Kazakhstan’s Crypto Crackdown: 36 Illegal Exchanges Shut Down, CBDC Launch Planned

Kazakhstan’s Bold Move to Legitimize Cryptocurrency

With over 95% of its crypto investors operating outside regulated platforms, Kazakhstan is taking decisive steps to transform its digital asset landscape.

- President Tokayev pushes for urgent crypto infrastructure expansion

- Only 5% of investors use regulated platforms

- 36 illegal exchanges shut down, 3,500 sites blocked in 2024

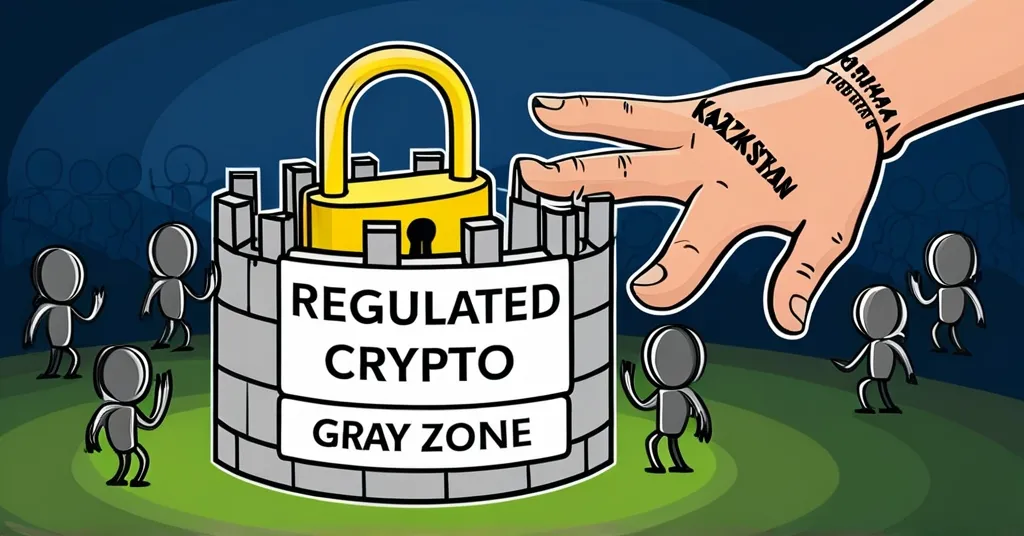

President Kassym-Jomart Tokayev has issued a clarion call for the rapid expansion of the country’s cryptocurrency infrastructure, aiming to legitimize crypto operations and shrink the shadowy “gray zone” where most activities currently take place. The ‘gray zone’ refers to crypto activities that operate outside of regulated frameworks, often on the edge of legality. According to experts, only 5% of Kazakhstan’s crypto investors use the Center’s platform, while the rest operate in this so-called ‘gray zone.’ President Tokayev remarked, “

according to experts, only 5% of Kazakhstan’s crypto investors use the Center’s platform, while the rest operate in the so-called ‘gray zone.’ Urgently, infrastructure for broader legal circulation of digital assets should be created. Financial regulators must focus on developing the appropriate legislative framework.

“

Kazakhstan’s financial authorities are not just cracking down on illegal crypto exchanges; they’re waging a full-blown war on the ‘gray zone.’ In 2024, they shut down 36 illegal crypto exchanges with a combined turnover of 60 billion tenge (around $112.84 million). Additionally, over 3,500 unregistered crypto trading sites have been blocked. The turnover of an exchange refers to the total value of transactions processed over a period. Despite these efforts, some sources suggest the turnover might be as high as $120 million, highlighting the scale of the challenge.

The International Financial Center in Astana stands at the heart of this regulated crypto ecosystem, hosting platforms like Galaxy Digital, SkyBridge Digital Finance, and Swiftex. However, its utilization remains low at just 5% among the nation’s crypto investors. This discrepancy highlights the challenge of shifting entrenched habits and the need for more robust infrastructure to support legal crypto operations.

