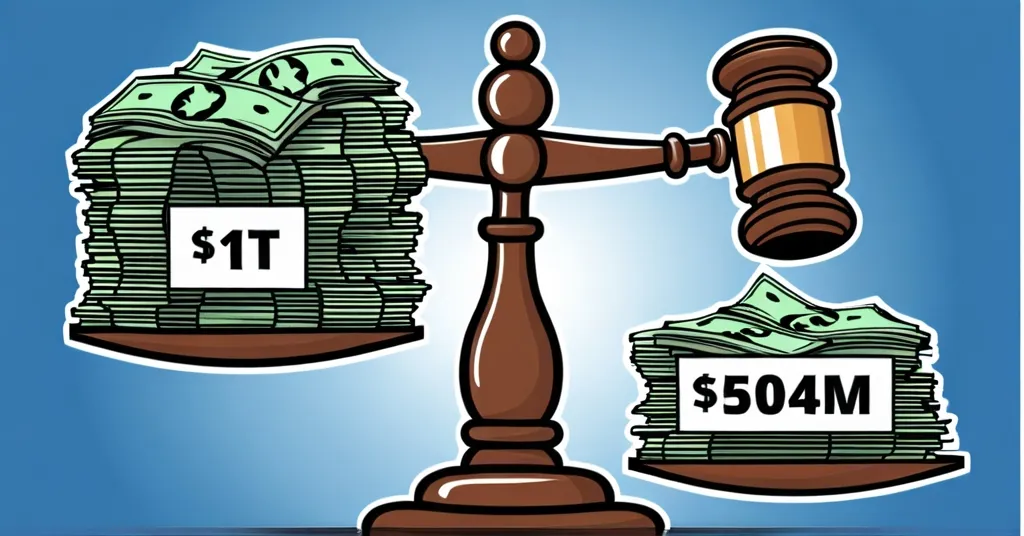

OKX Affiliate Guilty of $1T Unlicensed Transactions, Fined $504M

OKX Affiliate Admits to $1 Trillion in Unlicensed U.S. Transactions, Agrees to $504M Penalty

OKX’s affiliate, Aux Cayes FinTech Co. Ltd, has pleaded guilty to processing over $1 trillion in unlicensed transactions for U.S. customers, agreeing to a hefty $504 million penalty. This landmark case highlights the U.S. government’s stringent regulatory stance on cryptocurrency platforms.

- OKX affiliate pleads guilty to felony charge.

- $504 million penalty for unlicensed transactions.

- Over $5 billion in suspicious transactions facilitated.

The guilty plea was entered in a Manhattan federal court, where Aux Cayes FinTech Co. Ltd admitted to operating as an unlicensed money transmission business—essentially handling money transfers without the required legal permissions. The violations spanned from 2018 to early 2024, a period during which OKX had an official policy since 2017 prohibiting U.S. users. Yet, the platform exploited what they called “legacy compliance gaps” to process transactions for U.S. customers. These gaps are weaknesses in a company’s policies that allow illegal activities to occur.

Acting U.S. Attorney Matthew Podolsky emphasized the gravity of the situation, stating,

“Today’s guilty plea and penalties emphasize that there will be consequences for financial institutions that avail themselves of US markets but violate the law by allowing criminal activity to continue.”

His words underscore the U.S. government’s resolve to enforce financial regulations within the cryptocurrency sector, often criticized for its potential for illicit activities.

FBI Assistant Director James E. Dennehy added,

“Blatant disregard for the rule of law will not be tolerated.”

His comments spotlight OKX’s severe violations, including advising individuals to provide false information to circumvent procedures, thus allowing over $5 billion in questionable money movements.

Despite the hefty charges, OKX stressed that no customer harm was alleged, and no charges were brought against any of its employees. This distinction is vital, as it separates corporate wrongdoing from individual actions, a nuance often overlooked in sensational crypto stories.

This case illustrates the ongoing tension between the decentralized ethos of the crypto community and the centralized regulatory frameworks of governments. OKX, a Seychelles-based exchange known for supporting spot trading—buying or selling cryptocurrencies for immediate settlement—for over 300 cryptocurrencies, now faces the challenge of rebuilding trust and ensuring compliance with international financial regulations. These regulations include Anti-Money Laundering (AML) laws, which aim to prevent money laundering and terrorist financing.

The U.S. government’s action against OKX sends a clear message to other exchanges about the consequences of non-compliance, potentially prompting a shift towards more robust compliance practices industry-wide. Imagine having enough money to buy every American a new car—that’s the scale of the $1 trillion in unlicensed transactions OKX processed. It’s a wake-up call for the crypto industry to tighten up its compliance game.

OKX’s engagement of an external compliance consultant to improve its policies and controls could serve as a model for other exchanges navigating the increasingly stringent regulatory landscape. This move towards better compliance practices is crucial, especially as OKX focuses on attracting U.S. institutional customers for liquidity and volume, highlighting the complex dynamics between market growth and regulatory compliance.

The contrasting actions by the SEC, such as the dismissal of cases against Coinbase and Robinhood, add another layer of complexity to the regulatory environment. This shift might signal an evolving approach to cryptocurrency regulation, potentially creating uncertainty but also opportunities for clearer guidelines in the future. While regulatory crackdowns are necessary, some argue they stifle innovation. How can the industry balance compliance with growth?

Key Takeaways and Questions

- What were the specific violations committed by OKX’s affiliate?

Aux Cayes FinTech Co. Ltd admitted to processing over $1 trillion in unlicensed transactions for U.S. customers and facilitating over $5 billion in suspicious transactions, violating Anti-Money Laundering laws.

- How much did OKX agree to pay in penalties?

OKX agreed to pay more than $504 million in penalties, consisting of fines and forfeitures.

- What was the timeframe of the violations?

The violations occurred between 2018 and early 2024.

- Did OKX claim any harm to customers due to these violations?

OKX emphasized that no customer harm was alleged as a result of these violations.

- What is the significance of this case for the cryptocurrency industry?

This case underscores the U.S. government’s commitment to enforcing financial regulations within the cryptocurrency sector, serving as a warning to other exchanges about the consequences of non-compliance.