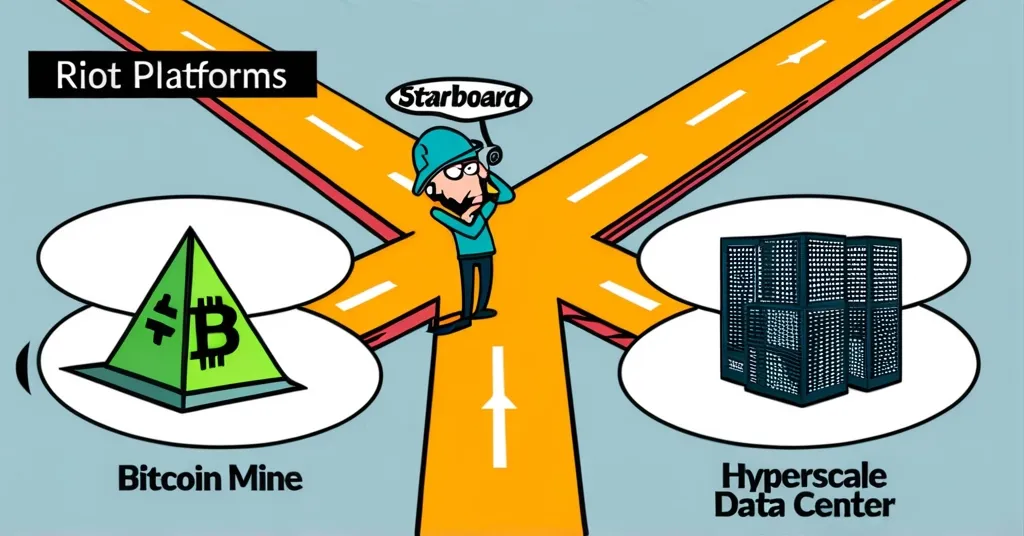

Riot Platforms Eyes Hyperscaler Shift Amid Starboard’s Call for Strategic Overhaul

Riot Platforms Faces Strategic Overhaul as Starboard Advocates Shift to Hyperscalers

Riot Platforms, a significant player in the Bitcoin mining sector, finds itself at a crossroads. Despite boasting an impressive 16,728 Bitcoins and a 1 GW mining capacity, the company is underperforming in the stock market. Starboard Value, an activist investor renowned for its aggressive strategies, is now demanding changes that could potentially unlock billion-dollar growth by directing Riot towards the hyperscaler market.

- Riot’s stock has decreased by 24% this year, even as Bitcoin’s value jumped by 130%.

- Starboard suggests focusing on hyperscalers like AWS and Google Cloud to drive growth.

- The company spent $225 million on selling and administrative expenses this year.

- 32.12% of revenue has gone towards executive compensation.

- Riot reported $304 million in operating losses, the worst performance in its history.

- Riot’s Texas facilities, with a 1.1 GW capacity, are well-suited for hyperscaler demand.

- Competitor Core Scientific already benefits from hyperscaler partnerships with high profit margins.

Riot’s financial health is a pressing concern. Despite robust resources, the company has bled $304 million in operating losses, with exorbitant spending on selling and administrative tasks. Moreover, a jaw-dropping 32.12% of its revenue is swallowed by executive compensation. These inefficiencies have made Riot ripe for a shake-up, and Starboard isn’t known for pulling punches when profitability is at stake.

“Starboard isn’t known for sitting quietly when there’s potential to make a company profitable.”

Starboard’s solution? A strategic pivot to serve hyperscalers—massive cloud computing providers such as Amazon Web Services, Microsoft Azure, and Google Cloud. These giants require vast infrastructure, making them a lucrative market for Riot’s substantial capabilities. By leasing its infrastructure, particularly the unused 600 MW at Corsicana, Riot could generate up to $600 million annually. Competitors like Core Scientific have already tapped into this potential, securing high-margin deals and setting a precedent for Riot.

“Leasing the unused 600 MW at Corsicana could bring in $600 million annually.”

Despite the potential windfall, this pivot isn’t just about financial gain. Starboard’s plan includes instilling stringent corporate governance, cutting down excessive executive compensation, and trimming operational overheads—essential measures for Riot’s survival and growth.

Here are some critical takeaways:

- Why is Riot Platforms underperforming in the stock market?

Operational inefficiencies and extravagant executive compensation are major factors. - What is Starboard’s plan for Riot Platforms?

Riot is being urged to pivot towards the hyperscaler market to unlock new growth avenues. - What are hyperscalers and why are they significant?

Hyperscalers are major cloud service providers needing extensive infrastructure, representing a lucrative market. - How can Riot Platforms benefit from serving hyperscalers?

Leasing out infrastructure to hyperscalers can stabilize revenue and boost profit margins. - What are Riot’s main operational challenges?

High costs in selling and administration, along with substantial operating losses, are key issues.

Riot Platforms stands at a pivotal moment. Embracing the hyperscaler market could be the strategic lifeline it desperately needs, promising not just survival but a robust transformation marked by financial discipline and focused growth.