Retail Bitcoin Selling May Shift to Holding as BTC Nears New Highs

Retail Bitcoin Selling Surge May Shift as BTC Approaches New Price Highs

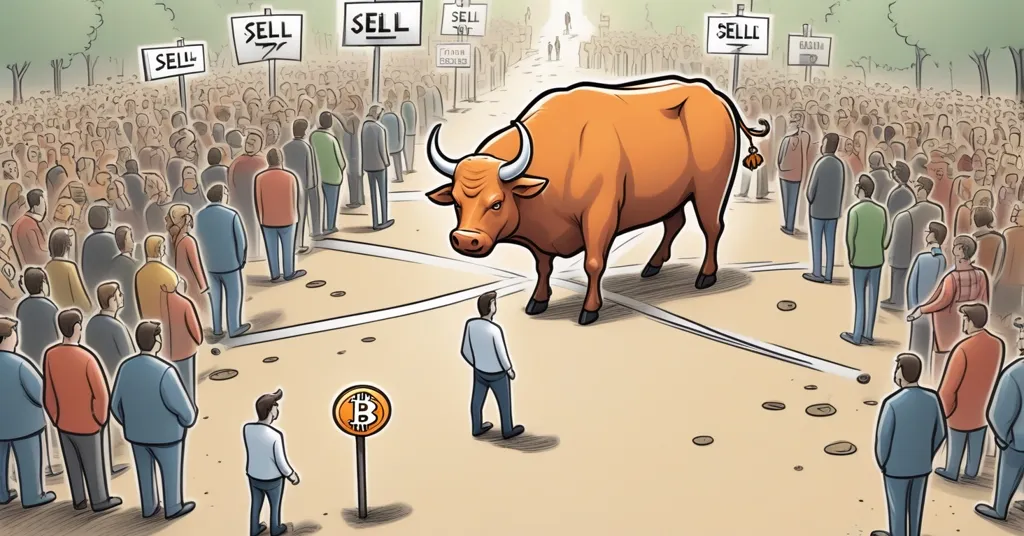

Bitcoin’s value is soaring, yet retail investors are offloading their holdings at an unprecedented rate. As the cryptocurrency approaches new highs, a significant trend of retail Bitcoin selling has emerged. However, as BTC breaches critical resistance levels—points where the price has historically struggled to rise above—this pattern may soon change.

- Retail Bitcoin selling surge

- BTC approaching new price highs

- Potential shift from selling to holding

- Impact on market dynamics and institutional interest

Retail investors have been quick to hit the sell button as Bitcoin nears new highs, likely to capitalize on gains before a potential market drop. This behavior is evident from the recent reduction in retail wallets holding less than 100 Bitcoins. However, with BTC trading at around $97,116 and showing signs of breaking through significant resistance levels, the dynamics might shift. Resistance levels act as a ceiling that the price of Bitcoin has difficulty surpassing, and breaking through these levels can signal a strong bullish trend.

As Bitcoin continues its ascent, there’s a possibility that retail investors may switch from selling to holding. This potential shift is influenced by various factors, including the recent U.S. election and regulatory developments. The SEC’s approval of Bitcoin ETFs, for instance, has opened the floodgates for institutional investors, potentially nudging retail investors to reconsider their strategies. Despite short-term fluctuations, experts like Roshan Aslam, CEO & Co-founder of GoSats, remain bullish on Bitcoin’s long-term prospects:

Retail investors have been quick to sell their Bitcoin holdings as the cryptocurrency approached new highs, but this trend may not last as Bitcoin breaks through key resistance levels.

However, it’s crucial to temper this optimism with a dose of realism. The crypto market is notoriously volatile, and while the future may look promising, investors should remain wary of sudden downturns. Aslam himself cautions against overzealousness, reminding investors to stay grounded amidst the hype.

The behavior of retail investors can significantly influence overall market dynamics. A shift towards holding could reduce sell-off pressure, leading to increased stability in Bitcoin’s price. This stability, in turn, might attract more institutional investors, who often seek more predictable investment environments. Hedge funds and pension funds, according to research from Ecos.am, are increasingly viewing cryptocurrencies as a means for risk diversification and long-term returns. Institutional investors can inject substantial capital and stability into the market, often swaying price dynamics and market sentiment:

As Bitcoin continues to climb, we may see a shift from selling to holding among retail investors, which could stabilize the market and attract more institutional interest.

Yet, it’s not all sunshine and rainbows. While retail wallets holding less than 100 Bitcoins are decreasing, indicating continued selling pressure, the broader market context suggests that a shift is possible. Bitcoin ETFs and clearer regulatory frameworks are making it easier for institutional investors to dive in, which could encourage retail investors to hold onto their assets in anticipation of further price increases. However, the risk of a market correction cannot be ignored, and investors should remain vigilant.

The rise of decentralized finance (DeFi) adds another layer to this evolving landscape. DeFi refers to financial services built on blockchain technology, often without traditional intermediaries. As DeFi continues to grow, it might influence how both retail and institutional investors interact with Bitcoin, potentially leading to new strategies and market behaviors. For instance, DeFi platforms might offer incentives like staking rewards, encouraging investors to hold onto their Bitcoin rather than sell.

In the world of crypto, where decentralization and disruption are celebrated, understanding the interplay between retail and institutional investors is crucial. As Bitcoin continues to challenge the status quo and push towards new highs, the potential for a shift in retail behavior could signal a new era for the cryptocurrency, one where holding becomes the norm and institutional interest fuels further growth. But remember, in this game, the only constant is change, and the savvy investor knows to keep an eye on both the bright and dark sides of the market. Retail investors holding onto their Bitcoin not only support the market’s stability but also align with the principles of decentralization and freedom that are at the core of the Bitcoin revolution.

Key Takeaways and Questions

- What is causing the surge in retail Bitcoin selling?

Retail investors are selling Bitcoin as its price approaches new highs, likely to capitalize on the gains and fearing a potential market drop.

- Why might the trend of retail selling shift to holding?

As Bitcoin breaks through resistance levels and continues to rise, retail investors may anticipate further price increases and decide to hold onto their Bitcoin, especially with the entry of institutional investors and the growth of DeFi.

- How could a shift from selling to holding affect the broader market?

A shift to holding could stabilize the market by reducing sell-off pressure, potentially attracting more institutional investors who seek stability at higher price levels.

- What role do institutional investors play in the Bitcoin market?

Institutional investors can bring significant capital and stability to the market, often influencing price dynamics and market sentiment when they enter or exit positions.