Montana Rejects Bitcoin Reserve Bill Amid Diverse U.S. Crypto Regulation Approaches

Montana’s Rejection of Bitcoin Reserve Bill: A Snapshot of U.S. Crypto Regulation

Can you imagine your state government holding Bitcoin in its reserves? Montana just said no, but why? The recent rejection of a bill that would have allowed the state to hold Bitcoin in its reserve fund has spotlighted the diverse approaches states are taking towards cryptocurrency regulation across the United States.

- Montana rejects Bitcoin reserve bill

- Varied state approaches to crypto regulation

- Growing legislative momentum nationwide

Montana’s decision to reject House Bill No. 429 on February 22, 2025, with a vote of 41-59, underscores a cautious approach. This bill aimed to create a special revenue account for investments in Bitcoin and other digital assets. Representative Steven Kelly expressed concerns about the riskiness of investing taxpayer money in cryptocurrencies, stating, “The volatility of Bitcoin is too high for us to responsibly invest public funds.” On the other hand, Representative Lee Demming argued for maximizing returns on taxpayer money, suggesting a more open stance towards Bitcoin investments. The bill’s sponsor, Curtis Schomer, emphasized Bitcoin’s potential to protect against inflation and generate higher returns, saying, “Bitcoin offers a hedge against the decreasing value of money over time, which is crucial for our state’s financial health.”

The legislative landscape in the U.S. regarding cryptocurrencies is a patchwork of innovation and caution. Wyoming has embraced digital assets by establishing Special Purpose Depository Institutions (SPDIs), a type of bank specifically for digital assets, to foster a crypto-friendly environment. These SPDIs are fully-reserved banks that provide custody and asset servicing without making loans with fiat currency deposits, ensuring 100% or more in liquid assets. Meanwhile, Colorado has implemented a ‘sandbox’ for fintech and blockchain companies, akin to a playground where companies can test new toys (technologies) safely under regulatory oversight.

Contrastingly, New York has imposed stringent regulations through the BitLicense, requiring entities engaging in virtual currency business activities to obtain a license. Critics argue that the BitLicense is overly burdensome and stifles innovation. Montana’s decision to reject the Bitcoin reserve bill aligns more closely with this cautious approach, reflecting concerns about the stability and security of holding Bitcoin in state reserves.

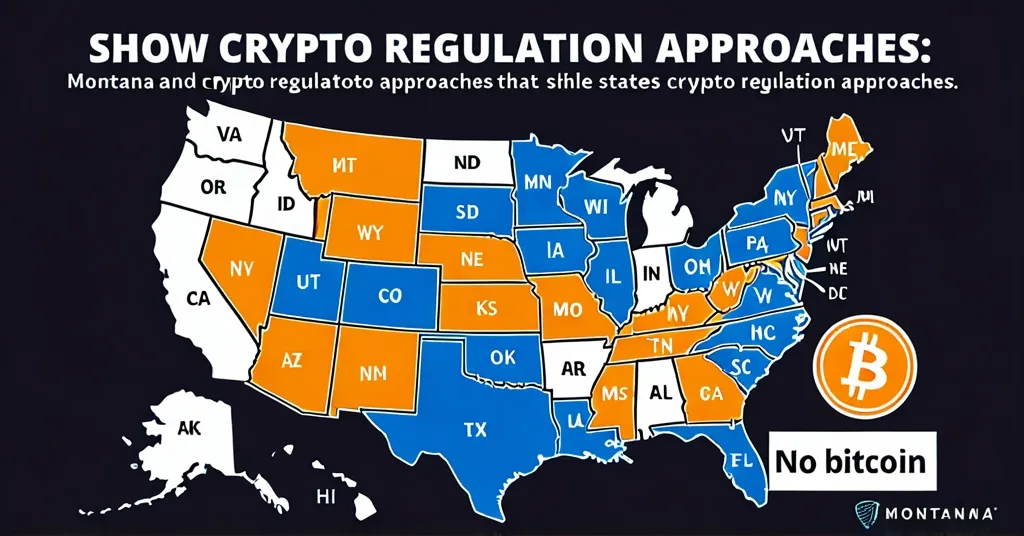

The momentum around cryptocurrency legislation is undeniable. In 2025, twenty-four states have introduced bills to establish Bitcoin reserves, with twenty still active. Utah, for instance, is making significant progress with its “Blockchain and Digital Innovation Amendments” bill, which could set a precedent for other states. This legislative activity reflects a broader national trend where states are grappling with the integration of cryptocurrencies into their financial systems.

The rejection of the Bitcoin reserve bill in Montana raises critical questions about the future of cryptocurrencies in state financial systems. While some argue that holding Bitcoin could protect against inflation and provide a new source of revenue, others are concerned about the potential for significant financial losses due to Bitcoin’s volatility. For Bitcoin maximalists, this rejection may be seen as a setback, yet it underscores the importance of continuing to educate legislators and the public about the potential benefits of Bitcoin and blockchain technology. On the other hand, advocates for altcoins and other blockchain projects may view this as an opportunity to highlight the unique roles that different cryptocurrencies can play in filling niches that Bitcoin does not serve well.

Montana’s rejection of the Bitcoin reserve bill is a microcosm of the broader legislative landscape in the U.S., where states are taking diverse approaches to cryptocurrency regulation. As the momentum continues to build, it will be crucial to monitor how these legislative efforts evolve and impact the future of digital assets in the country.

Key Questions and Takeaways:

- What does Montana’s rejection of the Bitcoin reserve bill indicate about its stance on cryptocurrency?

Montana’s rejection indicates a cautious stance on cryptocurrency, reflecting concerns about the stability and security of holding Bitcoin in state reserves.

- How are other states in the U.S. approaching cryptocurrency regulation?

Other states have diverse approaches: Wyoming embraces crypto through favorable regulations like Special Purpose Depository Institutions (SPDIs), Colorado implements a ‘sandbox’ for fintech, while New York imposes strict regulations like the BitLicense.

- What are the broader implications of this legislative trend for the future of cryptocurrencies in the U.S.?

The legislative trend suggests a complex future for cryptocurrencies in the U.S., where state acceptance or rejection could influence public perception, adoption, and the decentralization movement.