PayPal USD (PYUSD) Now on Cardano, Boosting DeFi via Wanchain Bridge

PayPal USD (PYUSD) Stablecoin Expands to Cardano, Enhancing DeFi Ecosystem

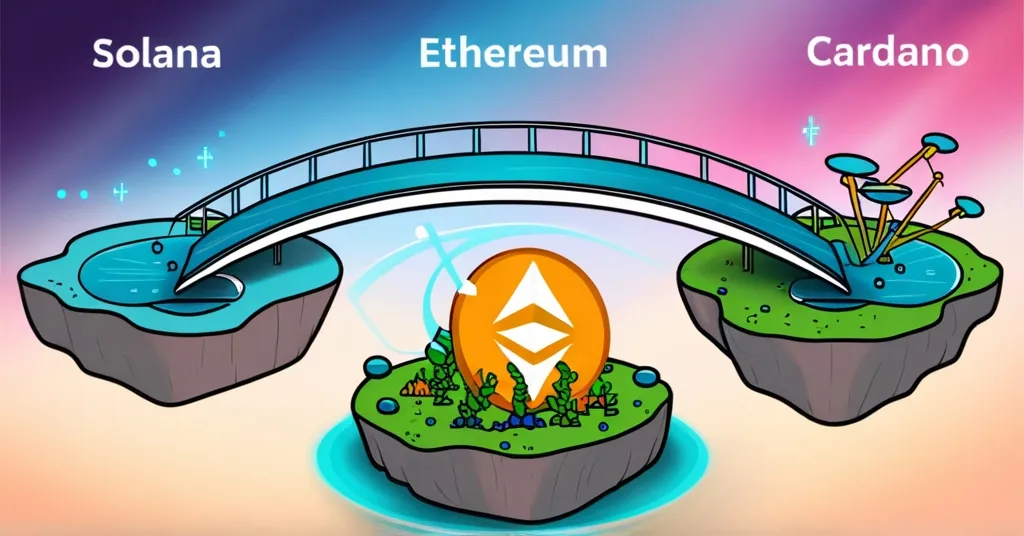

PayPal USD (PYUSD), initially available on Solana and Ethereum, has now expanded to the Cardano ecosystem through a cross-chain bridge developed by Wanchain. This move not only broadens the reach of PYUSD but also injects new life into Cardano’s decentralized finance (DeFi) landscape, which currently holds nearly $447 million in total value locked (TVL). Total value locked refers to the total value of assets held within DeFi platforms.

- PYUSD now accessible on Cardano

- Boost to Cardano’s DeFi ecosystem

- Wanchain’s interoperability solution

- FV Bank integrates PYUSD

- PayPal’s crypto expansion

Wanchain’s bridge serves as a critical interoperability solution, allowing PYUSD to flow seamlessly across different blockchains. According to Temujin Louie, Wanchain’s CEO, “The bridge will give users ‘more options, increased flexibility and control’ while transferring assets across different chains.” This is a significant step forward for users navigating the often fragmented blockchain landscape.

The integration of PYUSD into Cardano’s ecosystem is set to enhance its DeFi offerings. As Louie further explains, “Cardano’s decentralized finance ecosystem… will open doors for ‘greater synergy between networks, fueling innovation and adoption, and ultimately driving the next wave of blockchain interoperability across ecosystems.'” This move could catalyze Cardano’s DeFi growth, fostering a more interconnected and dynamic environment.

In January, FV Bank, an American financial institution, integrated PYUSD into its digital banking platform. This allows account holders to receive PYUSD stablecoins directly into their USD accounts, with the convenience of real-time conversion to USD. It’s a clear sign of the growing acceptance of stablecoins in traditional finance, bridging the gap between the crypto world and conventional banking.

Since its launch in August 2023, PYUSD has quietly amassed a total supply of around $515 million. This isn’t just a number—it’s a damn signal of PYUSD’s growing clout in the crypto world. And PayPal isn’t stopping there. Since September 2024, U.S. merchants have been able to buy, hold, and sell crypto directly through their business accounts. This expansion of services, which also includes consumer access to digital assets like Bitcoin and Ethereum since 2020, underscores PayPal’s commitment to integrating traditional finance with the crypto economy.

While this expansion is exciting, it’s crucial to keep our feet on the ground. The DeFi space is rife with potential pitfalls, from smart contract vulnerabilities—flaws in the code that can be exploited—to regulatory hurdles that could complicate the integration of stablecoins like PYUSD. As we celebrate this progress, let’s also remain vigilant about the challenges ahead.

Embracing this move in the spirit of effective accelerationism (e/acc)—a philosophy that supports rapid technological advancement to drive progress—we see it as a step towards a more decentralized and interconnected financial future. While bitcoin maximalists might scoff at the proliferation of stablecoins and altcoins, there’s no denying that each piece of the crypto puzzle plays a crucial role. Cardano’s embrace of PYUSD is a testament to the power of collaboration and innovation in driving the crypto revolution forward.

Looking ahead, we might see more stablecoins seeking interoperability solutions like Wanchain’s bridge to expand their reach. As Cardano’s cross-chain bridges move from Pre-Production to the mainnet, the potential for further integrations with other blockchains becomes increasingly tangible. This could significantly increase Cardano’s liquidity and attract more users to its DeFi ecosystem, setting the stage for exciting developments.

Here are some key takeaways and questions to ponder:

- What is PYUSD and on which blockchains is it now available?

PYUSD is a stablecoin backed by U.S. dollar deposits and similar cash equivalents, initially issued on Solana and Ethereum. It is now also available on Cardano through a cross-chain bridge by Wanchain.

- How does the integration of PYUSD benefit Cardano’s ecosystem?

The integration enhances Cardano’s decentralized finance ecosystem by adding nearly $447 million in total value locked and fostering greater synergy between networks, thereby fueling innovation and adoption.

- What role does Wanchain play in this expansion?

Wanchain provides the interoperability solution that enables the cross-chain bridge, allowing PYUSD to be transferred to Cardano and giving users more options and control over asset transfers.

- How has FV Bank utilized PYUSD?

FV Bank integrated PYUSD into its digital banking platform, allowing account holders to receive PYUSD stablecoins directly into their USD accounts with real-time conversion to USD.

- What are the latest developments in PayPal’s crypto services?

Since September 2024, PayPal has enabled U.S. merchants to buy, hold, and sell crypto directly through their business accounts. Since 2020, PayPal and its subsidiary Venmo have allowed consumers to access digital assets like Bitcoin and Ethereum.

Imagine being able to seamlessly transfer your PYUSD between Solana, Ethereum, and now Cardano. How might this change the way you interact with DeFi? As we navigate this exciting yet complex landscape, let’s keep our eyes peeled for the next big move in the world of crypto. The integration of PYUSD into Cardano is just one piece of the puzzle, but it’s a piece that could shape the future of decentralized finance in ways we can’t yet fully imagine.