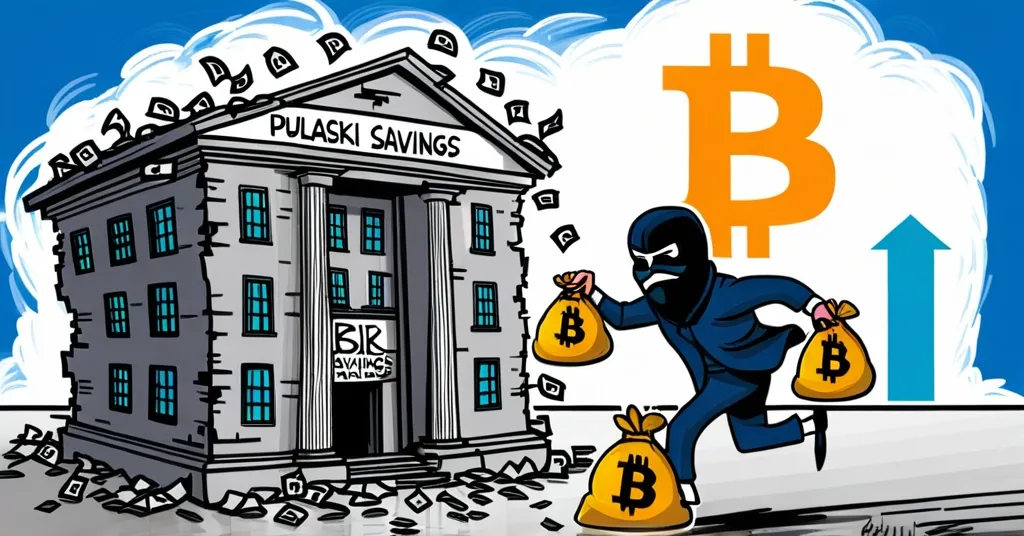

Pulaski Savings Bank Closes: First 2025 Failure Due to Suspected Fraud

First Bank Failure of 2025: Pulaski Savings Bank Shuts Down Amid Suspected Fraud

Pulaski Savings Bank in Illinois kicked off 2025 by becoming the first bank to fail this year, shut down by US authorities amid allegations of fraud.

- Pulaski Savings Bank closed by Illinois banking regulators

- FDIC steps in as receiver

- Assets transferred to Millennium Bank

- FDIC’s Deposit Insurance Fund hit with a $28.5 million cost

On January 17, 2025, the Illinois Department of Financial and Professional Regulation (IDFPR) pulled the plug on Pulaski Savings Bank, following orders from US regulators. The Federal Deposit Insurance Corporation (FDIC) swooped in as the receiver, ensuring depositors’ money was safe and sound by transferring all deposit accounts and most assets to Millennium Bank. This swift action was crucial in maintaining depositor confidence and minimizing disruptions. For those unfamiliar, a “receiver” in this context is a manager appointed by the FDIC to handle the bank’s affairs during its failure.

The FDIC estimates that the failure will cost its Deposit Insurance Fund a hefty $28.5 million, with suspected fraud being the villain of this story. As of September, Pulaski Savings Bank held $49.5 million in total assets and $42.7 million in total deposits, underscoring the magnitude of the situation.

This bank closure adds another chapter to the ongoing saga of concerns about the stability of financial institutions in the US. At the end of the previous year, the FDIC’s “problem list” included 68 banks, a clear indication of the challenges within the sector. For the uninitiated, the FDIC’s “problem list” is a roster of banks facing financial, operational, or managerial difficulties that could threaten their stability if left unaddressed.

The recent history of bank failures in the US is a worrying plotline. Last year saw two notable closures: Republic First Bank in April, with $6 billion in assets and $4 billion in deposits, and First National Bank of Lindsay in October, with $107.8 million in assets and $97.5 million in deposits. These failures, coupled with Pulaski Savings Bank’s closure, highlight the fragility of some regional and smaller banks.

In the world of cryptocurrency and blockchain technology, such incidents fuel discussions about the potential of decentralized financial systems as safer alternatives to traditional banking. The promise of greater transparency and security in decentralized finance could see a surge in interest as trust in conventional banks wavers. However, it’s not all sunshine and rainbows in the land of crypto; risks and challenges remain, such as volatility, regulatory hurdles, and the potential for scams.

“The FDIC says it will have to pay about $28.5 million from its Deposit Insurance Fund to cover the cost of the failure, pointing to ‘suspected fraud’ as the primary factor driving the expense.”

While the details of the alleged fraud at Pulaski Savings Bank remain murky, the incident serves as a stark reminder of the vulnerabilities within the traditional banking system. It’s like watching a financial thriller unfold in real-time, with depositors hoping for a happy ending.

As traditional banks face increasing scrutiny, many are turning to cryptocurrencies for a more secure financial future. The success of spot Bitcoin ETFs, as highlighted by Kbra Analytics, underscores the growing institutional interest in digital assets. However, the regulatory environment for banks engaging with cryptocurrencies remains complex and restrictive, adding another layer of intrigue to the story.

Depositors and borrowers of Pulaski Savings Bank were automatically transferred to Millennium Bank, ensuring continuity of service. Borrowers are advised to continue making payments under the same terms, with any changes communicated directly by Millennium Bank. This transition aims to keep the financial lives of customers running smoothly, much like a well-oiled machine.

Key Questions and Takeaways

What led to the failure of Pulaski Savings Bank?

Suspected fraud was cited as the primary factor leading to the bank’s collapse.

How does the FDIC handle a bank failure?

The FDIC appoints itself as the receiver, transfers the bank’s deposit accounts and assets to another institution (in this case, Millennium Bank), and covers the cost from its Deposit Insurance Fund.

What is the significance of the FDIC’s “problem list”?

The “problem list” indicates banks facing financial, operational, or managerial weaknesses that could threaten their stability if unresolved, signaling broader issues within the banking sector.

How might this bank failure impact the interest in cryptocurrencies and decentralized finance?

Bank failures can increase skepticism towards traditional banking systems, potentially driving more individuals towards cryptocurrencies and decentralized finance platforms as safer alternatives. However, the crypto space also has its own set of risks and challenges.

As we navigate these turbulent times, it’s clear that the banking sector must address its vulnerabilities head-on. Meanwhile, the crypto community watches closely, ready to champion the virtues of decentralization and privacy, offering a glimmer of hope for those disillusioned by the traditional financial system’s shortcomings. But let’s not forget, the journey to financial freedom is fraught with its own set of challenges and uncertainties. Stay tuned as we continue to unravel this financial drama and explore the potential of decentralized solutions in reshaping the future of money.