Kazakhstan’s push for a more structured legislative framework is part of a broader strategy to become a significant player in the global crypto market. The country is also venturing into the realm of digital currencies with plans to launch its own Central Bank Digital Currency (CBDC), the digital tenge, in 2025. A CBDC is a digital form of a country’s fiat currency, issued and backed by the central bank. This initiative reflects Kazakhstan’s ambition to integrate digital assets into its financial system, aligning with global trends towards digital currency adoption.

The involvement of global crypto giants like Binance, which has received in-principle license approval to operate within the Astana International Financial Centre (AIFC), underscores the attractiveness of Kazakhstan’s regulatory environment. Changpeng Zhao (CZ), CEO of Binance, praised Kazakhstan’s pioneering role in Central Asia’s crypto adoption and regulation, emphasizing the importance of operating in a well-regulated environment. However, the journey is not without its hurdles. The discrepancy between the reported turnover of the illegal exchanges and the effectiveness of regulatory measures highlights the ongoing battle against the ‘gray zone.’

Kazakhstan’s significant role in cryptocurrency mining, driven by its abundant and affordable energy resources, adds another layer of complexity to its regulatory efforts. As a major mining hub, the country’s push for regulation could further enhance its position in the global crypto market. Yet, the transition from a mining-focused approach to a comprehensive regulatory framework poses unique challenges.

While Kazakhstan’s efforts to regulate and legitimize cryptocurrency are commendable, there are counterpoints to consider. Some in the crypto community might resist these changes, fearing that stringent regulations could stifle innovation and push activities back into the ‘gray zone.’ Additionally, the economic impact of such strict regulations on local businesses and investors remains to be seen. Striking a balance between regulation and fostering a thriving crypto ecosystem will be crucial for Kazakhstan’s future in the digital asset space.

As Kazakhstan continues its journey in the world of cryptocurrency, its actions serve as a testament to the challenges and opportunities that lie ahead in the quest for a balanced and thriving crypto ecosystem. The country’s commitment to regulation, coupled with its strategic initiatives in digital currencies, positions it as a key player to watch in the global crypto arena. Yet, the journey from the ‘gray zone’ to a fully regulated market will require perseverance, innovation, and a steadfast dedication to the principles of decentralization and financial freedom that underpin the crypto revolution.

Key Takeaways and Questions

- What is the current state of cryptocurrency regulation in Kazakhstan?

Kazakhstan is actively working to expand its crypto infrastructure and enforce regulations, with only 5% of investors currently using regulated platforms. The government is pushing for a more structured legislative framework to bring more crypto activities into the legal domain.

- How is Kazakhstan addressing illegal crypto activities?

The country has taken strong measures by shutting down 36 illegal crypto exchanges with a significant turnover and blocking access to over 3,500 unregistered crypto trading sites in 2024.

- Why is it important for Kazakhstan to move crypto operations out of the “gray zone”?

Moving crypto operations into the legal domain helps regulate the market, protect investors, and combat illegal activities like money laundering, thereby fostering a more secure and trustworthy crypto ecosystem.

- What role does the International Financial Center in Astana play in Kazakhstan’s crypto landscape?

The International Financial Center in Astana is a hub for regulated crypto platforms, currently used by only 5% of Kazakhstan’s investors, indicating a potential for growth and increased regulation.

- What are the implications of Kazakhstan’s actions for the global cryptocurrency market?

Kazakhstan’s efforts to regulate and expand its crypto infrastructure could establish it as a leading hub for crypto activities, potentially attracting international investment and reinforcing global trends towards crypto legitimacy and regulation.

- What is a Central Bank Digital Currency (CBDC), and why is Kazakhstan launching one?

A CBDC is a digital form of a country’s fiat currency, issued and backed by the central bank. Kazakhstan is launching the digital tenge in 2025 to further legitimize and integrate digital assets into its financial system.

- How might these changes impact local and international investors?

The increased regulation and infrastructure could boost investor confidence by providing a more secure and regulated environment. However, it may also face resistance from those accustomed to operating in the ‘gray zone.’