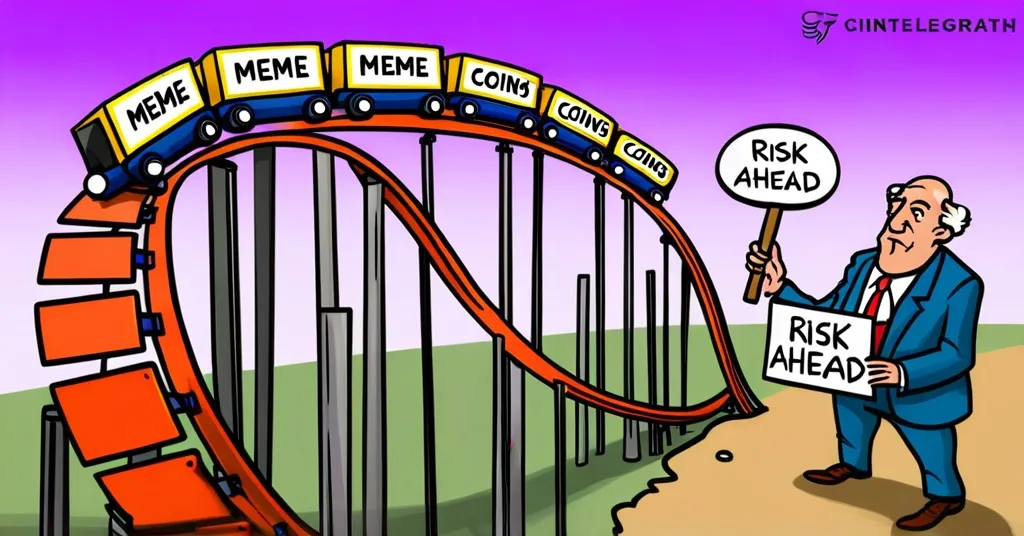

Peter Brandt Warns: Meme Coins Risky Amid 500% Market Surge

Peter Brandt’s Stern Warning: Navigating the Meme Coin Frenzy

Veteran trader Peter Brandt has issued a stark warning to cryptocurrency investors, cautioning against the perils of meme coins. With Bitcoin’s remarkable ascent from $0.07 in 2010 to its current value, Brandt’s skepticism stems from his extensive market experience, predicting significant corrections in the near future.

- Peter Brandt warns of meme coin dangers

- Bitcoin’s past growth not expected to repeat

- Predicts significant market corrections

- Meme coins see 500% market cap growth in 2024

Peter Brandt, a seasoned trader with over 50 years in the financial markets, has witnessed the meteoric rise of Bitcoin and other cryptocurrencies. However, his recent warnings focus on the speculative nature of meme coins. “I say this having witnessed markets for 50 years. Some will do great from here forward. But too many fools will get too leveraged, miss the top and get blown out in the next 50% correction in BTC, 90% correction in altcoins, 100% correction in memes,” Brandt stated. His message is clear: meme coins, often driven by internet culture and lacking traditional value metrics, pose a high risk of significant losses.

Meme coins, cryptocurrencies that gain popularity through social media and internet trends, have seen their total value soar by 500% in 2024, jumping from $20 billion to over $120 billion. Tokens like Andy Eth and Chill Guy have experienced returns exceeding 47,000%, fueling the speculative frenzy. Yet, Brandt’s concerns are rooted in the lack of intrinsic value and the potential for devastating market corrections.

While Brandt’s warnings may seem dire, not everyone shares his view. DWF LABS, for instance, sees meme coins as more than just speculative assets. “The memecoin phenomenon extends beyond mere speculation, representing a new form of social coordination and value creation. Their success challenges traditional notions of intrinsic value and asset fundamentals…and can be as powerful as traditional financial metrics,” they argue. This perspective underscores the role of community engagement and social capital in driving meme coin value, offering a counterpoint to Brandt’s skepticism.

Brandt remains critical of using debt to leverage investments in these volatile assets. “Go ahead, call me a hater (I own Bitcoin & SOL),” he quips, showing his confidence in more established cryptocurrencies while still acknowledging their risks. Despite his warnings, Brandt holds Bitcoin as a store of value and Solana for its established market position, indicating a nuanced approach to crypto investments.

The rise of meme coins isn’t just about speculation; it’s also about the democratization of capital markets. Platforms like pump.fun and gra.fun have made it easier than ever to launch new tokens, fueling the meme coin boom. This ease of access, while empowering, also contributes to the proliferation of risky investments. Understanding the lifecycle of meme coins—from deployment to value creation and distribution—helps explain how these projects gain traction and why they can be so appealing to investors seeking quick gains.

Yet, amidst the excitement, Brandt’s predictions of potential market corrections loom large. A 50% drop in Bitcoin, a 90% correction in altcoins, and a total wipeout for meme coins could be on the horizon. These forecasts should serve as a sobering reminder of the risks involved in speculative investments. Interestingly, Brandt’s outlook isn’t entirely bearish. In January 2025, he expressed bullishness on XRP, predicting it could reach a $500 billion market cap, suggesting he sees potential in certain established altcoins.

The meme coin phenomenon also highlights the market’s capacity to support multiple narratives. From AI-themed tokens to those driven by cultural memes, the diversity of these assets reflects the evolving nature of the crypto space. This variety can attract both retail and institutional investors, adding another layer of complexity to the market.

While meme coins might seem like the digital equivalent of a lottery ticket, without the fun of scratching it off, it’s important to remember that the crypto space offers immense potential alongside its risks. As investors, approaching these opportunities with a critical eye and a clear understanding of the potential downsides is essential.

Key Takeaways and Questions

- What risks do investors face when investing in meme coins?

Investors face high volatility, potential total loss of investment due to market corrections, and increased risk from using borrowed money to invest.

- Why does Peter Brandt hold Bitcoin and Solana despite his warnings about other cryptocurrencies?

Brandt holds Bitcoin as a store of value and Solana due to its established position in the market, showing a distinction between his views on speculative assets and those with more foundational value.

- How did the market capitalization of meme coins change in 2024?

The market capitalization of meme coins increased by 500% in 2024, rising from $20 billion to over $120 billion.

- What is the significance of the meme coin phenomenon according to DWF LABS?

DWF LABS views meme coins as more than just speculation, seeing them as a form of social coordination and value creation that challenges traditional notions of asset value.

- What does Brandt predict about future market corrections in cryptocurrencies?

Brandt predicts a 50% correction in Bitcoin, a 90% correction in altcoins, and a possible 100% correction (total loss) in meme coins.