MicroStrategy Rebrands to Strategy, Embracing Bitcoin with New Logo and $46B Holdings

MicroStrategy Rebrands to Strategy with Bitcoin-Focused Logo: A Bold Move into Crypto

What happens when a traditional business intelligence firm goes all-in on Bitcoin? MicroStrategy, now rebranded as Strategy, offers a compelling answer.

- MicroStrategy becomes Strategy

- New logo features Bitcoin’s “B”

- Holds $46 billion in Bitcoin

- Michael Saylor’s 2020 resurgence

The Rebranding: From MicroStrategy to Strategy

MicroStrategy, the largest corporate holder of Bitcoin, has made a bold statement by rebranding itself as “Strategy.” This isn’t just a name change; it’s a strong dedication to the future of cryptocurrency. The new logo, featuring the letter “B,” symbolizes the firm’s unwavering focus on Bitcoin, reflecting a strategic pivot initiated by co-founder Michael Saylor back in 2020.

Bitcoin’s Role in Strategy’s Vision

Strategy, formerly MicroStrategy, owns Bitcoin valued at about $46 billion. This significant investment showcases the company’s deep dive into the crypto space. Despite this shift, Strategy continues to serve its traditional business intelligence clients, like KFC and Hilton, blending the old with the new in a way that’s both intriguing and humorous.

Michael Saylor’s vision for Strategy is clear. He recently hinted at upcoming Bitcoin purchases amid market fluctuations, signaling a commitment to continue their aggressive investment strategy. This aligns with their ’21/21 Plan,’ aiming to invest $42 billion in Bitcoin over three years. So far, they’ve utilized $20 billion, primarily through senior convertible notes (loans that can be turned into company shares) and debt financing.

Financial Implications and Market Response

Strategy’s financial strategy has seen significant changes. For the fourth quarter of 2024, the company reported a $670.8 million net loss, with revenue declining 3% year-on-year to over $120 million. This was accompanied by a nearly 700% increase in expenses to $1.1 billion, attributed to their Bitcoin investment plan. Despite these challenges, Strategy’s Bitcoin holdings offer unrealized gains of $15 billion, with an average purchase price of around $64,500 per coin.

The crypto market has been volatile, with Bitcoin falling 11% from its January 20 record high of $108,786 following President Donald Trump’s inauguration and the introduction of new tariffs. However, Michael Saylor remains bullish, posting on social media, “Death to the blue lines. Long live the green dots,” signaling his continued faith in Bitcoin’s potential.

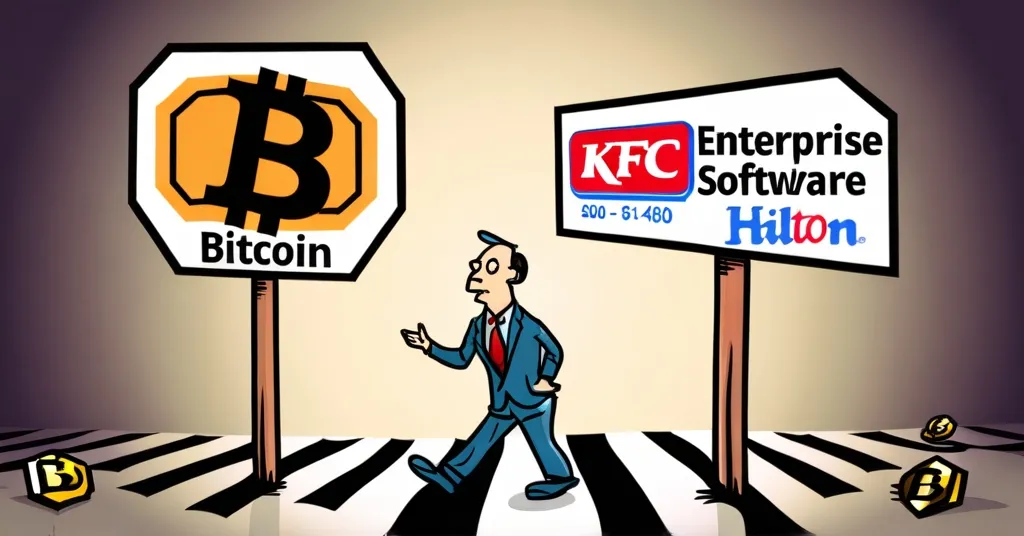

The Humorous Contrast

Bloomberg’s Joe Weisenthal captured the essence of this transition, saying,

“Microstrategy has rebranded as just Strategy, and its website is so funny now, cause it’s got all this Bitcoin aesthetics, but then the same old enterprise software buzzwords, and how it’s used by companies like KFC and Hilton.”

It’s like walking into a cyberpunk movie set while still trying to order your usual at KFC. This contrast between Bitcoin’s futuristic vibe and the conservative language of enterprise software encapsulates Strategy’s unique position at the crossroads of two very different worlds.

Risks and Criticisms

While Strategy’s Bitcoin strategy is bold, critics argue it could be risky during market downturns. The firm’s significant investment in Bitcoin, financed through debt, could lead to financial strain if the market takes a sharp turn downward. It’s a high-stakes bet on the future of cryptocurrency, but one that not everyone is ready to place. The impact of such corporate Bitcoin holdings on the market is a topic of much discussion.

Future Outlook

Strategy’s rebranding and continued investment in Bitcoin signal a clear direction for the company’s future. As the largest corporate holder of Bitcoin, their moves could influence other businesses to consider integrating cryptocurrency into their operations. The rebranding is more than a name change; it’s a declaration of Strategy’s vision for a future where Bitcoin plays a pivotal role. Discussions on Reddit reflect the community’s interest in Strategy’s Bitcoin investment strategy.

Key Takeaways and Questions

- What is the new name of MicroStrategy?

The new name of MicroStrategy is Strategy.

- What does the new logo of Strategy feature?

The new logo features the letter “B,” symbolizing Bitcoin.

- How much Bitcoin does Strategy hold?

Strategy holds approximately $46 billion worth of Bitcoin.

- Who announced the rebranding?

Co-founder Michael Saylor announced the rebranding.

- When did MicroStrategy experience a resurgence due to its Bitcoin strategy?

MicroStrategy experienced a resurgence in 2020 due to its Bitcoin strategy.

- What is the humorous contrast noted by Joe Weisenthal about Strategy’s rebranding?

Joe Weisenthal noted the humorous contrast between Strategy’s Bitcoin aesthetics and its traditional enterprise software terminology on the company’s website.