Operation Choke Point 2.0: Trump Targets Alleged Anti-Crypto Initiative Amid Regulatory Denials

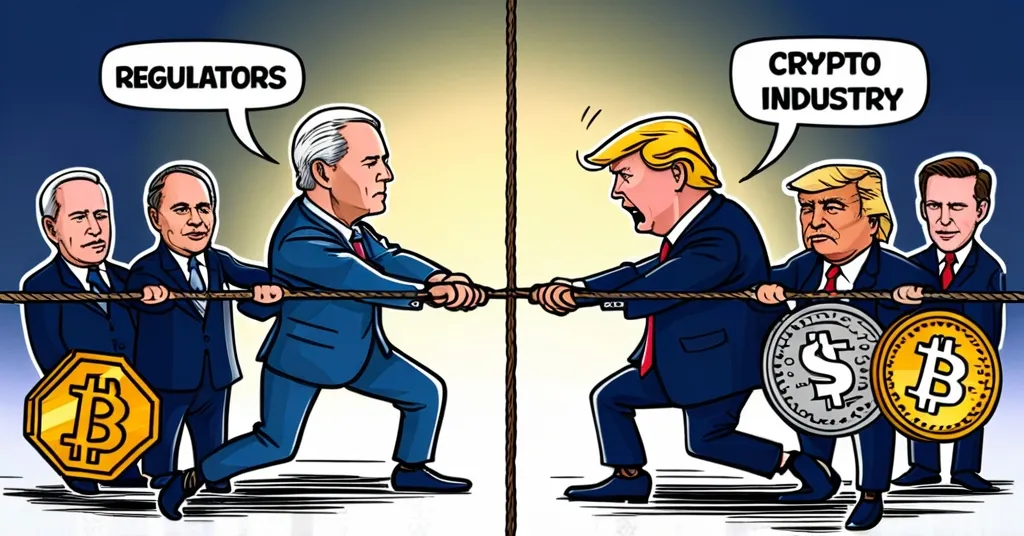

Operation Choke Point 2.0: Crypto in the Crosshairs or Political Theatre?

Incoming President Donald Trump has set his sights on the alleged “Operation Choke Point 2.0”, a rumored initiative by the Biden administration intended to curb the crypto industry’s access to banking services. While the administration denies any such program exists, regulatory actions paint a different picture, sparking a debate about the future of cryptocurrency in the United States.

- Operation Choke Point 2.0: Alleged initiative targeting crypto firms.

- Trump’s Promise: Vows to dismantle the initiative when in office

- Regulatory Denials: Biden administration denies the program.

- Industry Impact: Banks like Silvergate and Signature face turmoil.

The concept of “Operation Choke Point 2.0” is reminiscent of the original “Operation Choke Point,” initiated in 2013 under the Obama administration. This earlier effort aimed to pressure banks to sever ties with industries deemed high-risk, such as payday lenders and firearms dealers. Critics assert that this new iteration is an underhanded attempt to exert similar pressures on the burgeoning cryptocurrency sector. The current administration, however, firmly denies any such initiative is in play.

Yet, actions speak louder than words. Industry insiders and regulatory watchdogs have observed a pattern of behavior from financial regulators, such as the Securities and Exchange Commission (SEC) and Federal Deposit Insurance Corporation (FDIC), that suggests a coordinated effort to “debank”—or deny banking services to—crypto firms. Notably, banks with strong crypto ties, like Silvergate and Signature, have faced significant challenges that industry leaders attribute to undue regulatory pressure.

“As president, I will immediately shut down Operation Choke Point 2.0. They want to choke you out of business; we’re not going to let that happen,” – Donald Trump

Trump’s bold promise to end this alleged program if re-elected brings the issue into the political spotlight. His stance could appeal to crypto enthusiasts and companies who feel under siege. However, the situation is more complex than it appears. While regulatory scrutiny is evident, the instability in the banking sector involving crypto is not solely due to government action; some financial institutions have suffered due to questionable business practices unrelated to alleged regulatory interference.

Opponents of the current administration cite enforcement actions as evidence of a hidden agenda. For instance, Gemini’s Tyler Winklevoss noted regulatory movements as proof that “Operation Choke Point 2.0 is ‘in full swing.'” Similarly, Paul Grewal from Coinbase voices concerns of anti-crypto pressures, echoing sentiments across the industry.

The crypto market, already scrutinized for potential fraud and anti-money laundering issues, faces additional hurdles from what some perceive as government overreach. This tug-of-war between innovation and regulation continues to shape the future landscape of cryptocurrency in America.

Key Takeaways and Questions

- What is Operation Choke Point 2.0?

An alleged regulatory effort aimed at restricting crypto firms’ banking access, similar to a previous initiative under Obama.

- What evidence supports the existence of Operation Choke Point 2.0?

Actions by regulators like the SEC and FDIC against crypto-friendly banks and anecdotal reports from industry insiders.

- What is Trump’s stance on Operation Choke Point 2.0?

He has promised to dismantle it, citing it as harmful to business.

- Are the crypto industry’s banking issues solely due to regulatory actions?

Not entirely; bank failures like Silvergate also involved risky business practices independent of regulatory pressure.

- How has the crypto sector responded to alleged regulatory crackdowns?

Industry leaders are speaking out, seeking transparency and fairness in regulatory practices.

The battle between regulatory bodies and the crypto industry continues to be a contentious issue, with far-reaching implications for financial innovation and regulation. As the debate unfolds, stakeholders on all sides must navigate this complex landscape with caution and clarity.