Pump.fun’s Profit Reality: Only 0.412% of Traders See Big Gains

Most Pump.fun Traders Yet to See Significant Profits, Data Indicates

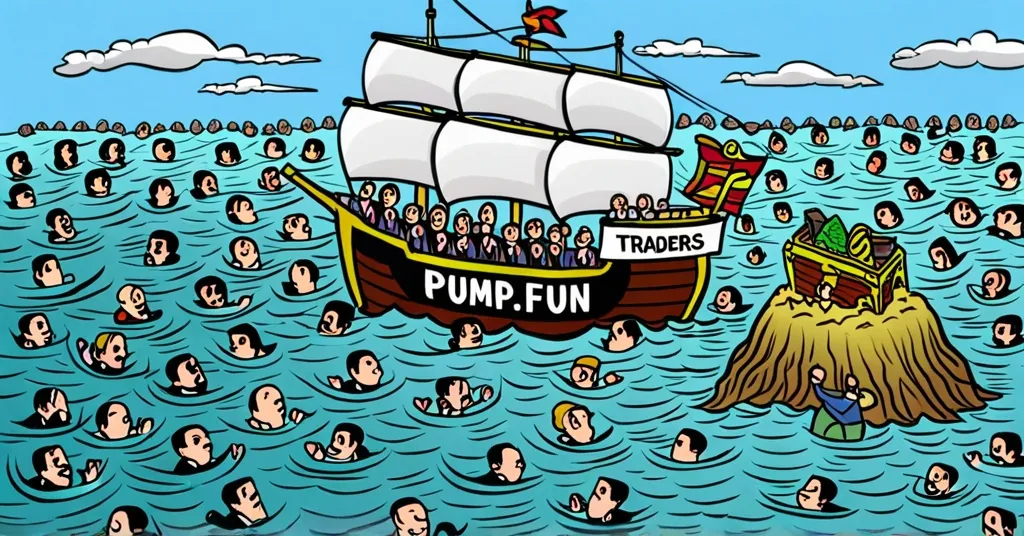

Pump.fun, a decentralized platform for Solana-based memecoins, has made waves in the world of decentralized finance (DeFi). Memecoins, cryptocurrencies often born from internet memes or viral trends, thrive on Pump.fun’s high-speed transactions and low fees. Despite the platform’s financial success, amassing nearly $398 million in revenue, the reality for most of its 13.55 million wallet addresses tells a different tale.

- Pump.fun’s wallet addresses reveal stark profitability disparities.

- Only a tiny fraction of traders have hit significant profits over $10,000.

- The platform’s total earnings reached nearly $398 million, but where’s the money going?

According to data from Dune Analytics, out of the 13.55 million wallet addresses interacting with Pump.fun, only 55,296 have managed to secure profits above the $10,000 mark. That’s a mere 0.412% of the total, leaving the vast majority still chasing that elusive big win. Analyst Adam Tehc highlights this exclusivity of gains, stating:

Only 0.412% of wallets have realized profits of $10,000 or more on Pump.fun’s tokens.

Even fewer traders have reached higher thresholds, with just 0.048% (6,521 wallets) realizing over $100,000, and a mere 0.00217% (293 wallets) exceeding the million-dollar mark. But as we dig deeper, it’s important to recognize the limitations of this data. Pseudonymous analyst Alon points out:

Early investors with strong conviction in their holdings often have substantial unrealized gains.

The reported figures don’t account for unrealized profits or gains from tokens traded on other exchanges like Raydium, where most Pump.fun-created memecoins find their home. This means the actual number of profitable traders might be higher than what’s being reported.

Pump.fun’s liquidity strategy also sheds light on its broader approach. The platform has deposited over $300 million in SOL to Kraken and converted about $41 million into USDC. This not only helps manage liquidity but also engages with established exchanges, potentially stabilizing the platform’s position in the volatile memecoin sector. A wallet address, by the way, is simply a unique identifier used to send, receive, and store cryptocurrencies.

Within the dynamic landscape of decentralized finance, Pump.fun represents a microcosm of the high-risk, high-reward environment. While the platform has generated significant revenue, the uneven distribution of profits among its users highlights the challenges faced by traders navigating this speculative market. In the world of memecoins, where fortunes can be made or lost in the blink of an eye, Pump.fun’s story is a testament to the highs and lows of decentralized finance. While the odds may seem stacked against the average trader, the success stories on Pump.fun remind us of the potential rewards in the world of DeFi. So, what does this mean for those dipping their toes into the memecoin pool on Pump.fun? It’s a reminder that while the potential for massive gains exists, it’s far from guaranteed. The data suggests that success on this platform requires more than just luck; it demands strategy, timing, and perhaps a bit of that elusive crypto magic.

Here’s a look at some key questions and takeaways:

- What is the current profitability rate for traders on Pump.fun?

Only 0.412% of wallets have realized profits of $10,000 or more, indicating a low rate of significant profitability. - How much revenue has Pump.fun generated?

Pump.fun has generated nearly $398 million in revenue, equivalent to 2,016,391 SOL tokens. - What are the limitations of the profitability data on Pump.fun?

The data does not include unrealized profits or profits from tokens traded on other exchanges like Raydium, potentially underrepresenting profitable traders. - What is Pump.fun’s liquidity strategy?

The platform’s strategy involves depositing over $300 million in SOL to Kraken and converting about $41 million into USDC, with the created memecoins primarily traded on Raydium. - How does Pump.fun fit into the broader memecoin sector?

Pump.fun plays a significant role in the volatile memecoin sector, generating substantial revenue while attracting traders and investors amidst the challenges of decentralized finance.