

Russia’s Position

In Russia, Finance Minister Anton Siluanov echoed Japan’s cautious sentiments, emphasizing the high risks associated with Bitcoin’s volatility. He suggested waiting 5 to 10 years to assess the cryptocurrency’s trends before even considering a national reserve. Siluanov’s perspective was clear:

“It is of course easy to [say]: If you had invested money in Bitcoin at the beginning of the year, you would have earned twice or even three times your money back. However, there is also a risk of loss. So the state does not take those kinds of financial risks. Not at all. It is better to earn less, but keep – as they say – your powder dry.”

However, Russia’s approach is more nuanced than it appears. While cautious about national reserves, the country is actively using cryptocurrencies in international trade, a move to counter economic sanctions. This dual approach highlights the complex balance between embracing innovation and mitigating risk.

U.S. Developments

Across the Pacific, the U.S. is taking a more proactive stance. President-elect Donald Trump has expressed interest in launching a state-operated Bitcoin reserve, with American lawmakers already crafting legal frameworks to support this initiative. This bold move has sparked excitement, with some analysts from VanEck predicting a 35% debt reduction for the U.S. by 2049 if it starts buying Bitcoin. While intriguing, such predictions should be taken with a healthy dose of skepticism until further verified.

On the state level, Wisconsin, Michigan, and potentially New Jersey are jumping on the Bitcoin bandwagon by investing in Bitcoin ETFs. These state-level initiatives, coupled with federal legislative efforts, suggest that despite the volatility, Bitcoin is gaining traction as a strategic asset in the U.S.

Global Trends and Private Sector Responses

Beyond the U.S., Brazil is also exploring Bitcoin acquisition options, signaling a broader trend of countries considering digital assets as part of their financial strategies. This global push for Bitcoin reserves underscores the cryptocurrency’s growing acceptance, even as many governments remain wary of its volatility.

The contrast between governmental caution and private sector boldness adds an extra layer of intrigue to the Bitcoin narrative. As countries like Japan and Russia take a wait-and-see approach, private entities are forging ahead, betting on the future of digital currencies.

Balancing Innovation and Risk

The debate around national Bitcoin reserves highlights a critical point: the delicate balance between embracing innovation and mitigating risk. Bitcoin’s volatility remains a double-edged sword – offering the potential for significant gains but also posing substantial risks. As the world watches and waits, it remains to be seen whether other countries will follow the U.S.’s lead or continue to play it safe like Japan and Russia.

What’s clear, however, is that the cryptocurrency revolution is far from over. Whether as a hedge against inflation, a tool for international trade, or a strategic asset for national reserves, Bitcoin continues to challenge traditional financial systems and push the boundaries of what’s possible.

Key Takeaways and Questions

- What stance have Japan and Russia taken regarding national Bitcoin reserves?

Japan and Russia have both decided against establishing national Bitcoin reserves in the near future, preferring to monitor developments in other countries first.

- Why did Japan rule out a national Bitcoin reserve?

Japan cited a lack of detailed understanding of developments in other countries and the incompatibility of cryptocurrencies with their current legal framework due to volatility.

- What did Russia’s Finance Minister say about Bitcoin reserves?

Anton Siluanov emphasized the high risk and volatility of Bitcoin, suggesting that Russia should wait 5-10 years to assess trends before considering a national reserve.

- Is the U.S. considering a national Bitcoin reserve?

Yes, U.S. President-elect Donald Trump has expressed interest in launching a state-operated Bitcoin reserve, with supporting legislative efforts underway.

- How could a U.S. Bitcoin reserve impact its debt?

Analysts from VanEck predict that the U.S. could reduce its debt by 35% by 2049 if it starts buying Bitcoin, though this prediction requires further verification.

What are your thoughts on the future of Bitcoin reserves? Share your predictions in the comments below and join the conversation!